ZTO Express Reports Steady Earnings While Facing Revenue Challenges

ZTO Express reported earnings of 37 cents per share for the first quarter of 2025, matching the performance from the same period last year. However, total revenues reached $1.50 billion, falling short of the Zacks Consensus Estimate of $1.67 billion, even though this figure marks a year-over-year improvement.

Performance Overview of ZTO Express

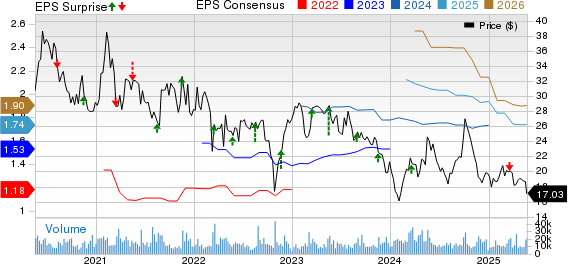

ZTO Express (Cayman) Inc. Price, Consensus, and EPS Surprise

ZTO Express (Cayman) Inc. price-consensus-eps-surprise-chart | ZTO Express (Cayman) Inc. Quote.

Mr. Meisong Lai, the founder and CEO of ZTO, highlighted that in the first quarter, the company maintained its strong service quality, handling 8.5 billion parcels and achieving adjusted net income of $2.3 billion. Retail volume saw a remarkable growth of 46% year over year due to deeper penetration in reverse logistics. ZTO continues to collaborate with e-commerce platforms and enterprise customers to develop unique products, including time-definite delivery and customized services for KA consumers.

Detailed Operational Statistics

The core express delivery business saw a 9.8% increase in revenue year over year, driven by a 19.1% rise in parcel volume, although the parcel unit price decreased by 7.8%. Revenues from KA, which are derived from direct sales, surged by 129.3%, primarily due to an uptick in e-commerce return parcels.

Conversely, revenue from freight forwarding services dropped by 11.6% compared to last year, mainly due to weakening cross-border e-commerce pricing.

Sales in accessories, mainly thermal paper for digital waybills, rose by 15.5% year over year. Other revenue sources largely stem from financing services.

Gross profit fell by 10.4% from the previous year, with the gross margin rate decreasing to 24.7% from 30.1% during the same quarter last year.

ZTO Express reported total operating expenses of RMB283.8 million ($39.1 million) compared to RMB735.4 million a year prior. As of the end of the first quarter in 2025, ZTO held cash and cash equivalents totaling $1.71 billion, down from $1.84 billion at the end of the last quarter.

In November 2018, ZTO’s board authorized a share repurchase program, which has seen several adjustments since. The most recent update raises the total value of shares to be repurchased to $2 billion and extends the program through June 30, 2025.

As of March 31, 2025, ZTO acquired 50,899,498 ADSs for $1,228.3 million on the open market, including associated repurchase commissions. The remaining funds available for the share repurchase program stand at $771.7 million. On May 20, 2025, ZTO announced an extension of the share repurchase program until June 30, 2026.

ZTO’s 2025 Guidance

ZTO Express has reaffirmed its guidance for 2025, targeting a parcel volume between 40.8 billion and 42.2 billion, which reflects a year-over-year growth of 20-24%.

ZTO’s Zacks Rank

Currently, ZTO Express holds a Zacks Rank of #4 (Sell).

Q1 Performances of Other Transportation Companies

United Airlines

United Airlines reported first-quarter 2025 earnings per share (EPS) excluding 25 cents from non-recurring items, totaling 91 cents. This performance surpassed the Zacks Consensus Estimate of 75 cents, notably recovering from a loss of 15 cents per share in the same quarter last year.

Operating revenues stood at $13.21 billion, slightly below the Zacks Consensus Estimate of $13.22 billion. This revenue represents a 5.4% increase year over year, despite a slow domestic air travel market influenced by tariffs. Passenger revenues, which make up 89.7% of the total, increased by 4.8% year over year to $11.9 billion, with United’s flights carrying 40,806 passengers, a rise of 3.8% from last year.

Delta Air Lines

Delta Air Lines reported earnings for the first quarter of 2025 at 46 cents per share, excluding 9 cents from non-recurring items. This figure exceeded the Zacks Consensus Estimate of 40 cents and represents a 2.2% year-over-year increase largely due to lower fuel costs.

In the quarter ending March 31, revenues reached $14.04 billion, surpassing the Zacks Consensus Estimate of $13.81 billion and indicating a year-over-year increase of 2.1%. Adjusted operating revenues, excluding third-party refinery sales, rose 3.3% year over year to $13 billion.

C.H. Robinson

C.H. Robinson Worldwide, Inc. (CHRW) reported mixed results for the first quarter of 2025. While earnings outperformed the Zacks Consensus Estimate, revenues did not meet expectations.

The quarterly EPS came in at $1.17, exceeding the Zacks Consensus Estimate of $1.02 and reflecting a 36% improvement year over year. However, total revenues were $4.04 billion, falling short of the Zacks Consensus Estimate of $4.31 billion and marking an 8.2% decline year over year. This decline is attributed to the divestiture of CHRW’s Europe Surface Transportation business, lower volumes in North America’s truckload services, and reduced pricing in ocean services.