The realm of artificial intelligence (AI) witnessed an explosive surge last year, propelling tech stocks to remarkable heights. In the wake of this flourishing landscape, the Nasdaq-100 Technology Sector has rallied by approximately 55% over the past year, demonstrating unwavering momentum. Grand View Research data underscore the bountiful AI market, which soared to nearly $200 billion last year and is earmarked for a robust 37% compound annual growth rate until 2030. Such a trajectory signifies a staggering scale approximating $2 trillion by decade’s end. Hence, the window for AI investments remains wide open, promising substantial returns despite the considerable upsurge witnessed last year.

An alluring investment avenue emerges in the form of Advanced Micro Devices (NASDAQ: AMD), a renowned chipmaker deeply entrenched in the AI domain. The company’s stock has ascended by a remarkable 87% since March of the previous year, ushering in a wave of millionaires. Bolstered by a fresh line of AI-oriented graphics processing units (GPUs) and notable advancements within the PC sector, Advanced Micro Devices stands poised for meteoric stock growth in the imminent years, kindling the dreams of prospective investors.

The Winds of Expansion Favor AMD

AMD, after years of concentrating on central processing units (CPUs) claiming a 36% market share, has pivoted its focus towards the in-demand GPUs essential for AI model training due to the upsurge in AI pursuits. While rival Nvidia gained an early advantage in AI GPUs, AMD has commenced its quest to challenge the frontrunner with its line of avant-garde chips. Last December heralded the unveiling of the MI300X AI GPU by AMD, a direct contender against Nvidia’s offerings that duly attracted industry titans like Microsoft and Meta Platforms.

Moreover, AMD’s aspirations transcend snatching market share solely in the realm of GPUs. The chipmaker sets its sights on industry leadership in the AI niche by intensifying its focus on AI-powered PCs. Forecasts by research institution IDC predict a substantial uptick in PC shipments, spearheaded by AI integration, with a Canalys report prophesying that 60% of all PCs dispatched in 2027 will be AI-enabled, solidifying AMD’s strategic positioning in the ecosystem.

Significant Earnings Projections Pave the Way for AMD’s Ascendancy

Although AMD’s earnings are yet to fully mirror its hefty AI investments amid the transition from CPU-centric operations to GPUs, recent quarterly earnings testify to the company’s promising trajectory. Noteworthy aspects of AMD’s Q4 2023 performance include a 10% year-over-year revenue escalation to $6 billion, surpassing analysts’ expectations by $60 million. The AI-dedicated data center segment reported a robust 38% revenue uptick, harmonizing with commendable growth in its client segment.

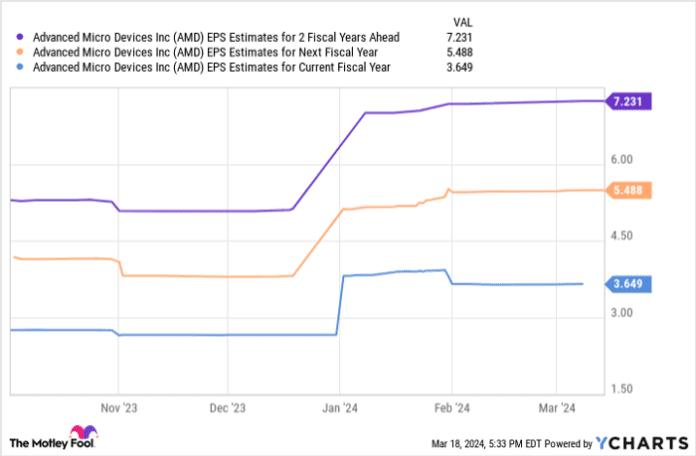

On a forward-looking basis, EPS estimates for AMD paint a rosy picture, with the potential to eclipse $7 per share by fiscal 2026. Concluding evaluations based on a forward price-to-earnings ratio of 50 suggest a share price projection touching $360, constituting a substantial stock growth of 97% over the forthcoming two fiscal years. With the dual promise of AI expansion and the resurgence of the PC domain, AMD’s stock beckons as a compelling investment choice at present.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 21, 2024