Investors of PayPal (NASDAQ:PYPL) experienced a disappointing year in 2023, with PYPL shares decreasing by 18%, in stark contrast to the S&P 500’s gain of 25% and the Nasdaq 100’s 50% return.

Despite this, shareholders are hopeful for a resurgence in 2024. However, I maintain a cautious outlook for the new year, as PYPL shares may not experience a significant bull run.

For context, I last covered PayPal stock in October, suggesting a “Buy” rating. Since then, PYPL shares have shown an 18% increase. In this article, my focus shifts to PayPal’s 2024 outlook rather than short-term prospects.

The Road Ahead in 2024

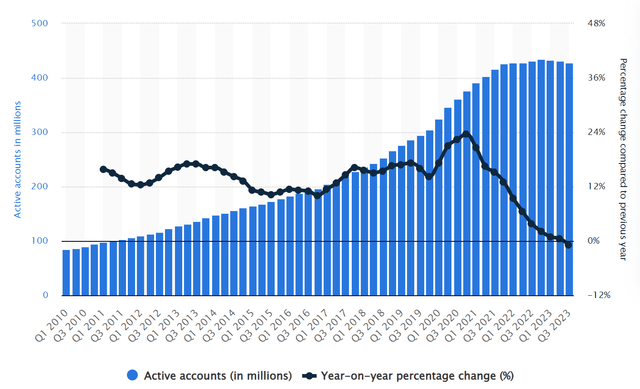

In Q3 2023, PayPal underwent a change in leadership, with a new CEO (Alex Chriss) and CFO (Jamie Miller) taking charge. The new management faces the critical task of addressing the declining active user base, which saw a consistent decrease throughout 2023. This decline could be attributed to PayPal’s contentious policy update aimed at preventing the use of its services for spreading misinformation. Rebuilding customer trust should be the top priority for the new management team in 2024.

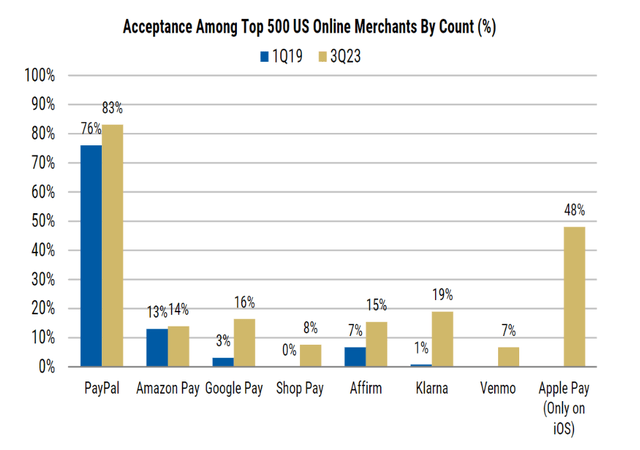

In established regions such as the United States and parts of Europe, PayPal’s market penetration is already high, potentially limiting room for expansion. Additionally, intensifying competition in the digital payment industry could make acquiring new users costly for PayPal.

Given these challenges, the 2024 management team might pivot towards alternative ventures like “Buy Now, Pay Later” and Crypto, as well as investing in unbranded checkout (Braintree) for potential growth. Despite the marked growth in Braintree’s revenues in 2023, there is still untapped potential, albeit at the cost of transaction margins.

Analysts’ Projections for 2024

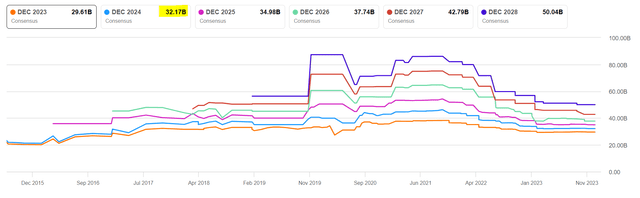

Analysts foresee PayPal’s sales for FY 2024 to range between $31.3 billion to $33.3 billion, with the consensus at $32.17 billion, hinting at an 8.6% YoY growth. When it comes to profitability, estimated earnings per share range from $5.26 to $6.13, with a consensus at $5.6, pointing towards a 12.5% YoY rise in EPS.

These stable revenue and earnings projections for PayPal in 2024 indicate cautious optimism among analysts, but the road ahead remains uncertain.

PayPal Outlook: Navigating Market Transitions in 2024

There has been a notable shift in market sentiment since the close of the June quarter 2022. This transition may herald a broader de-risking of sentiment in the market, and all signs indicate that this trend will continue into 2024.

When evaluating the consensus expectations for PayPal in 2024, it is prudent to consider that while they may seem somewhat optimistic, they remain within the bounds of reason. It is crucial to acknowledge that a significant driver of PayPal’s revenue and earnings growth will be anchored in macroeconomic factors, particularly the broader volume of e-commerce activity. Encouragingly, economists are revising downward their inflation estimates while increasing their GDP projections. Similarly, monetary policy in 2024 is likely to trend towards accommodation for consumption, with the FOMC projecting three rate cuts by the end of the year.

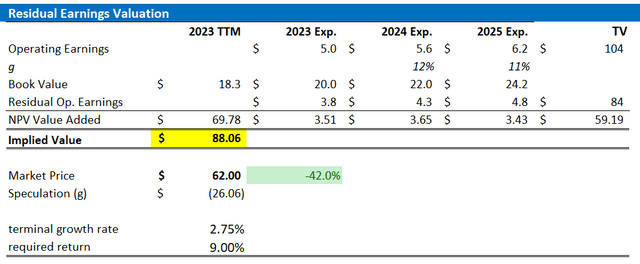

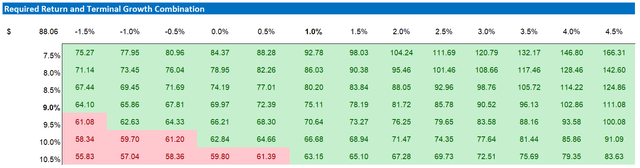

Revised Target Price: $88

In line with the updated analyst consensus EPS estimates for PayPal through 2025, adjustments have been made to the residual earnings model for the company’s stock. For 2024, the estimated EPS range now stands between $5.4 and $5.8 (non-GAAP), aligning with consensus. Looking ahead to FY 2025, the EPS expectation is set at $6.2. Furthermore, although the terminal growth rate input remains at 2.75%, the cost of equity assumption has been reduced by 50 basis points to 9.0%. This reduction chiefly reflects the anticipated 2024 rate cuts, which diminish the opportunity costs for holding equity assets.

In light of the aforementioned adjustments, a fair implied stock price for PYPL stock has been calculated at $88.06, suggesting approximately 42% upside based on fundamentals.

Below is the sensitivity table, testing different assumptions for the cost of equity (rows) and the terminal growth rate (columns).

Investor Takeaway

From a strategic perspective, 2024 appears to represent a pivotal transition period for PayPal. The company’s new management faces the formidable task of rebuilding both investor and customer confidence amidst challenges in growth deceleration and transaction margins. On a fundamental level, cautious agreement with analyst projections suggests an 8.6% year-over-year increase in sales and a 12.5% year-over-year jump in earnings as reasonable, provided the macroeconomic backdrop remains supportive. In conclusion, there is reasonable confidence in projecting that 10x earnings should mark the lower boundary of potential trading, implying a more favorable upside opportunity than downside risk. This rationale leans towards recommending a “Buy” stance on PYPL.