The Thriving Rise of Supermicro

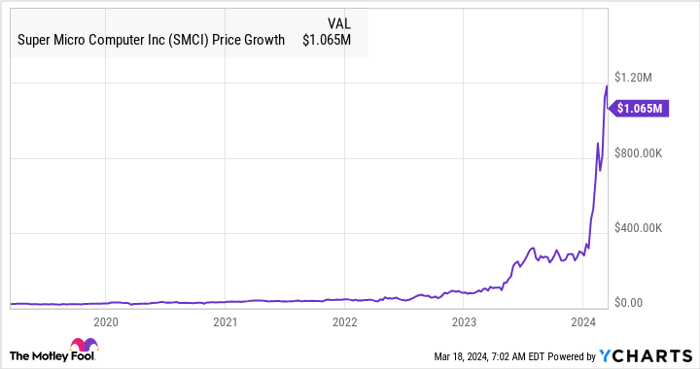

Super Micro Computer (NASDAQ: SMCI) stands tall as one of the most sizzling stocks in 2024, having surged by a staggering 300%. Nevertheless, for those who have held onto shares of this server manufacturer for a longer haul, the rewards run deeper.

An investment of $20,000 in Supermicro stock five years ago now commands a value exceeding $1 million, beckoning towards a newfound realm of affluence.

SMCI data by YCharts

Supermicro stock has been duly rewarded for its exceptional growth in recent years, propelled by the inexorable expansion of the server market.

SMCI Revenue (TTM) data by YCharts

While past performance may not presage future outcomes, the trajectory of Supermicro should entice those looking to forge a diversified portfolio set for a million-dollar destiny. Here’s why.

Supermicro’s Ascendance in a Rapidly Expanding Market

The advent of artificial intelligence (AI) has bestowed an uptick upon the server market. As per TrendForce, the AI server market witnessed a 38% surge in 2023 and is poised to sustain annual growth of over 20% until 2026. Global Market Insights (GMI) estimates the AI server market amassed $38 billion in revenue in 2023, a figure set to catapult to $177 billion by 2032.

With $9.25 billion in revenue over the trailing 12 months, Supermicro disclosed during its January earnings call that AI-related server sales constitute over 50% of its total revenue. This implies sales of approximately $4.6 billion in AI servers for 2023, affixing Supermicro’s stake in the AI server market at 12% based on 2023 market size per GMI.

Supermicro steers a more rapid growth trajectory than the AI server market, indicative of its widening footprint in this realm. For instance, revenue in the second quarter of fiscal 2024 (ending Dec. 31, 2023) catapulted to $3.66 billion from $1.8 billion in the corresponding period the prior year.

Performance for the first half of fiscal 2024 showcases a noteworthy 58% year-over-year revenue upsurge to $5.78 billion. More promisingly, the company anticipates closing fiscal 2024 with revenue hitting $14.5 billion at the midpoint of its guidance range, translating to a 104% year-over-year surge from fiscal 2023’s $7.1 billion in revenue.

Analysts foresee a 39% revenue uptick for Supermicro in the following fiscal year, cresting just beyond $20 billion. With new manufacturing facilities elevating its “annual revenue capacity above $25 billion,” as underscored in the preceding earnings call, Supermicro appears judiciously positioned to harness the buoyant growth potential inherent in the AI server market. This poised expansion is primed to bolster the company’s financials and, in turn, fortify Super Micro stock to yield robust returns over the ensuing decade.

Envisioning the Long-Term Potential

At present, Supermicro commands a mere 12% stake in the AI server market. Yet, envisaging its market share burgeoning in the near future is not far-fetched given its emphasis on capacity escalation. Should Supermicro reach $20 billion in revenue in the upcoming fiscal year, its AI server market share would swell to 38%, premised on GMI’s projection of an 18% annual growth rate for the AI server market and a $38 billion valuation in 2023—signifying a market size of $53 billion in 2025.

If Supermicro sustains a 35% share of the server market in 2032, its revenue could soar to $62 billion within a decade. Currently trading at 7 times sales, akin to the U.S. technology sector’s average price-to-sales ratio of 7.2, Supermicro’s market cap could burgeon to $434 billion by 2032, scaling sevenfold from its existing market capitalization. This trajectory suggests a transformation of a $20,000 investment into over $140,000. Nevertheless, Supermicro’s cost positioning below other AI stocks hints at potential heightened valuation in the future, paving the way for even more substantial gains.

Hence, while Supermicro’s reprise of turning $20,000 into a million dollars remains speculative, the underlying promise within this AI stock to propel investors towards million-dollar aspirations via its stellar growth and fortuitous positioning within the burgeoning AI server market is unequivocal.

Should you invest $1,000 in Super Micro Computer right now?

Before delving into Super Micro Computer stocks, contemplate this:

The Motley Fool Stock Advisor analyst squad has pinpointed what they deem the 10 prime stocks poised for investors to seize now… and Super Micro Computer didn’t make the list. The preferred candidates boast potential for colossal returns in forthcoming years.

Stock Advisor equips investors with an accessible blueprint for success, proffering counsel on portfolio construction, updates from analysts, and bimonthly stock selections. Since 2002, the Stock Advisor service has outperformed the S&P 500 return thricefold*.

Explore the 10 stocks

*Stock Advisor returns as of March 21, 2024

Harsh Chauhan neither holds positions in the cited stocks nor does The Motley Fool. The Motley Fool adheres to a disclosure policy.

The viewpoints and opinions presented here reflect those of the author and not necessarily Nasdaq, Inc.