Global Shipping Dynamics Amid Houthi Attacks

Ever since the Houthi attacks disrupted commercial shipping in the Red Sea, the global oil trading landscape has been in a state of flux. While Wall Street remains aloof to the geopolitical quagmire, the oil tanker industry faces a stark reality – a perilously low rate of new ship construction.

As other commercial vessels swiftly veered away from the Red Sea waters post the Houthi onslaught initiation in November, oil and fuel tankers gallantly plowed through. Nevertheless, the tide turned in January when U.S. and British military intervention in Yemen urged top tanker owners to rethink their routes, steering clear of the Red Sea battle zone.

The Bullish Trajectory for Oil Tanker Firms

Amidst the chaos, tanker rates are surging, and voyage durations are elongating, amplifying the strain caused by Russia’s conflict in Ukraine. Coupled with the meager new ship deliveries and an aging fleet, the future of tankers looks promising.

Forecasts indicate minimal additions to the tanker fleet, with only two new supertankers slated for 2024 – marking the lowest increase in almost four decades. The following year projects a mere five additions, significantly dwindled from the 42 ships delivered in 2022.

Despite a recent surge in orders, the construction backlog looms large, as shipyards are preoccupied with pandemic-induced container vessel orders and requests for LNG carriers. The looming tanker scarcity dovetails with a globally inefficient fleet, further exacerbated by an expanding “shadow fleet” of aged vessels amidst the Russia-Ukraine conflict.

Jacob Meldgaard, CEO of Torm PLC (TRMD), highlights the significant impact of a potential 5% uptick in global demand due to route diversions around the Cape of Good Hope on an already utilization-high fleet, as vessels increasingly reroute to avoid the Houthi conflict in the Red Sea.

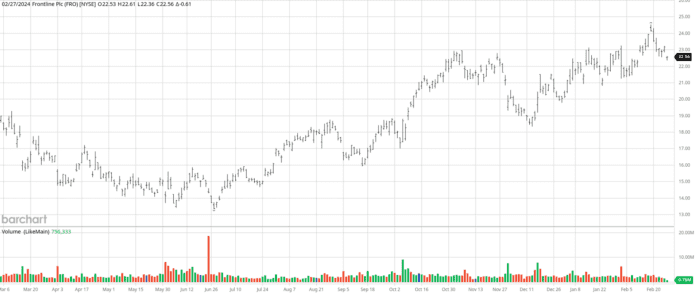

The Frontline Advantage

While industry turmoil persists, investors eye Frontline PLC (FRO), a premier player in crude oil and refined products transportation. Frontline’s formidable fleet boasts VLCCs, Suezmax tankers, and LR2/Aframax tankers, embodying modernity and scale in the sector.

The mastermind behind Frontline’s ascension is John Fredriksen, Norway’s wealthiest, steering the company towards market dominance. In a landmark deal, Frontline solidified its position as the largest publicly traded tanker entity, acquiring 24 VLCCs to bolster its fleet, augmenting dwt by 57% and sailing days by 37%.

Fredriksen’s strategic acumen, coupled with the industry turmoil, positions FRO stock as a compelling investment below $25, reflecting a bullish stance on the tanker market’s upswing.

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.