“`html

Stock Highlights: Five Investments Poised for Growth in 2025

For a second consecutive year, investors are finding plenty of reasons to be positive. As we approach the end of 2024, the well-known Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all posted strong gains of 13%, 24%, and 30%, respectively!

No matter if bullish trends dominate or bearish sentiments creep back into the market, there will still be opportunities for savvy investors looking for good deals as we enter the new year.

Where should you invest $1,000 today? Our analyst team has identified the 10 best performing stocks to consider right now. Discover the top 10 stocks »

Here are five impressive stocks that could enhance your portfolio in 2025.

Image source: Getty Images.

1. Meta Platforms

The first standout stock to consider is social media giant Meta Platforms (NASDAQ: META). With annual sales growth hovering around 20%, it remains relatively reasonably priced.

While attention focuses on Meta’s ventures in artificial intelligence (AI) and virtual worlds, its strength in social media is often overlooked. In the third quarter, Meta attracted an astonishing 3.29 billion daily active users across its apps, indicating businesses are willing to invest in advertising via its platforms.

Furthermore, Meta boasts substantial financial reserves, ending September with $70.9 billion in various liquid assets. The company is expected to exceed $85 billion in operating cash flow for 2024, enabling aggressive investment in growth initiatives that could yield significant returns in the latter half of the decade.

2. Pfizer

Another noteworthy stock is pharmaceutical company Pfizer (NYSE: PFE), which shows significant potential for recovery in 2025. The stock has faced pressure due to falling sales for its COVID-19 treatments, Comirnaty and Paxlovid, but its overall drug portfolio is in a stronger position now compared to four years ago.

Excluding its COVID-19 therapies, Pfizer’s sales increased by 14% in the latest quarter, with strong performance from its oncology and specialty care segments. Overall, sales are projected to surge by 49% (approximately $20.6 billion) from 2020 to 2024 when including the COVID drugs.

Additionally, Pfizer’s recent $43 billion acquisition of Seagen is set to enhance its cancer treatment pipeline and create significant cost efficiencies, leading to improved earnings per share starting this year.

With a forward price-to-earnings (P/E) ratio of 9 and a juicy 6.5% yield, Pfizer appears to be trading at a discount.

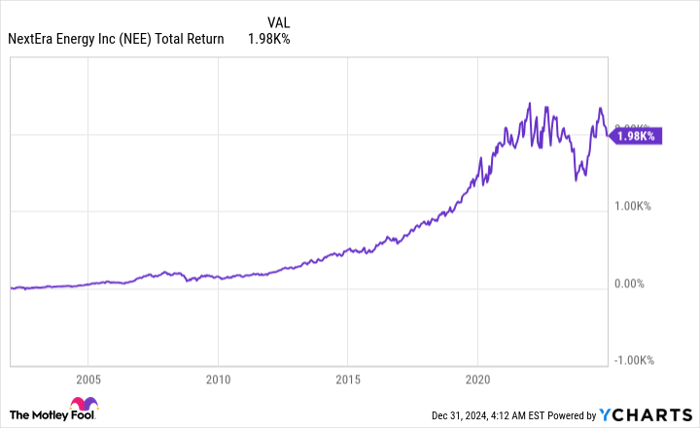

NextEra Energy has provided positive total returns for investors in 20 of the last 23 years. NEE Total Return Level data by YCharts.

3. NextEra Energy

Ranked as America’s largest electric utility by market capitalization, NextEra Energy (NYSE: NEE) also qualifies as a promising investment for the upcoming year. This company has managed to deliver a positive total return, factoring in dividends, for shareholders in 20 of the last 23 years.

Investors appreciate NextEra Energy for its reliable cash flow and predictable earnings. Regardless of broader economic trends, the demand for electricity remains steady, allowing the utility to generate consistent revenue.

A leader in renewable energy, NextEra produces more solar and wind energy than any other company globally. Although transitioning to greener solutions involves costs, it has ultimately decreased its electricity generation expenses, supporting high annual earnings growth and a targeted double-digit annual dividend increase.

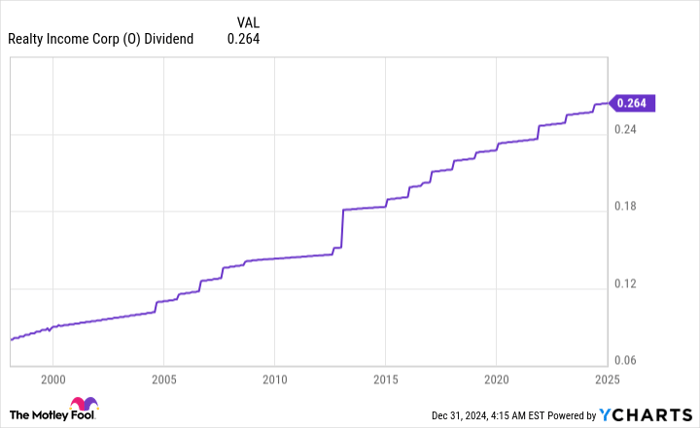

Realty Income pays a monthly dividend and has increased its payout for 109 consecutive quarters. O Dividend data by YCharts.

4. Realty Income

Another attractive option is Realty Income (NYSE: O), a well-known retail real estate investment trust (REIT) known for paying monthly dividends. Despite challenges posed by rising Treasury yields—leading investors to consider safer bonds—interest rate cuts from the Federal Reserve could provide a favorable environment for REITs.

The success of Realty Income stems from its partnerships with reliable, established businesses that consistently attract customers, such as grocery and drug stores. This ensures a predictable cash flow for the REIT.

Realty Income is expanding beyond retail through a joint venture with Digital Realty Trust, developing data centers and pursuing leasing agreements in new sectors. Currently valued at less than 12 times projected cash flow, it represents a notable discount of 29% compared to its historical average cash flow multiple over the past five years.

Image source: Pinterest.

5. Pinterest

Pinterest (NYSE: PINS) also looks like a smart buy as we head into 2025. While its recent sales forecast disappointed Wall Street, the company’s key performance measures are still trending positively.

By the end of September, Pinterest had 537 million monthly active users. Although this is considerably smaller than Meta’s staggering 3.29 billion daily active users, Pinterest enjoys improving advertising pricing dynamics. The company has seen growing average revenue per user (ARPU) globally, indicating a favorable outlook for ad revenue moving forward.

“““html

Top 10 Stocks That Could Boost Your Portfolio in 2025

Discover ten solid investment opportunities, ranging from tech giants to innovative biotech firms, poised for growth this year.

1. Pinterest

Pinterest (NYSE: PINS) stands out with impressive growth in average revenue per user (ARPU), particularly in emerging markets. The platform is uniquely structured, benefiting from users voluntarily sharing their interests, which makes it less affected by app developers’ data-tracking restrictions.

With a forward price-to-earnings (P/E) ratio of 16 and a price-to-earnings-growth (PEG) ratio of well below 1, Pinterest represents a remarkable investment opportunity.

2. SentinelOne

Cybersecurity firm SentinelOne (NYSE: S) is a promising stock for 2025. As more businesses shift their data to the cloud, services like SentinelOne’s are increasingly essential. This company operates on a subscription model, ensuring steady cash flow, with annual recurring revenue climbing 29% in the last quarter.

With a gross margin of 80%, investors can expect SentinelOne’s losses to decrease as it focuses on subscription growth.

Image source: Getty Images.

3. Alibaba Group

Alibaba Group (NYSE: BABA) remains an intriguing opportunity for investors amid political concerns regarding China. Although U.S. e-commerce is maturing, Alibaba thrives in China’s growing market, where its platforms Taobao and Tmall command nearly half of online retail sales in 2023, according to the International Trade Administration.

Additionally, Alibaba Cloud leads in cloud infrastructure services in China, which boasts higher profit margins than retail. With over $33 billion in net cash, Alibaba can enhance its market presence further while enjoying a low forward P/E of 9.

4. BioMarin Pharmaceutical

BioMarin Pharmaceutical (NASDAQ: BMRN) presents significant potential for portfolio gains this year. Despite rising competition in treating achondroplasia, BioMarin’s Voxzogo could still outperform due to opportunities for label expansion, targeting younger patients.

Moreover, BioMarin projects two new drug launches by 2027, aiming for total sales of $4 billion by that year, representing a 42% growth over the next three years. EPS is also expected to surpass $5 per share by 2027, warranting immediate investment consideration.

Image source: Getty Images.

5. Fiverr International

For a more unconventional investment, consider Fiverr International (NYSE: FVRR). The pandemic accelerated the shift towards remote work, making Fiverr’s freelancer marketplace increasingly relevant.

The platform’s pricing transparency, where freelancers quote for completed services instead of hourly rates, is likely increasing spending per buyer. Fiverr retains a take rate of 33.9%, nearly double that of its competitors, leading to higher profit margins.

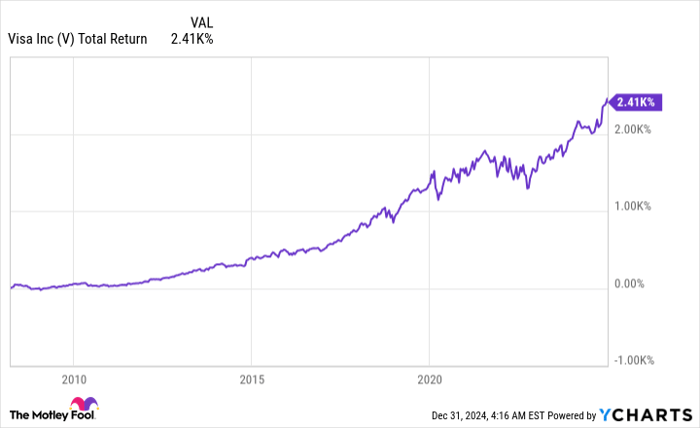

Visa has delivered steady returns for its shareholders since going public in March 2008. V Total Return Level data by YCharts.

6. Visa

Finishing the list is payment processor giant Visa (NYSE: V). While financial stocks can be risky, Visa’s solid foundation provides stability across various economic conditions.

Visa focuses solely on payment facilitation, sidestepping the risks associated with lending. This strategic choice protects it from economic downturns and defaults. Additionally, Visa sees steady double-digit growth in cross-border payment volume, particularly in underbanked emerging markets, enhancing its growth prospects.

Should You Invest $1,000 in Meta Platforms?

Before making investment choices, consider this:

The Motley Fool Stock Advisor analysts recently named the 10 best stocks to buy now, and Meta Platforms did not make the list. The stocks that did could yield significant returns in the years ahead.

For reference, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would now be worth $823,000!

Stock Advisor helps investors with portfolio strategies and provides two new stock picks each month, consistently outperforming the S&P 500 since its inception in 2002.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

Randi Zuckerberg, a former director at Facebook and sister to CEO Mark Zuckerberg, is a board member of The Motley Fool. Sean Williams holds positions in Fiverr International, Meta Platforms, NextEra Energy, Pinterest, and Visa. The Motley Fool recommends Digital Realty Trust, Fiverr International, Meta Platforms, NextEra Energy, Pfizer, Pinterest, Realty Income, and Visa, as well as Alibaba Group and BioMarin Pharmaceutical.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`