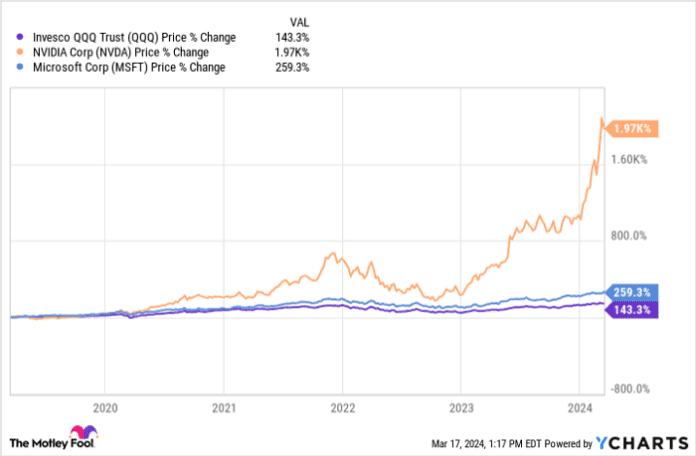

The tech-heavy Nasdaq index is riding high on a new bull market. The Invesco QQQ Trust has soared 63% since the beginning of 2023, a testament to the investor frenzy surrounding artificial intelligence (AI) stocks like Microsoft and Nvidia. Despite fears of an overvalued market, the allure of AI is undeniable, sparking interest in stocks that generate significant free cash flow (FCF) for long-term value creation. Two standout stocks leading this charge are Arm Holdings and Palantir Technologies.

Arm Holdings: Architect of the Future

Arm Holdings (NASDAQ: ARM) is a linchpin in the semiconductor industry without actually producing chips. Instead, the company designs chip architecture, licensing it to industry giants such as Nvidia, Amazon, and Apple. With 280 billion products boasting Arm-designed chips sold by the third quarter of fiscal 2024, the omnipresence of Arm’s technology in everyday devices like smartphones underscores its market dominance.

Arm’s chips are not limited to smartphones; they power industries such as automotive, data centers, and the Internet of Things (IoT). The IoT segment, encompassing internet-connected devices like smart appliances and drones, represents a lucrative market with vast growth potential.

Despite intense competition, Arm’s prowess shone through in the third quarter, with a 14% year-over-year increase in sales to $824 million. Although operating income dipped due to higher stock-based compensation post-IPO, the company’s robust cash flow, market share expansion to 51%, and a burgeoning remaining performance obligation of $2.4 billion herald a promising future.

Palantir Technologies: Unraveling Data for Profit

Palantir Technologies (NYSE: PLTR) has defied critics by not only achieving profitability but also diversifying its client base beyond government entities. The company’s software, adept at integrating and analyzing disparate data sources, has found applications in both the commercial and defense sectors.

Palantir’s recent success is epitomized by four consecutive profitable quarters, coupled with a solid 20% growth in commercial sales for fiscal 2023 and a substantial 32% surge in the fourth quarter. Furthermore, its increasing customer base underscores the expanding utility of its offerings.

The company’s innovative Artificial Intelligence Platform (AIP) revolutionizes data analytics, offering businesses real-time insights for informed decision-making. Palantir’s revenue growth and positive cash flow trajectory exemplify a company poised for sustained expansion.

Future Prospects and Investment Considerations

Both Arm Holdings and Palantir Technologies represent not just sound investments but pioneers shaping the technological landscape. While Arm’s unique business model and widespread market adoption bode well for long-term success, Palantir’s data analytics expertise and commercial strides position it as a key player in the AI domain.

Investors eyeing these stocks should acknowledge their robust financial foundations, with both companies exhibiting profitability and positive cash flow. Despite valuation complexities, prudent investment strategies like dollar-cost averaging can help capitalize on market fluctuations.

In a realm where data is king and innovation reigns supreme, Arm Holdings and Palantir Technologies stand as beacons of technological prowess, offering investors a promising glimpse into the future of AI-driven enterprises.