Investing in Quantum Computing: Why Alphabet and Nvidia Are Strong Choices

Quantum computing has taken a backseat lately, overshadowed by broader economic discussions and President Donald Trump’s tariff plans. However, it’s important to look at some of the pure-play quantum computing options, like IonQ and D-Wave Quantum, which have seen a significant decline, dropping over 30% recently. Despite this market disfavor, these are not the quantum computing stocks I’m recommending.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Instead, I’m turning my attention to larger companies that are also experiencing substantial sell-offs, making them attractive investment opportunities. Currently, I identify Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and Nvidia (NASDAQ: NVDA) as top buys; both stocks are significantly off their all-time highs.

The Role of Alphabet and Nvidia in Quantum Computing

Alphabet generated renewed excitement in December by introducing its Willow quantum computing chip, which features a unique method for minimizing computational errors inherent to quantum systems.

Unlike traditional computers that process data in binary (1s and 0s), quantum computers utilize qubits, which represent probabilities of being 1 or 0. This probabilistic nature means that errors can occur during calculations due to rounding and uncertainty, posing a critical challenge. If a quantum computation must be repeated multiple times to verify accuracy, it diminishes the advantages of quantum technology over classical computing.

Alphabet’s innovation of arranging qubits in a grid format enhances their interactions, thereby reducing calculation errors. This breakthrough generated substantial interest in quantum technology until Nvidia CEO Jensen Huang made headlines in January by declaring useful quantum computing was still over a decade away. However, during the 2025 GTC global artificial intelligence conference, Huang invited top quantum firms to showcase their advancements, signaling a shift in Nvidia’s approach toward supporting these companies through its quantum processing unit (QPU) products.

Rather than competing directly in the quantum space, Nvidia aims to support quantum computing startups with the necessary hardware. Its well-established CUDA software is instrumental in accelerating research and development in this field, positioning Nvidia favorably—especially since quantum systems require classical hardware, such as its leading GPUs.

Given these developments, both Alphabet and Nvidia are significantly engaged in the quantum computing sector, and their current valuations make them attractive investment options.

Valuation Analysis of Alphabet and Nvidia

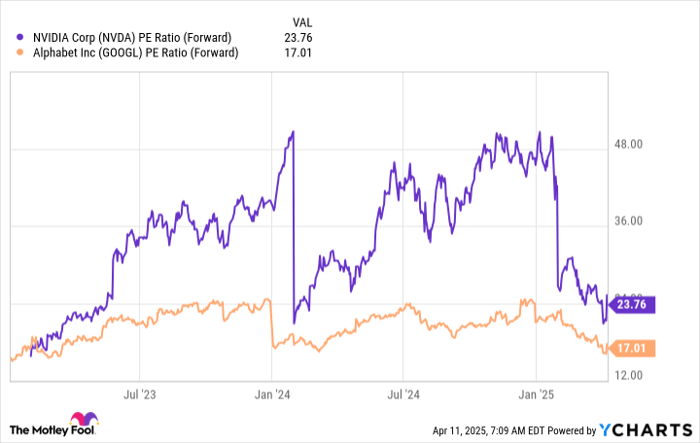

Notably, neither company relies on quantum computing for profitability. Both have robust core businesses that are thriving independently of any advancements in quantum technology. Alphabet and Nvidia are currently trading at valuations not seen since early 2023, a period characterized by recession fears.

NVDA PE Ratio (Forward) data by YCharts; PE = price to earnings.

The market has once again returned to a state of uncertainty. Historically, both stocks have bounced back to reach new highs. Currently, the S&P 500 is trading at approximately 20 times forward earnings, with Alphabet priced below market averages and Nvidia at a slight premium. Given both companies’ strong positions in artificial intelligence and their growth potential, these stock prices appear to be significant bargains.

While specialized quantum stocks have experienced steep declines, Alphabet and Nvidia have similarly faced sell-offs, yet they provide more stable investment opportunities that do not hinge on the success of quantum capabilities.

Should You Invest $1,000 in Nvidia Now?

Before committing to Nvidia, consider this:

The Motley Fool Stock Advisor analyst team has just listed the 10 best stocks to buy right now, which does not include Nvidia. Their picks represent significant potential for high returns in the coming years.

For example, when Netflix was added to this list on December 17, 2004, a $1,000 investment would now be worth $526,499!* Similarly, if you had invested $1,000 in Nvidia when it made this list on April 15, 2005, you’d currently hold $687,684!*

Stock Advisor has an average total return of 818%—significantly outperforming the 156 % return of the S&P 500. Don’t miss your chance to access this top 10 list by joining Stock Advisor.

Explore the 10 stocks »

*Stock Advisor returns as of April 14, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Nvidia. The Motley Fool has recommended both companies and has investments in them. For further details, refer to The Motley Fool’s disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.