Philip Morris International(NYSE: PM) shares have been oscillating within a narrow range of $87 to $102 for the past year, but a shift could be on the horizon with enticing growth prospects beckoning.

Smokeless Marvels

For years, Philip Morris International has been synonymous with distributing cigarettes, notably the revered Marlboro brand beyond U.S. borders, while its counterpart Altria handles the domestic territory.

Diving deep into international markets, the company has skillfully propelled its combustible cigarette business by implementing price hikes despite minor volume declines. In a notable instance, in 2023, the company witnessed a robust 5.5% organic surge in combustible sales through an 8.9% price escalation.

While traditional cigarettes remain a stalwart, the real buzz centers around the smokeless wonders – Zyn and Iqos. Not vending cigarettes within the U.S., Philip Morris is currently marketing Zyn and will soon add Iqos to its U.S. portfolio.

Zyn, a nicotine pouch, has gained rapid traction in the U.S. since Philip Morris acquired the brand in 2022. The acquisition of Swedish Match for $16 billion preluded this. Notably, Zyn observed a remarkable 62% volume surge in the U.S. in the fourth quarter, indicating a flourishing trajectory.

On the other hand, Iqos, which heats tobacco instead of combusting it, has been a standout success for Philip Morris International. By the close of 2023, the company tallied 28.6 million Iqos users, marking a surge of 3.7 million from the previous year, propelled by the enhanced heating component, Iqos Iluma.

Both Zyn and Iqos present a boon to Philip Morris International, flaunting superior unit economics compared to cigarettes. Zyn offers a six-fold product contribution advantage over cigarettes, while Iqos boasts double the unit profitability. Notably, smokeless products accounted for over 39% of the company’s Q4 revenue.

Dividend Delight

Besides its growth prospects, the allure of Philip Morris International stock is further accentuated by its enticing 5.6% dividend yield. Since its spinoff from Altria in 2008, the company has consistently upped its dividend, witnessing over a 180% surge to $5.20 annually.

In 2023, Philip Morris International raked in $9.2 billion in operating cash flow and anticipates generating between $10 billion to $11 billion in 2024. Despite shelling out nearly $8 billion in dividends in 2023, the ample cash flow leaves sufficient room for business investments and debt repayments, as evidenced by plans to slash leverage from 3x to 2x by the end of 2026.

Given the robust financial performance, one can anticipate a continued dividend uptrend from Philip Morris International, with prospects for substantial increases once the targeted leverage ratio is achieved.

Image source: Getty Images.

A Gem in Investment Land

Philip Morris International represents a rare fusion of a defensive consumer staples stock offering a generous dividend yield with robust growth potential. Projections for 2024 envision organic revenue growth between 6.5% to 8% and adjusted EPS growth ranging from 7% to 9%.

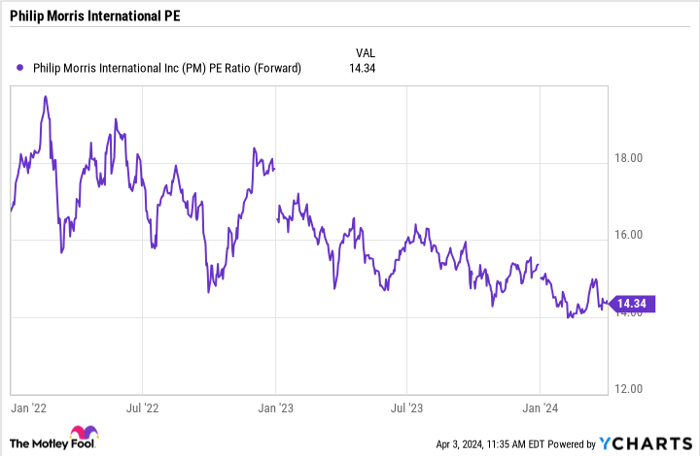

PM PE Ratio (Forward) data by YCharts

Trading at a forward P/E of slightly over 14x, one of the lowest figures in recent times, Philip Morris International offers an appealing proposition with its smokeless product potential and high dividend yield, presenting an attractive buying opportunity.

Is Philip Morris International Your Ideal $1,000 Play?

Before diving into Philip Morris International’s stock, ponder on this:

The Motley Fool Stock Advisor analyst squad has pinpointed the believed top 10 picks for investors to consider presently, with Philip Morris International not making the cut. The selected 10 stocks are deemed to deliver substantial returns in the foreseeable future.

The Stock Advisor subscription furnishes investors with a clear roadmap to success, offering counsel on portfolio construction, regular analyst updates, and two fresh stock recommendations monthly. Stock Advisor has remarkably outpaced the S&P 500 return since 2002*.

Check out the 10 stocks

*Stock Advisor returns as of April 4, 2024

Geoffrey Seiler holds positions in Philip Morris International. The Motley Fool endorses Philip Morris International and abides by a transparency policy.

The perspectives articulated here represent the author’s views and not necessarily those of Nasdaq, Inc.