The Power Players: Essential Properties Realty Trust, Inc. and Tanger Inc.

The retail landscape is experiencing a renaissance as consumers rediscover the joy of in-store retail therapy. Against a backdrop of limited new supply in commercial real estate, companies like Essential Properties Realty Trust, Inc. and Tanger Inc. are standing tall, ready to reap the benefits.

An Insight into the REIT and Equity Trust – Retail Industry

The Zacks REIT and Equity Trust – Retail industry is a multilayered universe comprising regional malls, outlet centers, grocery-anchored shopping spots, and power centers. These are places where big-box retailers dwell amidst a web of vibrant economic activity. The industry, once in the doldrums due to online retail dominance, has pivoted towards a resurgence centered on in-person shopping experiences.

Driving Forces Shaping the Retail Real Estate Industry

Amid a backdrop of robust job markets and evolving consumer behavior, the demand for physical retail spaces is on the rise. With a dearth of new constructions and a shift towards mixed-use developments, the supply side of the equation remains constrained, bolstering the fundamentals of the retail real estate sector even amidst economic headwinds.

Furthermore, retailers are embracing omnichannel strategies and diversifying their offerings to drive foot traffic. Physical retail spaces are no longer just places to shop – they are becoming community hubs offering all kinds of services, from fitness centers to healthcare facilities.

However, challenges persist as inflation, retailer bankruptcies, and escalating costs threaten to dampen the sector’s growth trajectory. The rise of e-commerce remains a lurking menace, compelling retailers to rethink their expansion plans.

Unlocking Potential: The Zacks Industry Rank

The Zacks REIT and Equity Trust – Retail industry has earned a Zacks Industry Rank #89, placing it in the top 35% of all Zacks industries. This ranking underscores the industry’s promising outlook, with analysts projecting a positive trajectory for companies within this sector.

The upward revision in funds from operations (FFO) per share estimates for industry constituents reflects growing confidence in the retail real estate market’s potential. Despite lingering challenges, the industry is poised for growth, fueling investor optimism.

Charting the Path Ahead

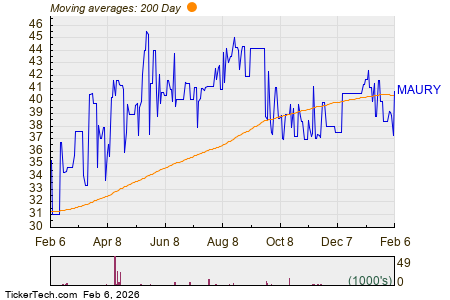

Stock performance within the REIT and Equity Trust – Retail Industry has been humbler compared to broader market indices over the past year. While the S&P 500 and the Finance sector witnessed robust gains, retail REITs made more modest progress.

One-Year Price Performance

Looking at valuations, retail REITs are currently trading at a favorable forward 12-month price-to-FFO ratio compared to the broader market. This suggests potential investment opportunities for those eyeing the retail real estate sector.

Forward 12-Month Price-to-FFO (P/FFO) Ratio

As retail REITs navigate through evolving consumer trends and economic uncertainties, savvy investors may find hidden gems within companies like Essential Properties Realty Trust, Inc. and Tanger Inc., poised to thrive in the changing retail landscape.

The Rise of REIT Stocks: Capturing Growth Potential

Essential Properties Realty Trust, Inc. (EPRT)

Essential Properties Realty Trust, Inc. (EPRT) delves into single-tenant properties, establishing net leases with service-oriented and experience-based businesses over extended periods. The company caters to industries ranging from casual dining, healthcare, convenience stores, to entertainment, and more. EPRT’s strategic focus on tenants in specialized sectors shields it from the pitfalls of online retail competition, ensuring a stable revenue stream.

With a robust portfolio comprising 1,873 properties dispersed across 48 states and serving 374 tenants from various sectors, EPRT stands strong with a weighted average lease term of 14 years and an impressive weighted average rent coverage ratio of 3.8 as of Dec 31, 2023. The company is well-positioned to scale the growth ladder.

Boasting a Zacks Rank #2 (Buy) status, EPRT has been on an upward trajectory. The Zacks Consensus Estimate for 2024 forecasts a 1.7% surge in FFO per share to $1.80, indicating a significant 9.1% rise year over year. The 2025 estimate, up by 3.2% in the past month, only adds to the bullish outlook. Noteworthy is the stock’s 20% spike over the last six months.

Tanger Inc. (SKT)

Tanger Inc. (SKT), based in Greensboro, NC, operates as a veteran in the outlet and open-air retail shopping realm for over four decades. Its portfolio comprises 38 outlet centers, strategically located to tap into tourist hotspots and thriving markets in 20 U.S. states and Canada, totaling more than 15 million square feet.

SKT’s strength lies in its open-air formats, providing brands a lucrative retail avenue, while consumers flock to its centers for branded merchandise at attractive values. As open-air concepts gain traction, Tanger is excellently positioned to amplify its gains in the flourishing retail real estate market.

Attaining a Zacks Rank #2 label, SKT has cemented its position as a promising stock. The upward revision of 2024 FFO per share estimate by a cent signals a 5.1% annual growth. The 2025 projection of $2.16, up by 4.85% year over year, solidifies investor confidence. Not to mention, the stock’s commendable 25.7% ascent over the past six months speaks volumes about its potential.

Funds from operations (FFO) stands as a pivotal metric for assessing REITs, overlooking net income for a more transparent view of operational cash flow. FFO emerges post-amalgamating depreciation and amortization with earnings while deducting sales gains.

Zacks Names #1 Semiconductor Stock

Give your attention to this new chip stock, a mere fraction of the size of the explosive NVIDIA. While NVIDIA holds its ground, this emerging chip player holds substantial growth potential. With a promising trajectory marked by robust earnings and an expanding clientele, this stock stands ready to cater to the voracious demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The semiconductor industry is slated to skyrocket from $452 billion in 2021 to a staggering $803 billion by 2028.

Explore This Stock Now for Free >>

Get a Free Stock Analysis Report of Essential Properties Realty Trust, Inc. (EPRT) here

Fetch a Free Stock Analysis Report of Tanger Inc. (SKT) here

For more insightful reads from Zacks.com, read the article here

Discover Zacks Investment Research here

The opinions expressed herein are solely those of the author and do not reflect the views of Nasdaq, Inc.