An Eager Look at Amazon

Warren Buffett’s multinational conglomerate, Berkshire Hathaway, cleverly sowed seeds in Amazon several years ago – and boy, are they reaping a bumper harvest now! The tech giant has showered investors with a remarkable 76% growth in share prices over the past year. An enticing performance by any measure.

A perusal into Amazon’s growth recipe reveals a delightful narrative – a stock currently priced at merely 3.2 times sales, despite its recent exhilarating surge. This valuation stands at a significant discount compared to the Nasdaq-100 Technology Sector index. Furthermore, with a forward earnings multiple of 41, Amazon appears on sale compared to its five-year trailing average of 57.

Experts predict a luscious 15% annual growth in Amazon’s profits over the next five years. The backdrop for this accelerated growth includes cutting-edge technologies like artificial intelligence (AI), a burgeoning digital advertising sector, and the ever-expanding e-commerce landscape.

Shining particularly brightly is Amazon Web Services (AWS), which raked in almost $91 billion in revenue last year, marking a brisk 13% surge. Commanding a 31% market share of the cloud infrastructure domain, AWS is primed to capitalize on the soaring AI cloud market that could potentially reach an enormous $400 billion in annual revenue by 2030, a monumental climb from its $60 billion figure last year.

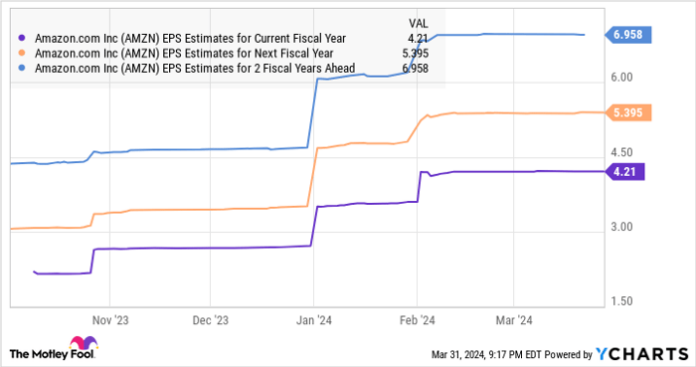

With Amazon’s recent strides in developing AI applications on AWS, such as Rufus – a generative AI shopping assistant – the future looks incredibly promising. It’s not surprising that analysts anticipate a substantial uplift in Amazon’s earnings over the upcoming years, building upon last year’s $2.90 per share baseline.

AMZN EPS Estimates for Current Fiscal Year data by YCharts

With long-term prospects such as AI integration in cloud computing, Amazon’s upward trajectory seems poised for an enduring ascent. Savvy investors should consider hitching a ride on this skyrocketing Buffett stock before it takes flight.

The Snowy Landscape of Snowflake

Let’s shift our gaze to Snowflake, a cloud computing wonderland that Berkshire found worthy to invest $989 million in. Despite a recent plummet in its stock price by 19% in 2024 due to a tepid fiscal 2025 guidance, Snowflake stands as a promising contender in the cloud arena.

Although Snowflake’s anticipated growth rate for fiscal 2025 appears modest compared to the previous year, boasting just a 22% year-over-year upsurge, the company’s cloud-based platform continues to attract robust demand in the long haul. With a substantial 41% increase in remaining performance obligations, totaling a hefty $5.2 billion, Snowflake’s value remains intact.

Despite a cautious tone in its revenue forecast for the current year, owing to possible customer spending pullbacks, Snowflake’s formidable 131% net revenue retention rate underscores a positive reinforcement from its existing customer base.

Moreover, Snowflake’s entry into the AI domain within its data cloud platform unveils a fresh avenue for growth, particularly in the lucrative AI-as-a-service sector. This strategic move could catalyze a resurgence in Snowflake’s fortunes over time. Moreover, trading at a relatively subdued 18 times sales, compared to nearly 25 by the end of 2023, Snowflake presents a charming investment opportunity.

All in all, you stand to gain by investing in a swiftly progressing company at a more favorable valuation. With Snowflake’s promising revenue pipeline and the expansive market it serves, prospects look sunny for this Buffett-backed stock.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 1, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Berkshire Hathaway, and Snowflake. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.