Technology stocks jubilantly sparkled in 2023, showcasing a remarkable ascent of nearly 67% on the Nasdaq-100 Technology Sector index throughout the year. And like a boomerang soaring higher against the azure sky, the sector seems ready to dazzle once more this year.

As we study the patterns, the Nasdaq-100 Technology Sector index has meandered upwards by about 7% thus far in 2024. History whispers tales that it may close the year with even mightier gains. With the U.S. economy flourishing and inflation waning, the stars seem aligned for Nasdaq to script another historic jump upwards in 2024. Hence, it’s an opportune moment for investors to turn their gaze towards tech giants like Microsoft (NASDAQ: MSFT) and Micron Technology (NASDAQ: MU).

Investing in Microsoft: A Cloud of Potential

The mantle of Microsoft stock currently rests at 36 times trailing earnings. Slightly higher than the Nasdaq-100’s average price-to-earnings ratio of 33, but Microsoft’s forward earnings multiple of 31 stands shoulder to shoulder with the index’s average.

Acquiring Microsoft at this valuation appears a prudent maneuver, given the company’s burgeoning dominance in the cloud computing realm. In the fourth quarter of 2023, the azure skies of Microsoft’s Azure cloud beheld a 24% control over the cloud infrastructure market, riding up by a percentage point from the preceding year.

The crescendo of cloud infrastructure spending, up by 20% year over year in the final quarter of 2023, slightly eclipsing the market’s 19% growth throughout that year, illuminates the realm. Generative artificial intelligence (AI) stood as the lighthouse guiding this market’s accelerated growth last quarter.

Yet, this is just the prologue to AI’s grand symphony in the cloud computing domain. Projections sketch a picture of the cloud AI market blooming into a $67 billion tapestry in 2024, commanding a significant slice of the $270 billion cloud computing canvas last year. A prophecy unfolds, whispering that by 2029, the cloud AI market might orchestrate annual revenues of a majestic $274 billion.

For Microsoft investors, these are tidings of great joy. The azure momentum of Azure cloud sailed up by 30% year over year last quarter, in contrast to the 13% growth at market Stalwart Amazon Web Services. AI unfurled its wings, propelling Microsoft’s cloud business by six percentage points last quarter, bridging the chasm with the market leader.

The vista of opportunity in the cloud computing realm, coupled with Microsoft’s seasoned AI integration across various domains, hints at analysts’ expectations for the company’s top and bottom lines to dance to a merrier tune in the long run. Whispers from investment banking firm Evercore foresee AI blanketing Microsoft with an additional $82.5 billion in annual revenue by 2028, while boosting its earnings by $5.10 per share.

A harmonious crescendo, considering the predicted $11.66 per share in earnings for Microsoft in the current fiscal year, embroidered upon revenues of $244.3 billion. Investors, therefore, may wish to loop their investment lassos around this tech colossus before it gallops off, carried by the rising demand for AI applications across sundry industries.

Embarking on Micron Technology’s Memory Lane

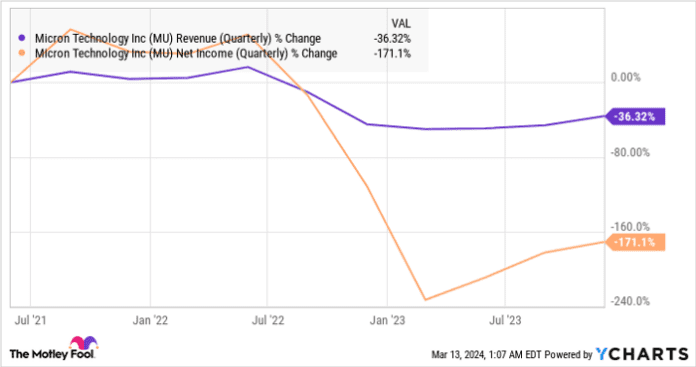

The memory market witnessed a renaissance in 2023 after enduring turbulent skies for nearly two years. The symphony of dynamic random access memory (DRAM) chip prices, plunging from the twilight of 2021 till the twilight of 2023, left Micron’s financial manors in disarray.

MU Revenue (Quarterly) data by YCharts

The musical interlude for Micron heralds that DRAM prices are set to ascend by 10% to 15% in the first quarter of 2024. The crescendo was orchestrated by expanding horizons, from PCs to smartphones to servers, harmonizing beautifully with the burgeoning presence of AI in these realms.

AI servers, for instance, herald a growing need for high-bandwidth memory chips, embraced by major chip artisans in their AI accelerators. Likewise, the dawn of AI-enriched PCs and smartphones promises a crescendo in demand for memory chips. Such harmonies have led Gartner to predict an 88% surge in the memory market’s revenues this year, swelling to $87 billion, fueled by robust pricing and volumetric movements. Meanwhile, the hymn of storage memory foretells a melody of nearly 50% growth in 2024, swelling to $53 billion.

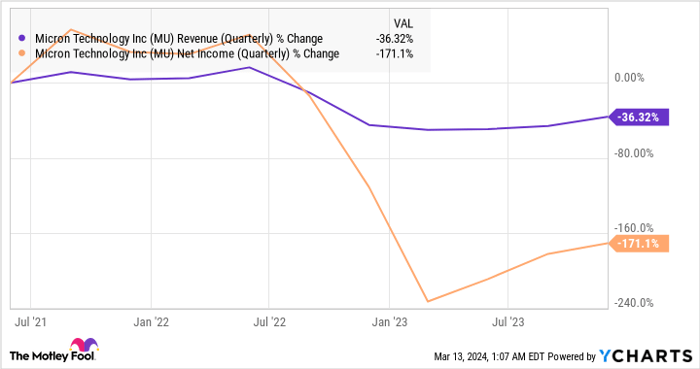

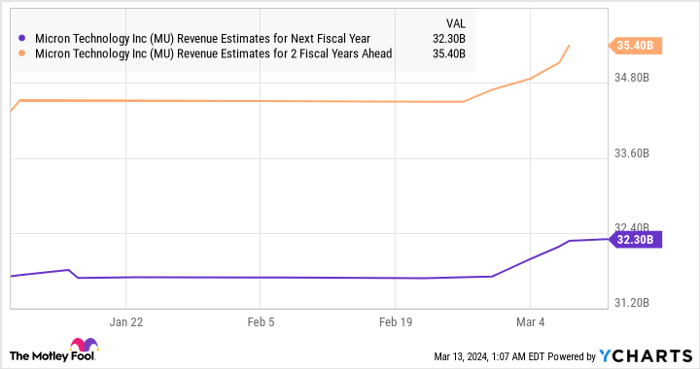

The reverberations of recovery in the memory market whisper that Micron’s revenues might bolster by a magnificent 46% in the present fiscal year, frolicking to $22.7 billion, as sung by the consensus. Analysts raise their torches, illuminating assurances of this momentum dancing through successive fiscal annals unscathed.

MU Revenue Estimates for Next Fiscal Year data by YCharts

Micron’s stock currently adorns a 6.6-fold sales attire. A fashion statement lower than the Nasdaq-100’s price-to-sales ratio of 7.3, suggesting investors a fetching offer on this semiconductor gem at present. An attire of a mere sales multiple of 6 in subsequent fiscal years hints that Micron could be crowned with a market cap of $212 billion, almost twofold its current adornment of around $107 billion. Thus, investors are beckoned to ponder on this Nasdaq jewel before it ascends skyward.

Where to invest $1,000 righ now

When our analyst troupe shares a stock reverie, it’s wise to tune in. After all, the chronicle they’ve scripted for two decades, Motley Fool Stock Advisor, has triumphed triplefold over the market.*

They’ve just unveiled their casket of the 10 best stocks for investors to embrace today… where Microsoft stands enthroned among them — yet there are nine others that might be hiding in the shadows.

Discover the 10 stocks

*Stock Advisor returns as of March 11, 2024

John Mackey, erstwhile monarch of Whole Foods Market, now an Amazon kin, graces The Motley Fool’s royal council. Harsh Chauhan stands affixed in a neutral stance amidst the concerned stocks. The Motley Fool stands as both herald and advocate for Amazon and Microsoft. The Motley Fool flutters a banner of recommendation towards Gartner and echoes a note of advice: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool clearly discloses its edicts.

The perspectives and musings shared herein reflect the sentiments of the author and may not essentially mirror those of Nasdaq, Inc.