When it comes to yielding a bountiful harvest, a seasoned investor knows that dividend stocks are the ever-reliable fruit-bearing trees of the financial world. They provide a steady and growing stream of income while adding ballast to any investment portfolio. Thus, here are a pair of powerhouse dividend-paying stocks that any prudent investor should consider stashing in their treasure chest.

Enterprise Products Partners – Sustaining the Energy

Large dividend payouts can often wither and die, leaving investors high and dry. However, Enterprise Products Partners (NYSE: EPD) has defied this trend, increasing its cash payments to investors for 25 consecutive years.

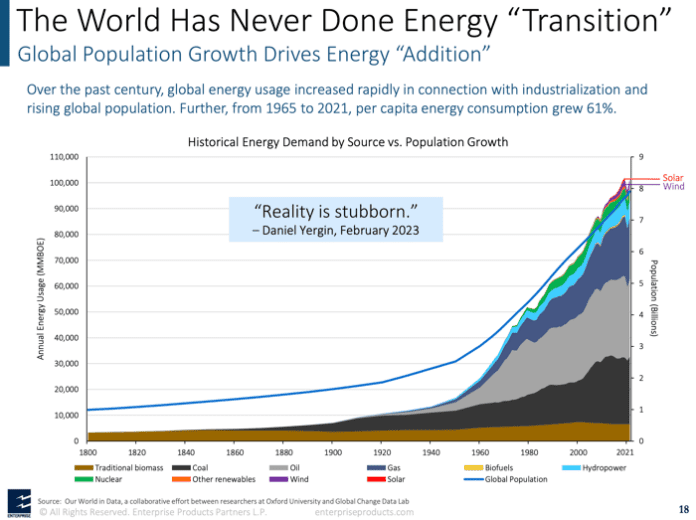

Operating a colossal network of energy infrastructure, Enterprise rules an empire of pipelines, storage facilities, and marine terminals crucial for the transportation of oil, natural gas, and petrochemicals across the United States. In an era where fossil fuels still reign supreme with an 80% global energy consumption share, Enterprise continues to serve a vital role in securing the nation’s energy needs.

Image source: Enterprise Product Partners.

Protected from the price volatility inherent in the oil and gas market due to its predominantly volume-based business, Enterprise’s reliable, fee-based revenue offers steadiness in even the most turbulent market conditions. As a master limited partnership (MLP), it must distribute the majority of its cash flow to investors, leading to a generous dividend yield of 7.8%.

With expansion projects worth $6.8 billion set to come online later this year, there is a promise of a continual upward trajectory in cash payments. Co-CEO Jim Teague conveyed this optimism in the company’s fourth-quarter earnings release, stating, “These projects provide visibility to new sources of cash flow for the partnership for this year and beyond.”

Ares Capital – Driving Growth with Resilience

For those seeking even juicier dividends, Ares Capital (NASDAQ: ARCC) with its 9.5% yield is a tantalizing prospect. Functioning as one of the mainstays in the business development company (BDC) realm, Ares specializes in providing capital to private companies for their operational expansion.

Catering to businesses with revenues ranging from $10 million to $1 billion, Ares carefully selects established enterprises with solid fundamentals to curate a portfolio that helps mitigate risks. Diversifying its $22.9 billion in loans and investments across more than 500 companies protects against potential losses.

By focusing on middle-market businesses, Ares capitalizes on higher interest rates, with an average yield on total investments exceeding 11% as of Dec. 31. This robust performance ensures stable dividend payments, which are further bolstered by a rising demand for business growth financing and a projected economic upturn.

Given the crispness in Ares Capital’s prospects, it is natural to wonder if investing in it would prove to be as fruitful as its dividend payouts. The Motley Fool Stock Advisor analyst team might opine on this, but one thing is certain: Ares keeps delivering appetizing dividends that are nothing short of delectable.

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.