Amidst the ebbs and flows of the market, high-yield stocks hold a tantalizing allure for investors seeking robust returns. Two such stocks – Devon Energy (NYSE: DVN) and Whirlpool (NYSE: WHR) – stand out as prime opportunities in the current landscape. Despite its appeal, 3M (NYSE: MMM) doesn’t quite make the cut for high-yield investors. Let’s unpack why.

The Resilience of Devon Energy with a 5% Dividend Yield

Devon Energy adopts a unique dividend strategy, blending fixed dividends with variable payouts based on free cash flow. This dynamic approach allows the company to allocate excess cash judiciously, benefiting shareholders in the process.

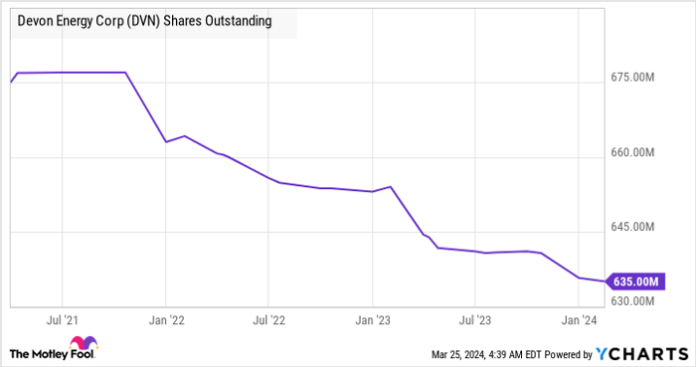

Highlighting its shareholder-friendly stance, Devon Energy has consistently reduced its share count, amplifying the share of future cash flows for investors. With a promising outlook based on oil prices and strong management projections, Devon Energy presents a compelling case for high-yield investors.

Whirlpool’s journey intersects with the housing market’s trajectory, a significant driver of demand for household appliances. Despite market headwinds, Whirlpool is realigning its focus, divesting its struggling European arm and honing in on the lucrative North American market.

Boasting significant cost-cutting initiatives and a shift towards higher-margin segments, Whirlpool is poised to weather market fluctuations and leverage future opportunities in the housing sector.

3M: A Cautionary Tale of a 5.7% Dividend Yield

While 3M appears attractive with its dividend yield, a closer look reveals potential pitfalls. The impending spinoff of its healthcare division introduces uncertainty, potentially impacting cash flows and dividend sustainability.

Despite management’s efforts to revamp operations and improve key markets’ performance, 3M faces ongoing legal challenges and cash outflows. Shareholders may find their returns compromised as 3M grapples with restructuring and impending dividend adjustments.

As investors navigate the high-yield landscape, strategic choices play a pivotal role in shaping their portfolios. While Devon Energy and Whirlpool offer promise, caution is warranted when considering 3M as an investment option. Diligence and foresight are key in this volatile financial terrain.

Image source: Getty Images.

Invest wisely, stay informed, and tread carefully in the quest for high-yield returns in the ever-evolving investment realm.

Disclaimer: The author’s views expressed herein are personal and do not necessarily reflect those of Nasdaq, Inc.