Amidst the intricate interplay of supply and demand, the real estate sector is poised for a paradigm shift in 2024.

What sets this year apart is the culmination of zero interest rate policy (ZIRP)-driven construction, signaling a departure from a period of perpetual abundance to an era of scarcity.

However, the impact of this transition may not be readily discernible, owing to delays in the supply chain:

- Underwriting

- Financing

- Zoning/permitting

- Acquiring labor and physical goods

- Construction

- Lease-up

These factors contribute to the time lag in the delivery of new supply, with projects initiated between 6 months to 3 years ago.

Although 2024 is characterized by a surge in deliveries, it is not indicative of heightened supply for the year itself; the peak in supply was witnessed in 2021 and early 2022.

Significance of the Shift

This shift holds pivotal importance as it heralds the ebbing of surplus in real estate. Once the ongoing construction phases are absorbed, the prospective supply trajectory appears notably more subdued.

Although the construction data might suggest an alarming oversupply, a closer examination of the Census Bureau figures indicates the highest level of construction spending in 2023, persisting into early 2024.

This trend has triggered market apprehensions, resulting in a sell-off of Real Estate Investment Trusts (REITs) amid concerns of looming oversupply, as evidenced by the downward slope of the Vanguard Real Estate ETF (VNQ).

This trepidation is palpable in the nature of inquiries during conference calls, with numerous mentions of oversupply across diverse sectors. For instance, during the Camden (CPT) call on 2/2/24, there were pointed queries regarding rent growth assumptions amidst supply headwinds.

Similarly, the Prologis (PLD) earnings call featured discussions about development stabilizations against the backdrop of elevated supply, underscoring the pervasive unease.

Such pervasive concerns are a reflection of the analysts’ need to grapple with client queries, with real estate oversupply constituting a predominant theme in these interactions.

However, a deeper analysis reveals a more sanguine outlook once the deliveries are contextualized in the framework of the following data:

The properties slated for delivery in 2024 primarily stem from the permitting boom of 2021 and early 2022. The current decline in new permits suggests a substantial reduction in deliveries anticipated for 2025 and 2026.

The underlying cause of this surge is rather straightforward:

The zero interest rate policy in the aftermath of the pandemic disrupted the economic landscape, with capital emerging as the primary barrier to new real estate supply.

Given the exorbitant costs associated with commercial real estate ventures and the extended gestation periods, the viability of such projects hinges on substantial returns. The aberration of near-zero interest rates rendered the traditional fiscal calculus moot, fueling a surge in construction with markedly diminished return expectations.

As the Federal Reserve embarked on the arduous journey of restoring normalcy, marked by a swift ascent in the Fed Funds Rate, SOFR, and Prime rates, the capital dynamics underwent a seismic shift.

This culminated in a sharp decline in development initiations, signifying that the forthcoming 2024 supply wave represents the denouement of the ZIRP-induced surge. While the ensuing temporary oversupply may impact various property sectors and locations, it is poised to herald an era of constrained real estate supply.

Perceptive strategizing is imperative to navigate this impending supply wave and capitalize on the ensuing diminished supply landscape:

- Sectors devoid of new supply

- Segments with negligible new supply

- Averting sectors vulnerable to protracted oversupply

- Sectors with demand growth poised to rapidly absorb the supply

Sectors with Minimal or No New Supply

Remarkably, retail construction remained subdued even during the ZIRP era, yielding bullish fundamentals today. This underlines the resilience of retail, offering an opportune entry point into a sector characterized by bearish prices juxtaposed with bullish fundamentals.

Limited land availability inherently precludes new supply, making farmland and timberland ideal havens during periods of abundant supply.

Long-term Oversupplied Real Estate Sectors

Office development defies rationale, with persisting oversupply despite a pre-pandemic high vacancy rate and enduring repercussions from remote work arrangements. The office segment is projected to grapple with persistent oversupply for the foreseeable future.

Conversely, self-storage properties are primed for swifter appreciation owing to their inherent operational simplicity, warranting careful scrutiny amid the current supply influx.

Navigating the Changing Tides of the Real Estate Market

The evolving landscape of the real estate market reflects the aftermath of the Zero Interest Rate Policy (ZIRP) era and a continual surge in new construction despite the normalization of interest rates.

The Oversupply Dilemma

Developers, in a state of financial exuberance, have overbuilt, seemingly extrapolating the temporary surge in pandemic-driven demand as a sustainable, long-term trend. The consequence of this miscalculation is an excess of units in existence, leading to a significant decline in rents. Reports from Yardi Matrix indicate negative rental rate growth for self-storage units in nearly every region, underscoring the ramifications of oversupply.

It appears that the market will continue to grapple with an oversupply conundrum for the foreseeable future, having been inundated to cater to what can be deemed an unsustainable level of demand.

Real Estate Sectors Facing Supply Surplus and Demand Disparity

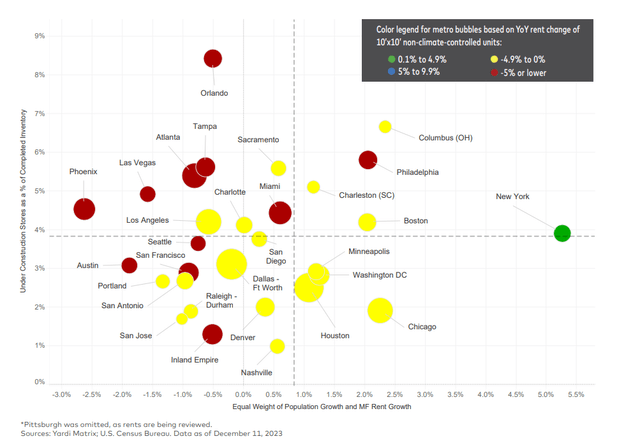

Amid an influx of construction deliveries in 2024, the real estate landscape is witnessing heightened pressure on rents, particularly in the apartment, lab, and warehouse sectors.

Projections indicate a modest decline of approximately 2% in national apartment rents for 2024. Lab rents, on the other hand, are not experiencing a direct decline but are necessitating larger concessions from landlords in the form of free rent periods or tenant improvements. Industrial rents continue to rise at a brisk pace despite an upsurge in supply, albeit resulting in a reduction in occupancy rates from 97% to around 95%.

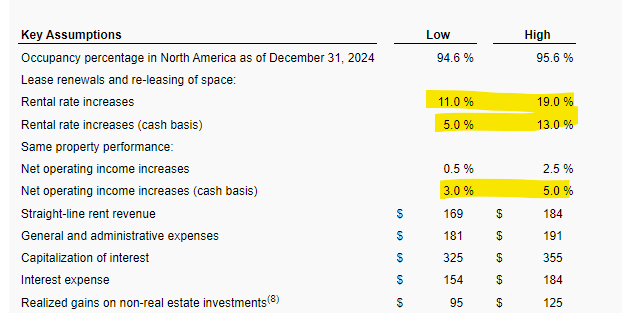

Notably, market experts and industry reports are anticipating a mitigated impact in the case of apartments and labs, with no substantial impact foreseen in the industrial sector. Alexandria (ARE), a prominent lab Real Estate Investment Trust (REIT), foresees a deceleration in rental rate growth to 5%-13% in 2024, resulting in same store Net Operating Income (NOI) growth of 3%-5%. While this growth rate is slower than that experienced in 2023, it remains robust considering the anticipated decline.

Conversely, Camden is projecting flat growth in 2024, indicating the diverse projections within these real estate sectors. However, all three sectors are expected to witness a resurgence in growth in 2025, owing to the projected low new supply in 2025 and 2026, ultimately setting the stage for sustained fundamental growth.

Essentially, the anticipated scarcity of new supply in 2025 and 2026 is poised to pave the way for a resurgence in fundamental growth across these sectors.

The Verdict

The dynamism of real estate supply and demand is a protracted process, and the myopic outlook of 2024 in isolation presents a distorted representation of the fundamental market outlook. National data, combined with industry-specific insights, indicates an impending surge in new supply in 2024, succeeded by a period of limited supply in 2025 and 2026. Investors are encouraged to position themselves strategically, considering the varying degrees of strength and weakness prevalent across different property sectors.