“`html

A Deep Dive into AI Stocks: Top Picks for 2025 Investment

Wall Street has seen a remarkable bull run over the past two years, with the technology sector, particularly artificial intelligence (AI) and generative AI, driving the surge. Companies that harness AI in their final products have sharply increased in value during this time.

Though some stocks may appear overvalued, the technology sector is expected to thrive long-term, fueled by continuous innovation. Technology evolves faster than any other sector, with generative AI standing at the forefront of this change.

For those considering a long-term investment (about one year), focusing on AI-centric stocks with favorable Zacks Rankings is wise. Despite high valuations, these stocks could maintain their upward momentum through 2025, presenting attractive buying opportunities during market dips of 5-10%.

Five top AI stocks include: NVIDIA Corp. NVDA, Broadcom Inc. AVGO, QUALCOMM Inc. QCOM, Innodata Inc. INOD, and Marvell Technology Inc. MRVL.

The Unstoppable AI Surge Continues

The remarkable rally in U.S. stocks that began early in 2023 can largely be attributed to advancements in the technology sector. Global adoption of generative AI has been the primary catalyst for this growth.

According to Bloomberg Intelligence, spending on generative AI is projected to soar from $67 billion in 2023 to $1.3 trillion by 2032. Additionally, UBS forecasts that the four largest U.S. technology companies, known as the “Magnificent 7,” will spend around $267 billion on AI applications by 2025, marking a 33.5% increase from the previous year.

In a sign of robust demand, Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), the largest maker of AI chipsets, recently reported strong fourth-quarter 2024 earnings and offered optimistic guidance, thanks to the high demand for AI chips.

AI-Enhanced Data Centers Are Thriving

AI-powered data centers are emerging as a crucial sector. On January 7, Microsoft Corp. (MSFT) announced an $80 billion investment in AI-friendly data centers by 2025, aimed at training AI models and deploying cloud applications.

The rapid growth of data centers has prompted major companies like Microsoft, Alphabet Inc. (GOOGL), Meta Platforms Inc. (META), and Amazon.com Inc. (AMZN) to seek partnerships with nuclear energy producers to address their substantial electricity needs.

A report from Rystad Energy predicts that the combined growth of traditional and AI-driven data centers, alongside chip foundries, will increase the total demand for electricity in the U.S. by 177 TWh from 2023 to 2030, totaling 307 TWh.

Top 5 AI Stocks for 2025 Investment

The following five AI-focused stocks are poised for strong growth in 2025, having experienced positive revisions in earnings estimates over the past month’s period. Each of these stocks holds a Zacks Rank of #1 (Strong Buy) or #2 (Buy). For a complete list of today’s Zacks #1 Rank stocks, see the complete list here.

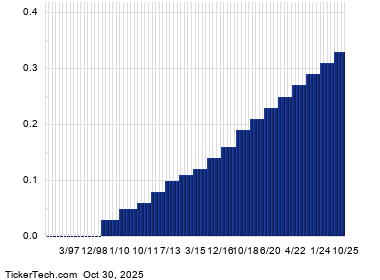

The chart below illustrates the price performance of these five stocks over the past year.

Image Source: Zacks Investment Research

NVIDIA Corp.

With a Zacks Rank of #2, NVIDIA leads the way in developing generative AI chipsets. The company continued showcasing its innovation at the Consumer Electronics Show 2025, where it unveiled the GeForce RTX 50 Series GPUs, driven by its advanced Blackwell architecture. These GPUs significantly enhance AI rendering for gaming and creative uses.

NVIDIA is targeting a $1 trillion opportunity in the growing AI data center market, with major clients soon to receive its next-gen Blackwell AI chips. The company expects to surpass earlier projections for Blackwell chip deliveries by the fourth quarter of fiscal 2025.

Considerable Short-Term Price Upside for NVDA Stock

NVIDIA anticipates revenue and earnings growth rates of 48.7% and 43.1%, respectively, for the upcoming fiscal year ending January 2026. The Zacks Consensus Estimate for next year’s earnings has recently increased by 1%.

Brokerage firms have set an average short-term price target for NVIDIA that suggests a 29.6% rise from its last closing price of $133.57. Predicted target prices range from $135 to $220, indicating potential upsides of up to 64.7% with no projected downsides.

Broadcom Inc.

Also carrying a Zacks Rank of #2, Broadcom benefited from heightened demand for its custom AI accelerators and networking products. The company reported a fourfold increase in AI connectivity revenues due to strong global shipments of its Tomahawk and Jericho solutions. Broadcom provides essential chips and accessories for data center infrastructure.

The recent acquisition of VMware has bolstered Broadcom’s software solutions. VMware’s expanding roster of clients, including major players like Alphabet and Meta, contributes positively to Broadcom’s growth. Partnerships with industry leaders such as Arista Networks, Dell Technologies, Juniper, and Supermicro further enhance AVGO’s prospects.

Moderate Short-Term Price Upside for AVGO Shares

Broadcom forecasts revenue and earnings growth rates of 18.3% and 29.4%, respectively, for the current fiscal year ending October 2025. Over the past week, the Zacks Consensus Estimate for current-year earnings has increased by 0.3%.

Brokerage firms also predict an average short-term price target for Broadcom that suggests a 7.8% increase from the last closing price of $229.41. Target prices range from $175 to $300, indicating potential upsides of 30.8% and downsides of 23.7%.

QUALCOMM Inc.

With a Zacks Rank of #2, QUALCOMM has teamed up with Google to develop generative AI digital cockpit solutions. The company has recently released advanced automotive platforms to enhance in-vehicle digital experiences and support automated driving, fueling growth in its automotive sector. Additionally, robust demand in the Android smartphone market is aiding progress.

QUALCOMM’s Cloud AI 100 chip is capable of executing 227 server queries while managing 3.8 queries per watt. In 2024,QUALCOMM introduced its Snapdragon 8s Gen 3 mobile chip, which incorporates support for 30 generative models, including those for image generation.

“`

Investing Insights: Promising Short-Term Growth in Tech Stocks

QUALCOMM: Fueling Growth with AI Innovations

QUALCOMM continues to advance its technology with the introduction of the AI-capable Snapdragon X Plus laptop processor, which boasts higher CPU speeds while consuming less power. The company is set to experience revenue growth of 8.3% and earnings growth of 9% by the end of the fiscal year in September 2025. Notably, the Zacks Consensus Estimate for its current-year earnings has risen by 0.3% over the last month.

Brokerage firms estimate that the average target price for QCOM shares suggests a 24% rise from the recent closing price of $161.43. Current projections range from $160 to $270, indicating a potential upside of 67.3%, with a minimal downside of just 0.9%.

Innodata Inc.: Data Solutions for the AI Era

Innodata, holding a Zacks Rank of #1, operates globally to provide data engineering through three segments: Digital Data Solutions (DDS), Synodex, and Agility. This year, its DDS segment focuses on AI data preparation, including the creation and annotation of training data, alongside AI model integration and deployment services.

Innodata also offers various data engineering services, promoting efficiency in data management processes. The company targets support for major tech firms as they develop generative AI models.

Innodata’s Growth Prospects Look Bright

For the upcoming year, Innodata anticipates a revenue growth rate of 34.6%, although it projects a slight earnings decline of 5.1%. The Zacks Consensus Estimate shows a 1.2% improvement in earnings expectations for 2025.

The price target from analysts indicates a 27% increase from Innodata’s last closing price of $37.09, with estimates varying from $40 to $54. This scenario offers a maximum upside of 46% with no expected downside.

Marvell Technology Inc.: Riding the Wave of Demand

With a Zacks Rank of #1, Marvell Technology is capitalizing on the strong demand in the data center market. The latest quarter saw a remarkable 98% year-over-year surge and a 25% sequential increase in data center revenue, driven by AI-related sales for PAM products and ZR electro-optics.

As a key player in the solid-state drive controller market, Marvell is set to benefit from the continuously rising demand for storage solutions. The growth is further supported by the increasing volumes of unstructured data.

Marvell’s Short-Term Stock Outlook

Looking ahead, Marvell expects revenue growth of 40.3% and impressive earnings growth of 72.8% for the year ending January 2026. Over the last 30 days, earnings estimates have improved by 0.4%.

The average price target among brokers shows a projected increase of 9.5% from the last closing price of $117.58. The target range for MRVL shares falls between $95 and $160, indicating a possible upside of 36.1%, with a downside risk of 19.2%.

Discover Zacks’ Top 10 Stocks for 2025

Don’t miss your chance to get in early on Zacks’ handpicked list of top stocks for 2025. This portfolio has historically performed exceptionally well, gaining +2,112.6% since its inception in 2012, significantly outperforming the S&P 500’s +475.6%. Sheraz Mian, Zacks’ Director of Research, has analyzed over 4,400 companies to select the top 10 to buy and hold for the upcoming year. Be among the first to explore these newly released stocks with immense potential.

Get the latest recommendations from Zacks Investment Research, including strategic insights into QUALCOMM Incorporated (QCOM), NVIDIA Corporation (NVDA), Marvell Technology, Inc. (MRVL), Broadcom Inc. (AVGO), and Innodata Inc. (INOD), all available for free in their stock analysis reports.

To explore this article further on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.