Quantum Computing Stocks Gain Traction Amid Emerging Market Trends

In 2025, quantum computing is projected to emerge as a major player in tech, generating considerable buzz on platforms like Reddit. Stocks from three key firms in this sector — D-Wave Quantum Inc. QBTS, Rigetti Computing, Inc. RGTI, and IonQ, Inc. IONQ — have experienced significant stock price increases over the last three months. Here’s a closer look at how investors might approach these companies.

The Expanding Quantum Computing Market

The global quantum computing market is currently valued at $1.3 billion, with expectations to grow to $5.3 billion by 2029, reflecting a compound annual growth rate (CAGR) of 32.7%, according to MarketsandMarkets.

As acceptance and investment in quantum technology rise, the market continues to flourish. Quantum computers outperform traditional machines by utilizing quantum mechanics to quickly and efficiently tackle complex problems.

McKinsey projects that quantum computing could contribute $1.3 trillion to the economy by 2035, primarily driven by its use in material sciences and advancements in pharmaceuticals. Furthermore, quantum systems are pivotal in enhancing artificial intelligence algorithms.

Within the financial sector, companies are leveraging quantum applications for machine learning and optimization tasks, particularly in derivative pricing and portfolio management. The forthcoming technological advancements in quantum computing will likely create additional growth prospects in the coming years.

Rising Quantum Computing Stocks

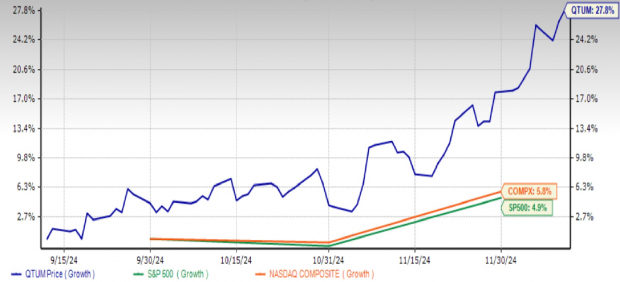

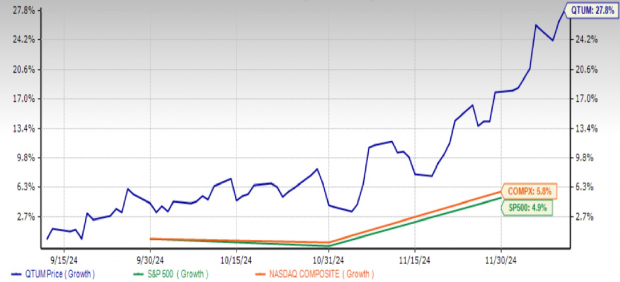

In the past three months, quantum computing stocks have demonstrated strong performance, with the Defiance Quantum ETF QTUM surging 27.8%. This outpaced the broader S&P 500, which gained 4.9%, and the tech-heavy Nasdaq Composite, which saw a 5.8% increase.

Image Source: Zacks Investment Research

The increase in these stocks is attributed to a potential breakthrough from Alphabet Inc.’s GOOGL AI division in quantum computing technology, which might soon yield a market-ready product.

Amazon.com, Inc.’s AMZN new Quantum Embark program is also fueling investor confidence in quantum computing. AWS now enables clients to access various quantum hardware on a pay-as-you-go basis, helping to reduce technological risks.

Two Quantum Stocks to Watch and One to Avoid

With the quantum computing trend on the rise, investors are eager to capitalize on the potential growth. However, due to the complexity of quantum technology and uncertainty about long-term impacts, selecting stocks in this arena requires caution. Here are two stocks worth monitoring and one to steer clear of.

First, D-Wave Quantum Inc. specializes in quantum annealing systems, which excel in optimizing real-world applications such as drug discovery, logistics, and network performance. Notably, NTT DOCOMO, Japan’s largest mobile operator, is looking to integrate D-Wave technology to alleviate network congestion. Furthermore, D-Wave has ramped up its research and development spending, contributing to an expected earnings growth of 31.7% and 7.3% for the current and next fiscal years, respectively.

Next is Rigetti Computing, Inc., which has drawn comparisons to NVIDIA Corporation NVDA for its infrastructure focus, developing quantum computers and their essential hardware. Rigetti’s Quantum Cloud Services platform will provide clients remote access to quantum processors, streamlining operations and creating cost savings. The company’s ongoing innovations in chip technology also point to encouraging long-term growth, with the same expected earnings growth as D-Wave.

Conversely, IonQ, Inc. may be one to avoid. Although the company is addressing challenges in quantum computing and aims to partner with AWS and Google Cloud, its current valuations raise concerns. With a market capitalization exceeding $6 billion and a price-to-sales ratio of 170, IonQ faces difficulty in delivering returns for investors. It also projects a contraction in earnings of 10.3% this year, followed by a growth rate of 33.7% the next year.

Currently, D-Wave and Rigetti hold a Zacks Rank of #3 (Hold). In contrast, IonQ has a Zacks Rank of #4 (Sell).

Zacks Picks for Top 10 Stocks of 2025

Ready for exclusive insights into the top 10 stocks for 2025?

Historically, these companies have delivered exceptional performance.

From 2012 — when our Director of Research Sheraz Mian took the helm — through November 2024, the Zacks Top 10 Stocks portfolio gained +2,112.6%. This figure drastically surpasses the S&P 500’s +475.6%. Don’t miss the chance to invest in these 10 stocks, to be unveiled on January 2.

Enable your early involvement with our Top 10 Stocks >>

Interested in receiving the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Get your free report now.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Defiance Quantum ETF (QTUM): ETF Research Reports

IonQ, Inc. (IONQ) : Free Stock Analysis Report

Rigetti Computing, Inc. (RGTI) : Free Stock Analysis Report

D-Wave Quantum Inc. (QBTS) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.