Your initial investment in a stock matters less the longer you hold on. Valuation is crucial, but enduring growth can offset any premium you paid upfront. For investors eyeing artificial intelligence (AI) stocks that promise longevity and profitability, making wise choices is paramount.

If AI proves to be the multi-trillion-dollar economic boon that experts envision, Snowflake (NYSE: SNOW), Arm Holdings (NASDAQ: ARM), and Palantir Technologies (NYSE: PLTR) stand poised to outperform the market for years and possibly decades, with their current prices carrying less weight.

Let’s delve deeper into these three AI stocks. They may not be cheap right now, but judicious buying and robust company performance could bolster your investment. The beauty lies in the fact that you can acquire multiple shares of all three for under $1,000.

Despite the recent fervor around semiconductor stocks, the real power of AI lies in the quality of data it processes. Imagine the plethora of data companies possess – customer information, operational data, financial records, all scattered across numerous spreadsheets. This is where Snowflake shines.

Snowflake’s cloud-based platform enables effortless data storage, searchability, sharing, and integration with various third-party applications. Compatible with major public clouds like Microsoft Azure, Amazon Web Services (AWS), and Alphabet‘s Google Cloud, Snowflake’s usage-based pricing ensures clients pay for what they need. As data and clientele grow, so does Snowflake’s potential.

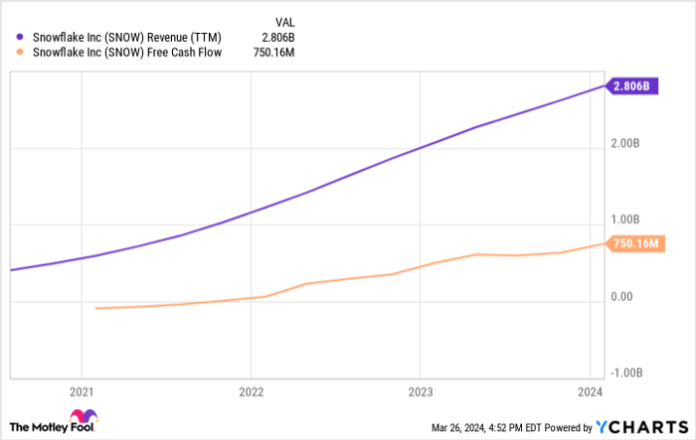

SNOW Revenue (TTM) data by YCharts; TTM = trailing 12 months.

With a new CEO heading Snowflake’s AI division, it’s evident where the company’s strategic focus lies. A bright future seems to be on the horizon for both the company and its shareholders.

Arm Holdings: Building the Foundation of the Future

Chip manufacturing commences with design, and in this realm, Arm Holdings reigns supreme. The company earns revenue through licensing fees and royalties on its intellectual property.

Arm estimates that nearly half of the world’s chips are based on its designs. This positions Arm as a profitable, asset-light entity set to thrive in a tech-driven world that’s increasingly reliant on chips.

With over 280 billion chips built on its intellectual property since its establishment in 1990, including over 30 billion in the most recent fiscal year, Arm’s potential growth trajectory is exponential, driven by the escalating demand for chips.

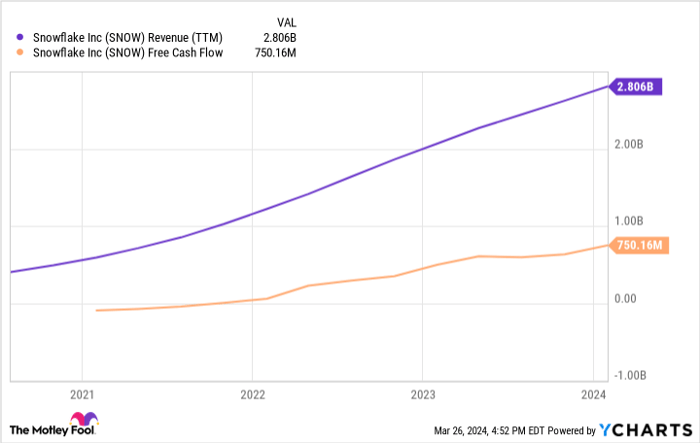

ARM revenue (TTM) data by YCharts.

With a robust cash conversion rate and a debt-free balance sheet boasting $2.4 billion in reserves, Arm’s potential share buybacks are set to augment its earnings growth, establishing it as a firm fixture in the chip sector.

Palantir Technologies: Forging a Path in the AI Realm

Given the multitude of software firms littering Wall Street, identifying the exceptional ones can prove challenging. Yet, Palantir Technologies seems to tick all the right boxes.

The company specializes in providing platforms for custom software app deployment for businesses and governments, particularly through its Gotham and Foundry platforms. The introduction of its Artificial Intelligence Platform (AIP) underscores its focus on AI applications.

With revenue growth ramping up post AIP launch, Palantir’s CEO heralded it as the company’s future in a recent shareholder letter.

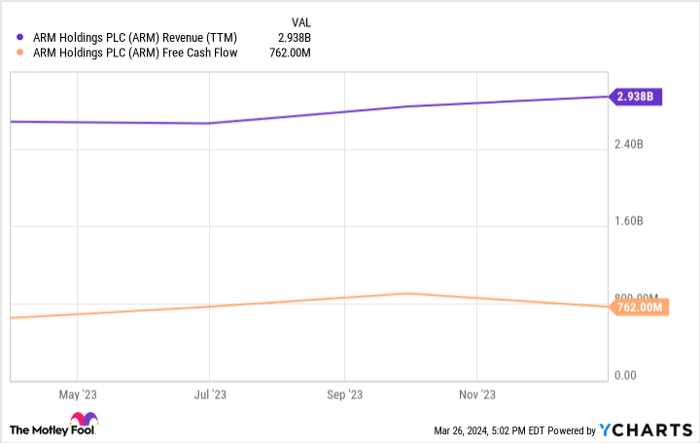

PLTR revenue (TTM) data by YCharts.

With copious cash flow, a high cash reserve of $3.6 billion, and immense growth potential given its limited customer base, Palantir is positioned to capitalize on the escalating need for AI across thousands of corporations worldwide.

Plotting Your Investment Journey

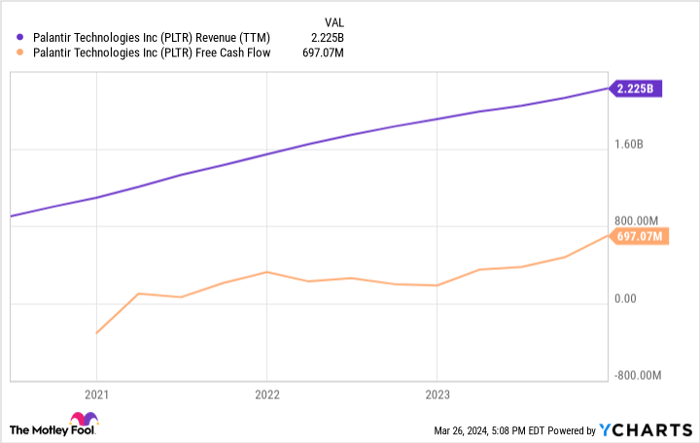

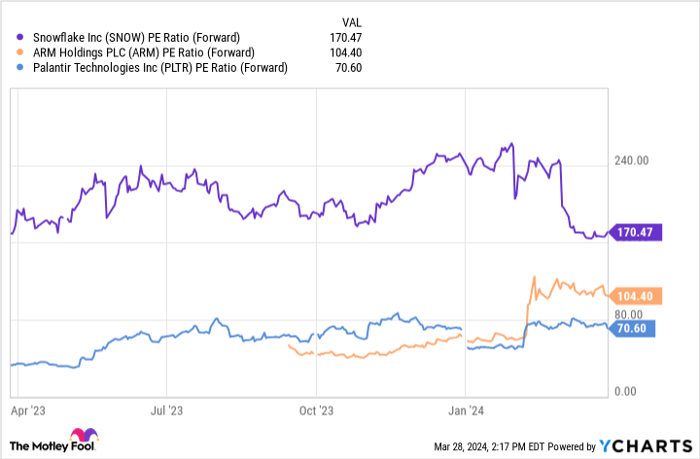

While the allure of the future beckons with these three stocks, their current valuations are lofty, with forward price-to-earnings ratios ranging from 70 to 170 times earnings. Though substantial profit growth is anticipated, this valuation premium far exceeds that of the broader market, with the S&P 500 trading at a mere 21 times earnings.

SNOW PE Ratio (Forward) data by YCharts

For potential investors, adopting a dollar-cost averaging strategy and patiently building your position over time could pay dividends should the market present opportunities at lower price points. Proceed with cautious optimism, be in it for the long haul, and watch your investment yield fruit.

Should you invest $1,000 in Palantir Technologies right now?

Before diving into Palantir Technologies, ponder this:

The Motley Fool Stock Advisor analyst team identified what they deem the 10 best stocks for investors to consider at present, and Palantir Technologies didn’t make the cut. These 10 stocks hold the potential to generate substantial returns in the forthcoming years.

Stock Advisor equips investors with a roadmap to success, providing insights on portfolio construction, regular analyst updates, and two fresh stock picks each month. Since 2002*, the Stock Advisor service has outpaced the return of the S&P 500 more than threefold.

Explore the 10 stocks

*Stock Advisor returns as of March 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Palantir Technologies, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.