Building Boom

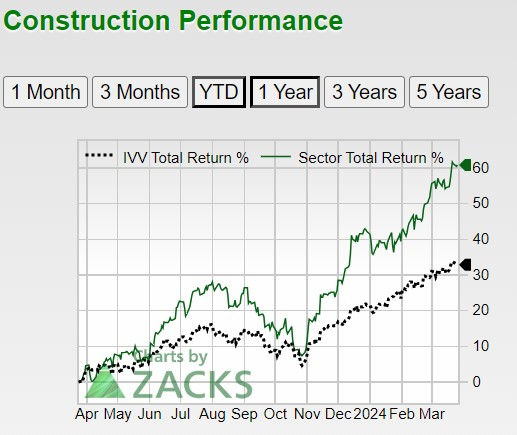

President Biden’s historic $1.2 trillion infrastructure bill and a robust backlog of construction-related projects are proving to be a goldmine for building product companies across the board. Fueling this trend further is the Zacks Construction sector’s remarkable rise to second place among the 16 Zacks sectors, with many building products stocks shining bright as Zacks Rank #1 (Strong Buy) contenders.

EMCOR Group: A Steady Beacon

Among the standout performers in this landscape is EMCOR Group (EME), attracting attention with its stellar Zacks Building Products-Heavy Construction Industry ranking in the top 37% of over 250 Zacks industries. Sporting a Zacks Rank #1 (Strong Buy) badge and an “A” Zacks Style Scores grade for Growth, EMCOR stands tall as a leading mechanical and electrical construction provider, catering to the industrial, energy infrastructure, and building services niches. The company’s annual earnings are on an upward trajectory, poised to rise by 9% in fiscal 2024 and an additional 8% in FY25, reaching an impressive $15.75 per share – a remarkable 123% surge over the last five years since earning $7.06 a share in 2021.

Knight River Corporation Steps Up

In the elite category of Zacks Building Products-Miscellaneous Industry, ranking in the top 3% of all Zacks industries are the stalwarts Knife River Corporation (KNF) and Advanced Drainage Systems (WMS). Both entities boast a solid “A” Zacks Style Scores grade for Growth, with Knife River leveraging integrated contract services and thriving as a key producer and marketer of aggregates in construction. Recent estimates reveal a 5% surge in FY24 EPS predictions in the last 60 days, with earnings set to rise by 8% this year to $3.50 per share. Looking ahead, expectations remain high as FY25 EPS estimates indicate a further 10% expansion to $3.85 per share for Knife River.

Advanced Drainage Systems’ Revved Up Performance

Bolstering the lineup, Advanced Drainage Systems, a pioneer in manufacturing thermoplastic corrugate pipe, offers a wide array of water management products for construction and infrastructure purposes. Recent earnings estimate revisions paint a promising picture, with projections for FY24 and FY25 soaring over 9% in the last 60 days. Anticipated to climb by 2% this year, the company’s annual earnings are on track to leap by 12% in FY25 to reach $6.95 per share.

Expert Insights

The enduring appeal of these top building products stocks, brimming with enticing EPS growth prospects, combined with optimistic earnings estimate revisions, underscore a prime buying opportunity. With a surge in infrastructure activities and a resilient homebuilders market, EMCOR Group, Knife River Corporation, and Advanced Drainage Systems emerge as sound investment choices not just for the year ahead but for the foreseeable future.

Spotting Hidden Gems

7 Best Stocks for the Next 30 Days

Just released: Experts highlight 7 premium stocks from the exclusive list of 220 Zacks Rank #1 Strong Buys, signaling these tickers as “Most Likely for Early Price Pops.”

Since 1988, this elite list has outperformed the market by more than double, boasting an average annual gain surpassing +24.2%. Thus, these selected 7 stocks warrant immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Advanced Drainage Systems, Inc. (WMS) : Free Stock Analysis Report

Knife River Corporation (KNF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.