“`html

Target’s Third-Quarter Results: A Mixed Bag but Potential Ahead

Target (NYSE: TGT) disappointed shareholders with its latest third-quarter earnings report. The retail giant saw comparable sales increase by only 0.3% year over year for the period ending Nov. 2. Additionally, adjusted earnings per share (EPS) came in at $1.85, significantly below the company’s guidance range of $2.10 to $2.40. As of now, the stock trades 30% lower than its 52-week high.

Despite these disappointing headline figures, a closer look reveals several positive aspects for investors. With anticipated stronger growth into 2025, there’s potential for a significant rebound in Target’s stock.

1. Persistent Profitability and Strong Fundamentals

The U.S. economy shows resilience through a strong labor market and improving consumer sentiment. Yet, prolonged price inflation and high interest rates still affect certain consumer spending categories. Target’s third-quarter results reflect this mixed landscape, with sales influenced by aggressive discounting and an increased focus on lower-priced items, which impacted both revenue and profits.

However, there were bright spots. Store traffic increased by 2.4% from last year, translating to over 10 million additional transactions. Additionally, beauty items like cosmetics experienced a 6% sales boost compared to last year. Online strategies are also paying off, as digital sales surged by 11% in Q3 2023, including home delivery and in-store pickup options.

These points illustrate ongoing brand momentum and customer engagement, positioning Target to come back strong as market conditions improve.

Image source: Getty Images.

2. Positive Earnings Outlook for 2025

Target’s stock may currently face challenges, but lower market expectations give the company a better chance to surprise positively. Analysts forecast a rebound in revenue, shifting from an anticipated 1.4% decline in 2024 to a growth of 2.8% in 2025. EPS is projected to rise from an estimated $8.67 in 2024 to $9.29 in 2025—a 7% increase.

A successful holiday shopping season this fourth quarter could help restore market confidence in Target’s stock. Moreover, declining interest rates from the Federal Reserve may boost consumer spending in upcoming quarters.

Exceptional results in 2025 could act as a catalyst for a stock rally.

| Metric | 2024 Estimate | 2025 Estimate |

|---|---|---|

| Revenue | $105.9 billion | $108.8 billion |

| Revenue change (YOY) | (1.4%) | 2.8% |

| EPS | $8.67 | $9.29 |

| EPS change (YOY) | (3%) | 7.2% |

Data source: Yahoo Finance. YOY = year over year.

3. Attractive Valuation

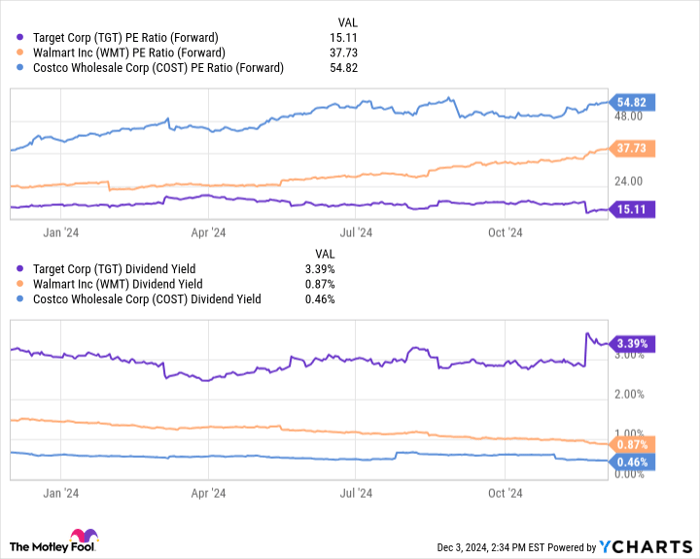

Target appears undervalued compared to its peers. The stock is currently trading at a forward price-to-earnings (P/E) ratio of 15 based on its 2024 consensus EPS, a significant discount to larger retailers like Walmart at 37 and Costco Wholesale at 55.

While Walmart and Costco may show stronger growth, Target offers more attractive value in the retail sector. Additionally, Target boasts a 3.4% dividend yield, rivaling Walmart’s 0.9% and Costco’s 0.5%. With a robust cash flow and a strong balance sheet, investors effectively earn a reward while waiting for Target’s turnaround.

TGT PE Ratio (Forward) data by YCharts

Final Thoughts

2025 holds great significance for Target, as it aims to prove itself amid ongoing uncertainties. Given the recent market shifts, it may be an opportune time for investors to consider purchasing shares of this well-established retailer with a positive long-term outlook.

Should you invest $1,000 in Target right now?

Before investing in Target, it’s wise to note the findings of the Motley Fool Stock Advisor analyst team. They have identified the 10 best stocks to buy now—and Target isn’t included. The selected stocks could yield impressive returns in the future.

For instance, if you had invested $1,000 in Nvidia when it was first recommended on April 15, 2005, you would have over $889,004 today!

Stock Advisor provides a clear path for investors, offering portfolio guidance, regular analyst updates, and two new stock picks every month. Since 2002, this service has more than quadrupled the return of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale, Target, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`