Exploring Undervalued Dividend Stocks: Three Strong Picks

For investors looking for value and income, there are undervalued income-producing stocks worth considering. Many of these are even well-known companies listed on the S&P 500 index. Here’s a closer look at three such stocks that could be great additions to your portfolio.

Ford Motor Company: Stagnation Amidst Change

The automobile industry is shifting in ways that challenge traditional brands like Ford Motor Company (NYSE: F). Notably, cars last longer now, and fewer young people are obtaining driver’s licenses, choosing services like Uber or Lyft instead.

It’s vital to recognize that Ford is struggling to keep up in the thriving electric vehicle (EV) market. According to CarEdge, Ford’s U.S. market share was only 8.7% in the fourth quarter, trailing behind Tesla, General Motors, Hyundai, and Kia.

Consequently, Ford’s profits have remained stagnant since the early 1990s, despite steady revenue. This stagnation is a significant reason Ford’s stock performance has lagged since the early 2000s. After peaking in early 2022, shares are down 64% and now trade at levels not seen since 1995. There seems to be little promise of growth on the horizon.

While the current outlook for growth appears bleak, Ford offers a forward-looking dividend yield of 6.5% from consistent quarterly payments of $0.15 per share, which surpasses many comparably risky bonds or stocks. The company supplements dividends with occasional special bonus dividends, offering some additional income for shareholders. However, these special payments should not be relied upon for regular income.

Despite its challenges, there is inherent value in Ford’s stock. The current price/earnings ratio stands at an attractive 5.5 based on projected earnings, and Ford’s earnings have generally proven resilient except for the disruption caused by COVID-19 in 2020 and 2021.

Merck: A Pharmaceutical with Potential

It has been a difficult few months for Merck (NYSE: MRK) shareholders, as the stock has dropped 36% since hitting its peak last March. Much of the recent downturn follows a couple of disappointing quarters last September. The company’s diabetes medications, Januvia and Janumet, face strong price competition, while the HPV vaccine Gardasil is encountering challenges in China.

Despite valid concerns surrounding these issues, the market may have overreacted and overlooked the ongoing potential of its leading cancer treatment, Keytruda.

Last year, combined sales for Januvia and Janumet fell 33%, but they still contributed to less than 4% of Merck’s total revenue. In contrast, Gardasil represents over 13% of overall sales, experiencing minimal growth in 2024 despite difficulties in China.

On a positive note, Keytruda experienced an 18% sales increase, contributing $29.5 billion to Merck’s revenue and accounting for approximately 46% of the total. Analysts expect that as more oncologists prescribe Keytruda, its annual sales could exceed $33 billion by 2027.

Investors should remember Merck’s history of developing and acquiring successful drugs. Since acquiring Keytruda via the purchase of Schering-Plough in 2009, the company has continued to seek new opportunities. Recently, it secured rights to an innovative immunotherapy from China’s LaNova Medicines and is progressing quickly with its development of Welireg.

While Merck may not be a high-growth stock, its past efforts to broaden revenue streams have enabled it to raise dividend payments for 14 consecutive years. Currently, investors can tap into a forward-looking dividend yield of nearly 3.9%.

AES: A Utility Player with Dividends

Lastly, The AES Corporation (NYSE: AES) stands out as a dividend stock worth considering while shares are down 64% from their late-2022 high, boosting its forward-looking dividend yield to 6.7%.

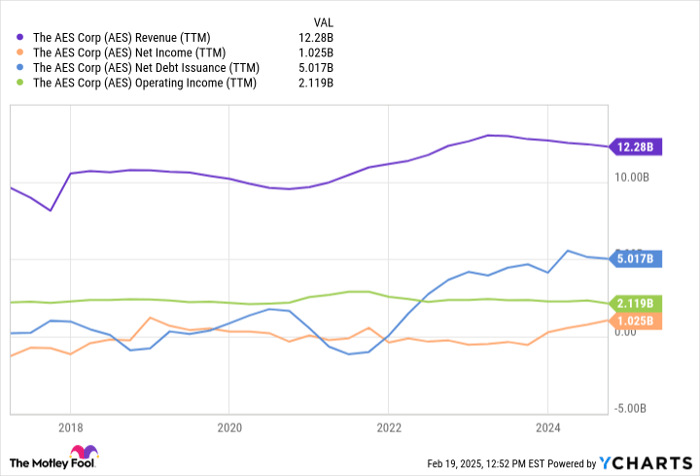

AES is a wholesale electricity supplier, providing power to utility companies that prefer purchasing rather than generating their own electricity. The company projects approximately $13 billion in business this year amid this increasingly common industry practice.

The transition from traditional energy sources like fossil fuels to renewable energy such as solar and wind, as well as nuclear power, presents challenges. AES may have been too ambitious in its shift to renewables, resulting in substantial debt that began impacting its stock price in 2022.

AES Revenue (TTM) data by YCharts

Despite the hurdles, there’s strong evidence suggesting the renewable energy market will grow at over 17% annually through 2034, regardless of political climates. AES anticipates its sales growth will remain robust at least through 2027, accompanied by profit advances as well.

Currently, AES boasts 12.7 gigawatts of long-term contracts which exceed its current production capacity of around 22 gigawatts, providing a promising outlook for future performance.

Though investor sentiment is cautious, analysts hold a more optimistic view. Most analysts rate this stock as a strong buy, forecasting a consensus price target of $16.40—almost 60% above the current market price.

The sustainability of AES’s dividend appears to be supported by overall industry growth and effective management practices.

Is Ford Motor Company a Worthwhile Investment?

Before purchasing stock in Ford Motor Company, think about this:

The Motley Fool Stock Advisor analyst team has identified what they believe to be the 10 best stocks to buy now, and surprisingly, Ford is not one of them. The stocks that made their list may deliver substantial returns in coming years.

To illustrate, consider Nvidia, which was highlighted on April 15, 2005. If you had invested $1,000 at the time of the recommendation, it would be worth approximately $823,858 today!*

Stock Advisor offers investors helpful strategies for managing portfolios, providing regular updates, and sharing two new stock picks each month. Since 2002, the service has more than quadrupled the return of the S&P 500.*

Learn more »

*Stock Advisor returns as of February 21, 2025

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck, Tesla, and Uber Technologies. The Motley Fool recommends General Motors. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.