April’s Market Struggles Amid Tariff Turbulence: Outlook Ahead

Historically, April ranks as the second-strongest month for the S&P 500, averaging a gain of 1.7% during post-election years since 1950.

However, April 2025 diverged from this trend, as market performance was subdued by increasing tariff tensions, impacting investor sentiment.

The ongoing concerns about tariffs have undoubtedly contributed to this uncertainty. Market reactions, in my view, have been marked by overreactions.

While President Trump continues his pursuit of tariffs, those looking for a clearer understanding should focus on Treasury Secretary Scott Bessent, who has indicated important updates on the situation.

Additionally, negative media coverage has amplified fears among investors. This trend is notably pronounced in international media, which frequently attributes blame to the Trump administration for existing economic challenges in various countries.

As a result, American investors encountering a stream of negative headlines are likely to feel disheartened.

Nevertheless, the old adage holds true: with April showers come May flowers. I believe that the market has the potential for growth in May, particularly among my Growth Investor stocks. In the following sections, I will highlight some promising signs already emerging in the market.

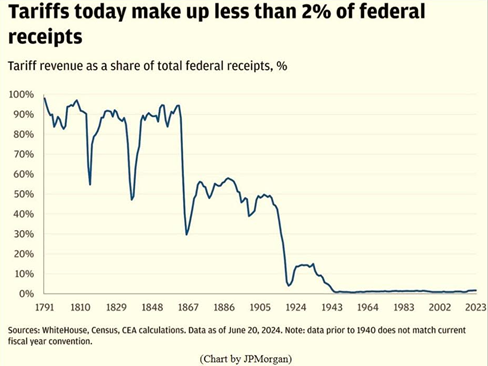

Green Shoot #1: Thawing Tariff Tensions

The trade conflict between the U.S. and China escalated in early April, primarily with China enforcing a ban on rare earth exports to the U.S. This prohibition affects industries such as electric vehicles (EVs), technology, and aerospace.

In response, the Trump administration restricted NVIDIA Corporation (NVDA) from shipping its H20 GPUs to China, a move made after previous restrictions targeted AI chip shipments.

However, Treasury Secretary Scott Bessent recently reassured investors at a private summit, stating the tariff standoff cannot continue indefinitely and that both nations will eventually need to de-escalate their tensions.

During a Tuesday press conference, President Trump echoed this sentiment, predicting that the final tariffs on China would ultimately be much lower than current levels. He mentioned that if an agreement is not reached, he may still consider reducing key tariffs, asserting that negotiations would remain amicable.

Moreover, countries like the U.K., the European Union (EU), and approximately 130 others are engaged in trade negotiations with the U.S., which should lead to the reduction of most trade barriers.

Consequently, this trend should lead to freer trade in the future.

Green Shoot #2: Powell’s Position Remains Secure

The Federal Reserve’s relative inactivity this year has drawn attention, sparking concerns regarding the job security of Fed Chair Jerome Powell amidst President Trump’s evident frustration.

During a recent appearance before the Economic Club of Chicago, Powell indicated a “strong likelihood” of higher prices and increased unemployment due to tariffs, complicating the Fed’s economic strategy.

Powell acknowledged the challenges of balancing interest rate adjustments with inflation and unemployment pressures, calling it a “difficult place for a central bank to be.”

Despite ongoing inflation worries, both consumer and wholesale prices declined in March, while deflation seems to be emerging due to the lowest crude oil prices in four years.

President Trump voiced his dissatisfaction on Truth Social regarding Powell, reminding the public that Powell’s term ends in 2026, though speculation about dismissal arose earlier this week.

Fortunately, Trump calmed these fears in a Tuesday press conference, confirming he had “no intention” of firing Powell.

While Trump may direct blame at Powell if a recession occurs due to the Fed’s rate strategies, Powell appears likely to complete his current term.

Green Shoot #3: Earnings Momentum Is Present

One of the most promising indicators is earnings performance.

Initial quarterly earnings reports are typically the most encouraging, showcasing resilience in various sectors despite the broader market’s challenges in April.

# Strong Earnings Performance Boosts S&P 500 Outlook

Currently, 71% of the S&P 500 companies that have reported earnings have exceeded analysts’ estimates, showcasing an average earnings surprise of 6.1%. FactSet projects that the S&P 500 will achieve at least 7.2% average earnings growth for the first quarter.

Notably, early results indicate that solid earnings are yielding positive market reactions. When companies with robust fundamentals surpass analysts’ expectations, their stock prices tend to rally significantly.

For example, in Growth Investor, two of our stocks saw gains of 4% and over 8% following their quarterly earnings beats this Tuesday. Similarly, on Thursday, one stock advanced 4% while another surged more than 8%, both after exceeding analysts’ forecasts.

This trend of better-than-expected sales and earnings is expected to continue, propelling fundamentally strong stocks higher in the coming weeks.

Positive Economic Indicators Ahead

Progress in tariff negotiations and easing tensions between the U.S. and China suggest that trade barriers may continue to decline. If oppressive tariffs do not stall the U.S. economy, we can expect a favorable earnings environment combined with falling interest rates to create a significant upward momentum for fundamentally sound stocks.

The bottom line is that spring has arrived, signaling a time for optimism.

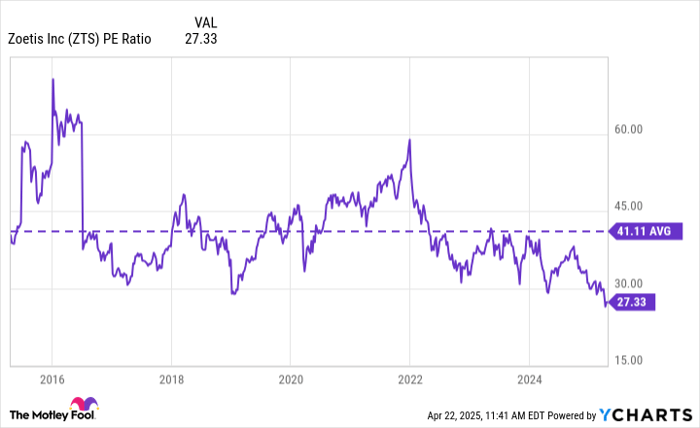

This prompts the question: where can investors find the best stocks with strong fundamentals?

This is where my Growth Investor service becomes valuable.

The stocks recommended in this service are supported by solid fundamentals. Evidence can be seen in the numbers.

Our Buy List stocks have demonstrated an average annual sales growth rate of 24% and an average annual earnings growth rate of 81.1%. In contrast, the S&P 500 is projected to see an estimated 4.6% revenue growth and a 7.2% earnings growth rate for the first quarter.

Additionally, analysts have increased earnings estimates by an average of 3.8% over the past three months, reflecting positive sentiment within the analyst community toward these stocks.

To gain immediate access to my latest stock picks from Growth Investor, go here.

(Already a subscriber? Click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor discloses that, as of the date of this email, the Editor owns securities mentioned in this commentary, including:

NVIDIA Corporation (NVDA)