Three ETFs to Boost Your Investment Strategy for 2025

Investing in the stock market can build substantial wealth over time, but your choice of investments is crucial. If you want a simple and low-maintenance way to enter the market, consider exchange-traded funds (ETFs). Here are three funds that might enhance your savings in 2025 and later.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

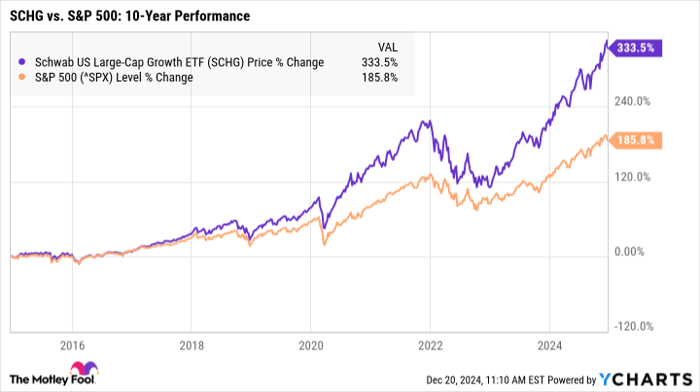

Schwab U.S. Large-Cap Growth ETF

The Schwab U.S. Large-Cap Growth ETF (NYSEMKT: SCHG) targets large-cap stocks, featuring 229 holdings with a significant portion—almost 49%—in technology. This fund is ideal for investors seeking growth with a relatively stable option.

Top holdings include Apple, Microsoft, and Nvidia, which collectively account for about 30% of the ETF. While these dominant companies can experience volatility, their size often affords them a better chance of weathering economic downturns.

This fund has outperformed many others, posting an average annual return of 16.55% over the last decade, far exceeding the S&P 500 index (SNPINDEX: ^GSPC). If the ETF maintains this growth rate, investing $200 monthly could lead to nearly $600,000 after 25 years.

SCHG data by YCharts

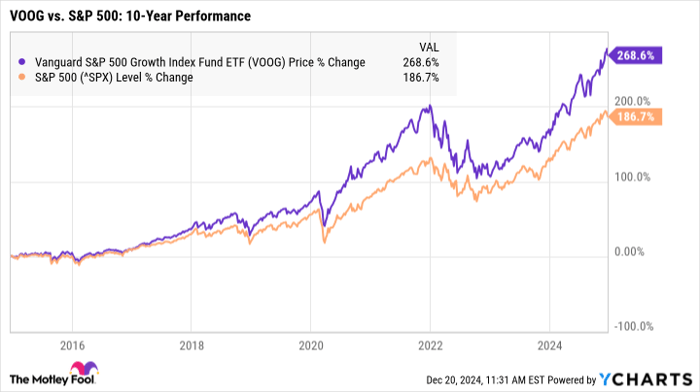

Vanguard S&P 500 Growth ETF

What sets this fund apart is that it exclusively holds S&P 500 stocks. Companies in this index must meet strict criteria, which has made it a reliable gauge of market performance.

Thus, investing in S&P 500 stocks can limit risk while exploring the potential for above-average returns. Over the past 10 years, the Vanguard ETF has yielded an average return of 14.95% annually, still outpacing overall S&P 500 performance.

If you invest $200 a month with a projected 15% return, your investment could grow to around $511,000 in 25 years.

VOOG data by YCharts

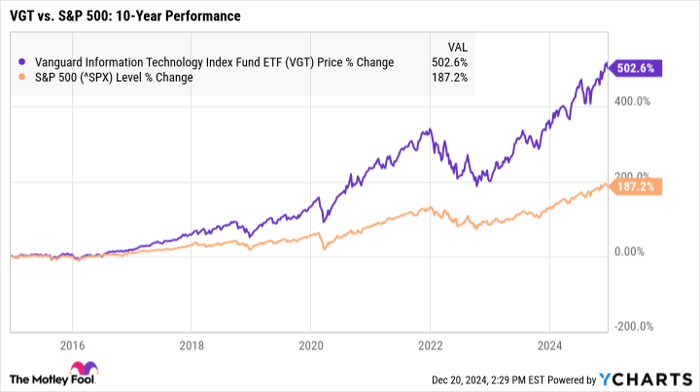

Vanguard Information Technology ETF

The Vanguard Information Technology ETF (NYSEMKT: VGT) stands apart by focusing exclusively on the tech sector.

Industry-specific ETFs carry additional risks due to less diversification, but they also offer higher potential returns, particularly in a dynamic sector like technology. Whether to choose this fund depends on your risk tolerance and portfolio strategy.

This ETF has outshone the S&P 500, boasting an average return of 20.59% per year over the past decade. Though the volatility of tech stocks can deter some investors, those willing to take risks could see hefty rewards. A consistent return of 20% could lead to an investment of $200 per month growing to over $1.1 million in 25 years.

VGT data by YCharts

Overall, investing in these ETFs can help you grow your savings with minimal effort. By understanding your risk preferences and investment goals, you can set yourself on a path toward significant wealth growth.

Seize this Investment Opportunity

If you feel like you’ve missed out on profitable stocks, don’t worry. Sometimes our team highlights stocks they believe will soar soon.

The track record speaks for itself:

- Nvidia: A $1,000 investment since 2009 would now be worth $363,593!*

- Apple: A $1,000 investment in 2008 would be worth $48,899!*

- Netflix: A $1,000 investment in 2004 would now be valued at $502,684!*

Currently, we have three strong stock alerts that could lead to exciting returns.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Katie Brockman holds positions in Vanguard Information Technology ETF. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.