https://www.youtube.com/watch?v=uV2qhJTO4W4[/embed>

Top Financial Stocks Near 52-Week Highs: Strong Buys in Focus

As financial sector stocks approach new 52-week highs, investors are keenly observing those on the Zacks Rank #1 (Strong Buy) list.

The ongoing recovery from the pandemic, combined with stability in inflation, has bolstered leading banks and financial firms. Global fiscal policies are particularly focused on controlling inflation, which includes cutbacks in interest rates to promote economic growth.

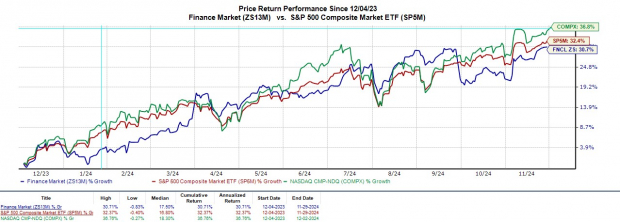

The Zacks Finance Market has reflected this positive trend, rising over +20% year-to-date, closely matching the impressive gains of the S&P 500 and Nasdaq.

These stock picks benefit from recent earnings estimate revisions, indicating potential for further growth, along with dividend yields exceeding 3%.

Image Source: Zacks Investment Research

Janus Henderson Group – JHG

YTD Performance: +48%

Janus Henderson Group JHG has seen its stock soar nearly +50% in 2024. The asset management firm reported impressive growth, with assets under management (AUM) rising by 6% quarter-over-quarter and 24% year-over-year, totaling $382.3 billion by Q3 2024.

Its strong AUM performance outpaced many industry benchmarks, supported by nearly half a billion in net inflows during Q3. With a 3.45% annual dividend yield, Janus Henderson also enjoys increasing earnings estimates, and currently trades under $50, boasting a forward earnings multiple of just 13.2X and expected double-digit EPS growth in both fiscal 2024 and 2025.

Image Source: Zacks Investment Research

State Street – STT

YTD Performance: +27%

Founded in the 1800s, State Street Corporation STT is well-established in the financial sector. Through its primary subsidiary, State Street Bank, the company has maintained a competitive edge in the investment banking industry.

With a valuation attractive to investors, State Street’s stock currently trades under $100 at an 11.7X forward earnings multiple, compared to BlackRock’s BLK share prices exceeding $1,000 and a 23.6X multiple.

Along with BlackRock, State Street has recently achieved 52-week highs. This stock gains attention for its superior valuation and offers a 3.09% annual dividend yield, which is more attractive than BlackRock’s 2%. Notably, State Street’s EPS estimates for FY24 and FY25 have increased 3% and 4% respectively in the past two months.

Image Source: Zacks Investment Research

United Overseas Bank – UOVEY

YTD Performance: +26%

United Overseas Bank UOVEY, Singapore’s largest bank, is a key player to watch. While Singapore may not yet be a leading global economy, its fiscal landscape is significantly shaped by global trends.

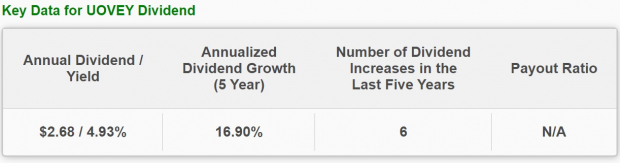

Following the Federal Reserve’s interest rate cuts in September, Singapore is also expected to benefit from reduced borrowing costs. Consequently, EPS estimates for United Overseas have risen recently, forecasting annual earnings growth of 8% this year and an additional 2% growth in FY25 to around $5.47 per share. UOVEY trades at a forward earnings multiple of 10.1X, along with an attractive annual dividend of 4.93% (paid semi-annually), appealing to income-focused investors.

Image Source: Zacks Investment Research

Conclusion

With stocks reaching new 52-week highs, these financial firms may have even more growth ahead. This could be a favorable time to invest, considering their appealing P/E ratios and the recent trend of positive earnings revisions.

Just $1 for Full Access to Zacks’ Recommendations

Seriously.

A few years back, we surprised our members by offering a 30-day trial to view all our investment picks for just $1—no further obligations.

Many have seized this chance, while others passed on it—believing in the old adage…

Exploring High-Growth Investment Opportunities in 2023

In 2023, our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others, successfully closed 228 positions at impressive double- and triple-digit gains. Discover how these strategies can benefit your investments.

State Street Corporation (STT): Access Your Free Stock Analysis Report

United Overseas Bank Ltd. (UOVEY): Access Your Free Stock Analysis Report

Janus Henderson Group plc (JHG): Access Your Free Stock Analysis Report

BlackRock, Inc. (BLK): Access Your Free Stock Analysis Report

For more insights, read this article on Zacks.com.

The views and opinions expressed herein are those of the author and may not reflect the views of Nasdaq, Inc.