Identifying Opportunities: Oversold Stocks in the Industrials Sector

Investors may find a buying opportunity in the industrials sector as several stocks are showing signs of being oversold, indicated by their low Relative Strength Index (RSI) values.

The RSI, a momentum indicator, gauges the strength of a stock by comparing its performance on up days to down days. An RSI below 30 suggests a stock is oversold, potentially signaling a good buying opportunity, according to Benzinga Pro.

Here are some notable oversold stocks in the industrials sector, with RSI values near or below this key threshold.

Regal Rexnord Corp RRX

- On February 5, Regal Rexnord reported quarterly results that fell short of expectations. CEO Louis Pinkham remarked on the efforts to tackle growth, margin, and debt reduction despite challenging market conditions. Their IPS segment managed to post adjusted EBITDA margins of 26.0%, up two points from the previous year. Despite these efforts, the company’s stock has dipped about 12% in the last week, reaching a 52-week low of $130.94.

- RSI Value: 28.2

- RRX Price Action: Regal Rexnord shares fell 7.9% to close at $142.87 on Thursday.

- Benzinga Pro’s real-time newsfeed was updated with the latest insights on RRX.

Deluxe Corp DLX

- Deluxe Corp also faced challenges, as reported on February 5 when they announced disappointing fourth-quarter sales and provided FY25 revenue guidance below expectations. The stock has fallen roughly 15% in the past five days, with a 52-week low of $18.48.

- RSI Value: 21.6

- DLX Price Action: Shares of Deluxe dropped 11.3% to end Thursday at $20.02.

- Benzinga Pro’s charting tools indicated the recent trend for DLX stock.

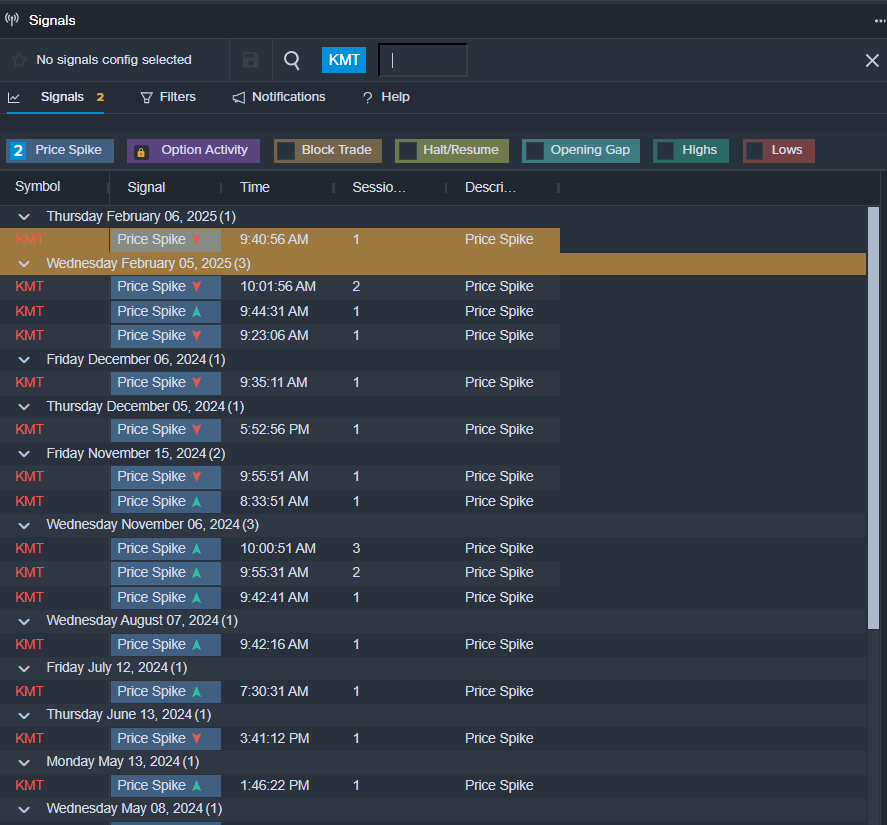

Kennametal Inc KMT

- Kennametal reported on February 5 that its second-quarter financial results were below expectations. President and CEO Sanjay Chowbey noted strong cash flow from operations; however, weakening conditions in various end markets, particularly in EMEA, affected sales. The stock has seen a decline of approximately 9% over the last five days, reaching a 52-week low of $20.50.

- RSI Value: 22

- KMT Price Action: Kennametal’s stock decreased by 3.1%, closing at $21.97 on Thursday.

- Benzinga Pro’s signal features broadcasted a potential breakout for KMT shares.

Read This Next:

Market News and Data brought to you by Benzinga APIs