Understanding the Rally

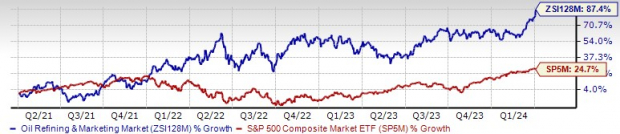

The ascending trajectory of Valero Energy, Marathon Petroleum, and Phillips 66 stocks to unprecedented highs undeniably attracts the gaze of discerning investors. On a recent noteworthy day, the trio hit new pinnacles, with share prices soaring by approximately 2%. This feat builds on a substantial year-to-date climb of between 30% and 45%, exuding resilience in the face of market fluctuations.

Unraveling the Catalysts

Their ascendancy can be largely attributed to the recent upsurge in oil prices — a driving force that directly impacts prices at the gas pumps. Notably, oil prices experienced a bullish run in the first quarter of 2024, with Brent and West Texas Intermediate (“WTI”) crude futures witnessing robust upswings. Brent oil, the global benchmark, soared by nearly 14%, while its U.S. counterpart, WTI crude, surged by approximately 16%. Currently, the global benchmark stands at $87.48 per barrel, while U.S. crude rests comfortably at $83.17 per barrel.

Market Dynamics and OPEC+

The powerful collective hands of major oil-producing nations notched in a formidable production cut, propelling the tightening of supply-demand dynamics. Emblematic of this strategy, OPEC+ nations, spearheaded by the environs of Saudi Arabia and Russia, initiated production slashes in early 2022. These concerted efforts, aimed at defying rising U.S. production and lukewarm global demand, continue to hold steady grip, reinforcing stability in the oil markets.

Geopolitical Ripples and Demand Spike

Geopolitical undertows, ranging from the Russia-Ukraine standoff to the Israel-Palestine conundrum, ushered in a cloud of uncertainty about potential supply disruptions in key oil-producing regions. Add to the mix attacks on ships in the Red Sea, and the concoction fuels bullish sentiments, driving prices higher. Meanwhile, downstream players like Marathon Petroleum capitalized on augmented gasoline prices, observing a strategic completion of scheduled maintenance activities.

Stellar Performance and Industry Standing

The towering earnings performance of Valero Energy, Marathon Petroleum, and Phillips 66 further fuels their ascent, effortlessly surpassing bottom-line prognostications during the fiscal period. Gliding through the fourth-quarter earnings, VLO’s earnings of $3.55 per share elegantly surpassed the Zacks Consensus Estimate by 20%. MPC, not to be outdone, recorded earnings per share at $3.98, outstripping estimates by a staggering 69%. Additionally, PSX posted a commendable performance, with quarterly EPS topping estimates by a handsome 30%.

Looking Ahead

The horizons seem promising for refining and marketing entities. Bolstered by a stable macroeconomic outlook, sustained demand for their commodities, and a clear revenue stream, the future gleams brightly. However, enforcing a prudent patience seems advisable, amid burgeoning inflation fears and looming economic trials. Hence, a judicious wait for an opportune entry juncture appears prudent. Presently holding a Zacks Rank #3 (Hold) each, Valero Energy, Marathon Petroleum, and Phillips 66 inspire cautious optimism for the discerning investor.