Why Investing in Growth Stocks Like Meta, AMD, and Adobe is Smart for 2025

Investing in growth stocks during a potential stock market downturn may seem risky. However, the crux of long-term investing is not about precisely timing the market but recognizing companies with the potential for sustained earnings growth. Here, we’ll explore why Meta Platforms (NASDAQ: META), Advanced Micro Devices (NASDAQ: AMD), and Adobe (NASDAQ: ADBE) stand out as top growth stocks to consider as we head into 2025, even amidst potential market challenges.

Where should you invest $1,000 today? Our team of analysts has identified what they believe to be the 10 best stocks to consider right now. Discover the 10 stocks »

Image source: Getty Images.

1. Meta Platforms

While Nvidia often garners attention for its role in the AI-driven growth surge, we should also recognize Meta Platforms. Currently trading around $600 per share, Meta has shown remarkable resilience after an impressive comeback from a low of $90 in October 2022. This turnaround followed criticism of its high spending on the metaverse and challenges from TikTok, as its Instagram platform struggled to capture attention.

Thanks to strategic use of AI, Meta has transformed Instagram into a robust platform for engaging content and targeted ads. This incorporation of AI has significantly improved engagement and advertising effectiveness. Despite having increased over sixfold from its previous low, the stock remains fairly priced as we approach 2025, making it a sound investment choice.

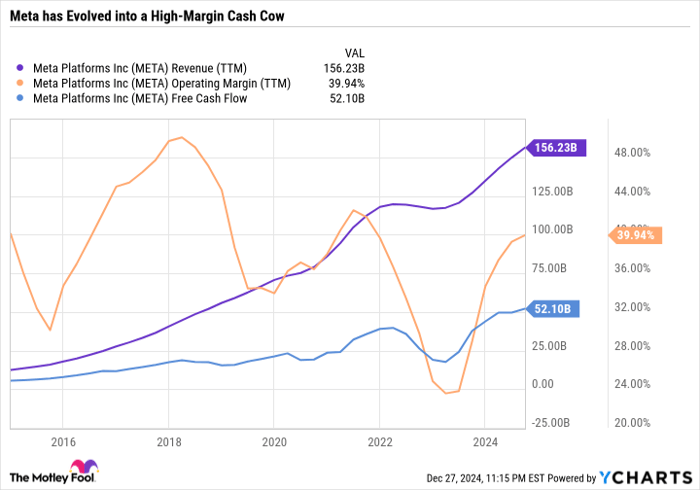

Meta’s business model focuses on its Family of Apps — Facebook, Instagram, and WhatsApp. This strategy mirrors that of Alphabet with Google and YouTube, where user-generated content drives engagement without heavy investment in content creation. The shift from static images to short-form videos on Instagram has significantly boosted Meta’s cash flow and profit margins, as illustrated in the chart below, showing strong operating margins and substantial free cash flow generation.

META Revenue (TTM) data by YCharts

With a forward price-to-earnings (P/E) ratio of 26.5, Meta’s valuation is reasonable, especially considering it is lower than those of other major tech companies like Apple, Microsoft, Nvidia, Amazon, Tesla, Broadcom, and Netflix. This balanced mix of growth potential and value positions Meta to become even more valuable than both Alphabet and Amazon in the future.

2. AMD

This year, AMD achieved a remarkable 128% increase, making it one of the top performers in the S&P 500. By March 2024, the stock reached an all-time high of $227.30 per share. However, the company has recently experienced a decline and is currently down over 15% year to date, sitting near its 52-week low. This drop is particularly notable as the broader tech sector has gained more than 23% so far this year, with chip leaders like Nvidia and Broadcom enjoying even more significant gains.

NVDA data by YCharts

A primary reason for AMD’s underperformance in this rally can be traced back to its AI investments, which have not yet yielded substantial returns. Reporting $24.3 billion in revenue over the past twelve months, the company allocated over 25% of that to R&D expenditures. While AMD currently operates on slim margins, much of this can be attributed to the product development timeline.

Initially focused on CPUs, AMD is now expanding into GPUs, an area dominated by Nvidia. The company plans to launch new GPU lines in 2025 and 2026, potentially providing good alternatives for major customers like Microsoft and Meta.

While AMD’s 2023 surge was fueled by optimism about gaining market share from Nvidia, its current investment trajectory leans towards speculation. Increased competition or misalignment with market cycles could impact its performance, particularly if overall AI investments decline.

Though AMD’s stock appears inexpensive relative to the rise of other chip stocks, it still carries a high valuation. Analysts expect earnings per share to reach $5.13 in 2025, resulting in a P/E ratio of 24.4 based on its current price. This fact may interest investors who are optimistic about sustained AI investment and are prepared for possible volatility as AMD’s product launch window approaches.

3. Adobe

Similar to AMD, Adobe enjoyed tremendous success in 2023, soaring by over 77%. Nevertheless, it has since been among the underperformers in the megacap tech space in 2024, down by more than 25% year to date.

Despite facing challenges, Adobe continues to post reasonable sales and earnings growth, supported by its sound financial position. The company generates significant cash flow, enabling it to buy back shares and boost earnings per share. The concern centers not on where Adobe is now, but rather on uncertainty about its future trajectory.

Unlike its peer Salesforce, which has a clear strategy for monetizing AI, Adobe lacks a well-defined plan. While new AI-driven tools have been added to its Creative Cloud suite, it remains unclear how the company will ultimately profit from these advancements.

Adobe Faces Challenges Amid AI Revolution

Adobe has long been recognized as a leader in the software-as-a-service (SaaS) industry. The company’s strategy typically involves enhancing software offerings over time to justify higher subscription costs. However, the rise of AI presents both an opportunity and a challenge for Adobe. While AI can enhance customer experience, it risks reducing the number of subscriptions companies are willing to purchase. This could undermine Adobe’s foundational business model. Additionally, competitors are introducing AI-driven graphic design tools that may threaten Adobe’s market dominance or force the company to lower its prices to retain customers.

To stay competitive, Adobe must establish itself as the top player in AI for graphic design. Until it proves its adaptability and innovation in this area, its stock may remain under pressure. On a positive note, Adobe’s stock appears affordable, with a forward P/E ratio at just 21.9. For investors who believe in Adobe’s ability to successfully leverage AI, it represents a potentially strong value in the enterprise software sector.

Is This Your Chance to Seize a Valuable Investment?

Have you ever felt like you missed out on investing in top-performing stocks? If so, you might want to pay attention.

Occasionally, our team of investment analysts releases a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re concerned that you’ve already lost your investment chance, now could be the ideal moment to consider buying before you miss out. The numbers don’t lie:

- Nvidia: Investing $1,000 when we recommended it in 2009 would now be worth $356,514!*

- Apple: A $1,000 investment in 2008 would have grown to $47,762!*

- Netflix: If you invested $1,000 back in 2004, it would now be worth $485,594!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and you may not find another opportunity like this in the near future.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, which is now an Amazon subsidiary, is also a board member. Randi Zuckerberg, who previously handled market development for Facebook and is the sister of Meta Platforms CEO Mark Zuckerberg, is another board member. Daniel Foelber currently holds no positions in any mentioned stocks. The Motley Fool has interests in and recommends Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Salesforce, and Tesla. The organization also recommends Broadcom and has options positions involving Microsoft. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`