Stocks are no mere lottery tickets or quick financial fixes, but hidden within the market lie promising investment opportunities that could change the game for your portfolio. For those willing to weather the risks, a select few stocks in their infancy stages stand out with vast potential and undeniable competitive edges. These businesses have the power to evolve into cash-generating powerhouses on a grand scale, shaping lasting financial legacies along the way.

Below, three stocks emerge as standout contenders for substantial growth in the foreseeable future. By seizing the opportunity early on, investors might chart a course toward transformative returns in their personal financial journeys.

Shockwave Medical: Shaking Up the Medical Device Landscape

Rectifying calcium buildups in the cardiovascular system, Shockwave Medical (NASDAQ: SWAV) has perfected Intravascular Lithotripsy (IVL), a groundbreaking treatment method. IVL, derived from a proven procedure for kidney stones, deploys rapid sonic pulses via a specialized catheter to eradicate hazardous calcium accumulations in blood vessels.

This non-invasive approach not only surpasses traditional surgical methods but also broadens the scope of treatment to patients previously ineligible for existing protocols. With a robust line of products established by Shockwave, the demand is poised to surge, fueled by the aging population and the escalating prevalence of heart disease worldwide.

Boasting promising safety and efficacy data from clinical trials and a growing pool of treated patients, Shockwave secured a pivotal win last year when the Centers for Medicare & Medicaid Services (CMS) assigned a new reimbursement code for hospital procedures deploying the company’s technology. Such a milestone signifies a pivotal acceptance leap in the market and a catalyst for revenue growth. Still in the nascent stages of market penetration and medical practitioner education, Shockwave brims with untapped potential on the horizon.

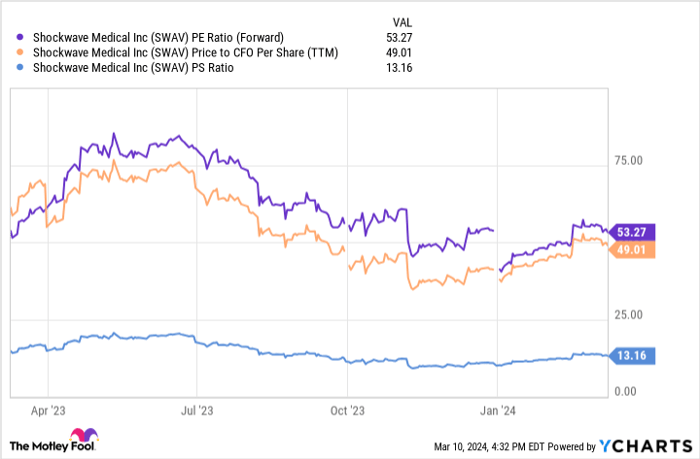

Despite the stock’s seemingly lofty metrics, including a price-to-sales ratio exceeding 13 and a forward P/E ratio over 50, the projected 25% growth rate results in a PEG ratio nearing 2. This alignment signifies a fair valuation mirroring the anticipated growth rate. Should the growth trajectory remain unhindered in 2024, the stock’s current price might even be deemed economical relative to its growth prospects.

SWAV PE Ratio (Forward) data by YCharts

Packaged with a high beta of 1.3, investors should brace for short-term volatility with Shockwave’s shares. However, should the company navigate these tumultuous waters successfully, high-beta stocks often outpace the broader market in the long haul. Nearly breaching the $10 billion market cap threshold, Shockwave nears the coveted large-cap club, offering substantial growth potential if its treatments become ubiquitous across the globe.

Workday: Orchestrating Operational Success

Facilitating financial and human capital management through cloud-based software, Workday (NASDAQ: WDAY) empowers organizations with AI-enhanced tools. In an era where global distributed workforces thrive, these tools drive operational efficiency, unlocking enhanced insights for management while fostering employee satisfaction and productivity. Gartner, a reputable industry evaluator, ranks Workday among the frontrunners in human capital management software, underscoring its capabilities.

Catering to diverse clientele, from non-profits to large enterprises, Workday counts nearly half of the S&P 500 companies as subscribers, a testament to its strong consumer base. While this widespread adoption indicates robust existing demand, there remains a vast pool of prospective customers yet to be tapped.

Anointed a wide-moat stock by analysts, Workday’s sustainable competitive advantage stems from high switching costs and a suite of top-notch, mission-critical products. Fortified by an impressive net dollar retention rate, the company stands firm in its moat stronghold.

With a sales growth projection of 17% to 18% for the upcoming year, in line with recent quarterly performance, Workday relies heavily on subscription-based revenue, constituting 92% of total sales. This stability in cash flows, coupled with recent profitability milestones, casts a favorable light on Workday. Trading at a price-to-cash-flow ratio near 32, the company presents an enticing valuation proposition should it meet its growth ambitions.

Pegged at a market value nearing $70 billion, Workday stands as a well-established entity harboring solid growth prospects and a rational valuation. Positioned to potentially yield a fivefold return over the long term, it signifies a blend of growth and stability for prudent investors.

ServiceNow: Revolutionizing Tech Automation

Pioneering workflow automation software for IT services, ServiceNow (NYSE: NOW) navigates the critical terrain of tech team management vital for every major enterprise. Expanding its offerings to encompass finance and customer service tools, ServiceNow rides the AI wave, driving the next wave of technological metamorphosis for its clientele.

Lauded by Gartner for its excellence, ServiceNow holds a firm footing among industry frontrunners. Bolstered by outstanding customer retention rates surpassing 98% and continuous customer relationship expansion, the company radiates leadership in its sector.

A 26% revenue surge in the latest quarter sets the tone for ServiceNow, with a projected sales uptick of nearly 25% on the horizon. Anticipating a stable adjusted operating margin in 2024, the company foresees its cash flows tracking proportionally with its revenue growth trajectory. While the stock’s price-to-cash-flow ratio hovers around 45 and its forward P/E ratio approaches 60, these metrics, though at the pricier end, align reasonably with the robust growth outlook.

Granted, stocks with such valuations carry inherent volatility risks. Nevertheless, fueled by a potent blend of competitive prowess and expansive growth potential, ServiceNow emerges as a strong contender poised to ascend the ranks as a tech behemoth of tomorrow.

Are you ready to invest $1,000 in Shockwave Medical?

Before diving into Shockwave Medical stocks, consider this:

The Motley Fool Stock Advisor team recently unveiled their selection of the 10 most promising stocks poised for massive returns – and Shockwave Medical didn’t make the cut. The chosen 10 stocks hold the potential to yield substantial returns in the forthcoming years.

Stock Advisor extends investors a road map to success, offering insights on portfolio curation, regular analyst updates, and two fresh stock picks monthly. Since 2002, the Stock Advisor service has nearly tripled the returns of the S&P 500 index*.

Explore the 10 stocks here

*Stock Advisor returns as of March 11, 2024

Ryan Downie has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ServiceNow, Shockwave Medical, and Workday. The Motley Fool upholds a disclosure policy.

Opinions expressed herein reflect the views of the author and do not necessarily align with those of Nasdaq, Inc.