Nvidia, the reigning champ of the initial artificial intelligence (AI) investment wave, faces an impending shift. As cloud computing and AI modeling giants stockpile its graphics processing units (GPUs), a tipping point looms. Once these powerhouse companies amass all required computing power, Nvidia’s ascendancy could wane due to diminished future demand for fresh capacity.

Prepare to ride the next tide of AI investments with three shrewdly selected companies poised for success.

Explosive Growth Awaits Cloud Computing

Enterprises currently engrossed in training and crafting AI models or providing cloud services to AI-driven entities stand to gain robustly in the upcoming wave. The prominent cloud computing stalwarts Amazon (NASDAQ: AMZN), Microsoft (NASDAQ: MSFT), and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) spearhead this progression. Notably, these industry titans have significantly bolstered Nvidia’s revenue stream by placing substantial GPU orders over recent stretches.

All three possess affiliations with generative AI models: Amazon and Microsoft foster connections with Anthropic and Open AI, respectively, while Alphabet nurtures its in-house generative AI brainchild, Gemini. Armed with robust generative AI platforms, these firms are strategically positioned to offer users the necessary resources for AI model construction.

Although these tech behemoths predominantly utilize generative AI models for cloud operations, many workloads within global enterprises are currently handled on-premises. Nevertheless, a vast majority of these tasks are anticipated to migrate to the cloud in due course. Industry projections suggest that the cloud computing market is set to burgeon from $676 billion in 2024 to an estimated $2.3 trillion by 2032, per Fortune Business Insights data.

The Unique Value Propositions of the Three Market Leaders

What sets these companies apart is their diversified service portfolios beyond cloud computing operations. While cloud services continue to fuel the growth of their respective enterprises, other primary business segments also steer their stock performances. Furthermore, the pricing structures of their stock shares exhibit diverse ranges.

Amazon, despite commanding a premium price, promises significant cloud computing potential through its dominant Amazon Web Services (AWS) arm. AWS, the cloud services market leader, generates 64% of Amazon’s operating profits despite contributing a mere 18% of its revenue. Thus, accelerated growth in AWS would swiftly elevate Amazon’s profits, swiftly bridling its lofty valuation.

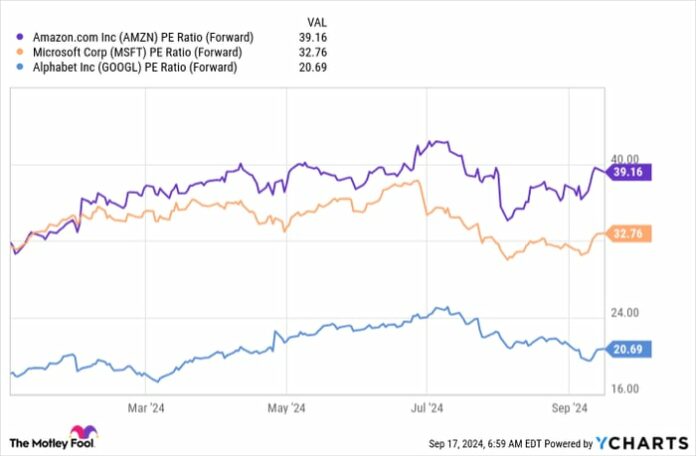

Conversely, although Amazon appears expensive based on forward price-to-earnings (P/E) ratio, the case could be made that Microsoft is the priciest. While Microsoft has enjoyed steady revenue growth, its profit margins have plateaued. Consequently, Microsoft lacks significant upside potential and must maintain its status quo to uphold its premium valuation.

In contrast, Alphabet boasts a more modest valuation relative to the broader market (represented by the S&P 500, trading at 22.7 times forward earnings). Despite lagging behind in some critical product releases, Alphabet’s cloud computing division is gradually turning profitable and could significantly boost profits by mirroring AWS-like profit margins.

Each cloud computing giant showcases distinctive merits; however, Amazon and Alphabet emerge as superior investment selections compared to Microsoft at present, primarily driven by their profit growth prospects.

Is Now the Time to Invest in Amazon?

Prior to delving into Amazon stock acquisitions, ponder this:

The Motley Fool Stock Advisor analysts recently identified what they deem the top 10 stock picks warranting investor attention. Surprisingly, Amazon did not make the cut. The 10 selected stocks proffer substantial potential for robust returns in the foreseeable future.

Reflect on Nvidia’s inclusion in this list back on April 15, 2005… a $1,000 investment then would have burgeoned into a staggering $710,860!*

Stock Advisor furnishes investors with a user-friendly roadmap to success, offering insights on portfolio construction, analyst updates, and two fresh stock recommendations monthly. Since 2002, the Stock Advisor service has surpassed S&P 500 returns fourfold*.

Explore the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, also sits on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Amazon. The Motley Fool possesses and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool further suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The insights and opinions articulated herein represent the author’s perspective and do not inherently mirror those of Nasdaq, Inc.