3D Systems Faces Revenue Dip Amid Market Challenges

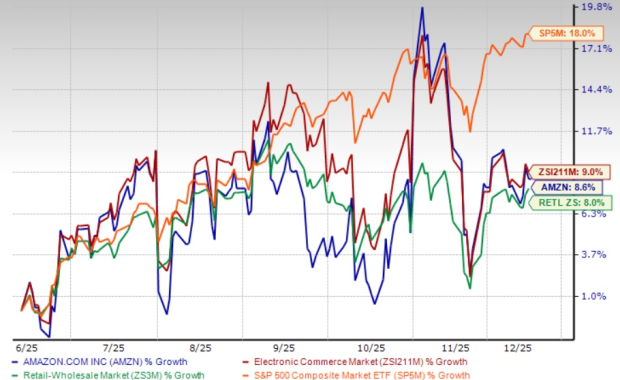

3D Systems’ DDD shares have dropped 19.9% in the last month, lagging behind the Zacks Computer and Technology sector, which saw a 2.3% increase.

The decline in stock price arises from weak demand for new printing systems, resulting in an 8.8% year-over-year revenue decrease to $112.9 million. This trend reflects broader macroeconomic and geopolitical uncertainties that have compelled clients to cut back on capital expenditures (CapEx) for factory expansions. As a result, the adoption of DDD’s hardware solutions has suffered.

In spite of these hurdles, 3D Systems is committed to ongoing innovation, a strong portfolio, operational efficiencies, and growth in the healthcare segment.

Should investors delve into DDD stock given these circumstances? Let’s analyze further.

3D Systems Corporation Price and Consensus

3D Systems Corporation price-consensus-chart | 3D Systems Corporation Quote

Strategic Moves in High-Performance Markets

3D Systems is making strides in the high-performance automotive sector through a partnership with Sauber Motorsports. This collaboration involves eight SLA 750 dual laser printers along with two PSLA 270 platforms, featuring top-notch materials. This strategic move positions 3D Systems as a leader in photopolymer applications.

In the third quarter of 2024, the company unveiled QuickCast Air, a novel casting solution tailored for the investment casting market, especially for aircraft and rocket propulsion systems. This casting technique is essential for high-performance uses and is projected to grow into a $34 billion market over the next ten years.

Another significant achievement for 3D Systems is the commercialization of its Oqton Industrial MOS platform, thanks to a partnership with Baker Hughes. This platform has shown impressive efficiencies, such as a 98% reduction in active monitoring engineering time and an 18% decrease in scrap costs due to real-time alerts during production.

The company also expanded its EXT family of products, now including the 1270, 1070, and the new 800 model. This hybrid solution unites pellets, filaments, and traditional CNC machining in one platform, optimizing cost and speed.

Healthcare Division Shows Promising Growth

In the latest quarter, the Healthcare segment saw revenues climb 5% year over year to $55.1 million, primarily driven by advancements in Dental and Personalized Healthcare solutions.

3D Systems’ healthcare segment continues to expand, highlighted by the recent FDA clearance for its patient-matched guides for total ankle replacements, developed in collaboration with Smith & Nephew. This positions 3D Systems well within the expanding market for patient-specific surgical solutions, which is anticipated to exceed $5 billion soon.

By leveraging cutting-edge technology in orthopedic surgery, 3D Systems aims to meet increasing demand while enhancing patient outcomes, thereby solidifying its foothold in healthcare.

Earnings Forecasts Show Caution

For 2024, 3D Systems forecasts revenues between $440 million and $450 million, suggesting a mid-to-high-single-digit percentage improvement sequentially.

The Zacks Consensus Estimate for revenues stands at $444.69 million, marking a year-over-year drop of 8.89%. Estimates for earnings reflect a predicted loss of 47 cents per share, with no changes in projections over the last month.

Investment Outlook for DDD Stock

3D Systems’ Value Score of F indicates potential issues with its valuation.

Currently, DDD is grappling with adverse macroeconomic conditions, reduced customer demand, and intense competition. Given these elements, investors are advised to maintain a hold position on DDD stock. Waiting for more favorable market conditions could present better investment opportunities.

The company holds a Zacks Rank #3 (Hold).

Alternative Investment Options

Garmin GRMN, NVIDIA NVDA, and Broadcom AVGO are better-ranked options within the tech sector. Each stock currently enjoys a Zacks Rank #2 (Buy). A complete list of today’s Zacks #1 Rank (Strong Buy) stocks is available.

The projected long-term earnings growth rates are 21.60% for Garmin, 20% for NVIDIA, and 16.52% for Broadcom.

Explore Promising Energy Ventures

The demand for electricity is soaring, while efforts to decrease reliance on fossil fuels like oil and natural gas are ramping up. Nuclear energy presents itself as an effective alternative.

Recently, leaders from the US and 21 other nations pledged to triple global nuclear energy capacities. This transition could yield significant profits for nuclear-related stocks and those investors who act swiftly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, highlights the key players and technological advancements in this area, including three standout stocks that are likely to benefit significantly. Download the report today at no cost.

To access the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double for free.

Garmin Ltd. (GRMN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

3D Systems Corporation (DDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.