Amidst the tumult of cord-cutting woes in the Broadcast Radio and Television industry, bright stars like Netflix, Warner Bros. Discovery, Fox, and Roku are forging ahead. These industry players are embracing the surge in digital content consumption, riding on diversified offerings, original content, and enhanced technology integration. Although ad revenues remain subdued, focused profit protection and cash management, paired with advanced technology adaption, are forecasted to drive revenue growth in the near future.

Insight into the Industry Scene

The Broadcast Radio and Television sector encompasses companies delivering entertainment, sports, news, and music content across television, radio, and digital platforms. Revenue streams originate from program sales, advertising, and subscriptions. With a pivot towards research, marketing, and technological advancements, industry players are navigating a competitive landscape by responding to technological shifts and an evolving consumer base.

Up-and-Coming Trends in the Industry

1. Embracing Change in Viewer Preferences: Players in the industry are diversifying content to cater to the rise of over-the-top (OTT) services, leveraging streaming across platforms to capture a wider global audience. This shift is not only expanding international user bases but also attracting advertisers, consequently inflating ad revenues.

2. Harnessing the Power of Digital Viewing: The demand for digital content is driving companies to leverage user insights and advanced technologies to curate targeted content. Through artificial intelligence and machine-learning algorithms, enhancing user engagement and potentially increasing revenue streams.

3. Economic Uncertainty Impacting Production and Ad Demand: The industry faces headwinds like high inflation, rising interest rates, and stiff competition for ad dollars in the wake of technological disruptions. Advertisers trimming budgets due to macro-economic uncertainties pose challenges to industry growth.

4. Rise of Low-Priced Skinny Bundles: The prevalence of cord-cutting has spurred the introduction of affordable “skinny bundles,” offering reduced channel options. While catering to evolving consumer trends, these services may impact revenue streams for industry players.

Assessment of Industry Standing

The Zacks Broadcast Radio and Television industry, part of the broader Consumer Discretionary sector, currently carries a Zacks Industry Rank #175, situating it in the lower echelon among more than 250 Zacks industries. The industry forecast appears lackluster due to a pessimistic earnings outlook, with a significant decline in estimated earnings for 2024 since February 28, 2023.

Despite the challenging landscape, there are standout stocks exhibiting potential in surpassing market expectations based on a robust earnings outlook. However, before delving into specific stock recommendations, evaluating industry shareholder returns and valuations is prudent.

Industry Outshines Peers

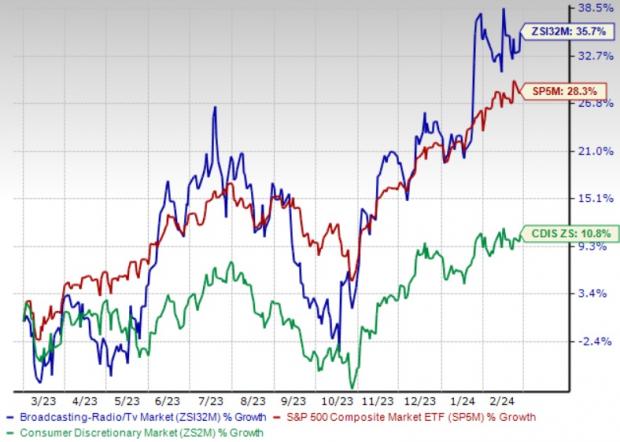

Over the past year, the Broadcast Radio and Television sector has surpassed the broader Consumer Discretionary sector and the S&P 500 Index, boasting a 35.7% increase compared to the S&P 500’s 28.3% return and the sector’s 10.8% rise.

One-Year Price Performance

Evaluating Industry Valuation

Based on the trailing 12-month EV/EBITDA ratio, the Broadcast Radio and Television industry currently trades at 10.77X, presenting an opportune valuation compared to the S&P 500’s 14.3X and the sector’s 8.52X. Over the last five years, industry valuations have fluctuated between 7.23X and 42.61X, with a median of 28.54X.

EV/EBITDA Ratio (TTM)

4 Standout Broadcast Radio and TV Stocks

Netflix: This Zacks Rank #1 (Strong Buy) company is primed for continued growth with an expanding subscriber base and a robust content portfolio. Initiatives like curbing password-sharing and advanced revenue models showcase the company’s commitment to nurturing a lasting market presence.

The Streaming Giants: A Story of Growth and Resilience

Netflix’s Diverse Content Strategy

Netflix’s growth trajectory remains fueled by a diverse content portfolio bolstered by substantial investments in localized, foreign-language content. The recent launch of five documentary short films backed by the Documentary Talent Fund showcases the streaming giant’s commitment to fostering unique storytelling experiences.

Netflix’s Strategic Acquisition

Netflix’s strategic acquisition of the exclusive livestreaming rights for World Wrestling Entertainment’s Raw from January 2025 at a hefty price point marks a significant move to enhance its content offering. This 10-year deal, valuing over $5 billion, positions Netflix as a prominent player in the streaming space across regions such as the United States, Canada, Britain, and Latin America.

Netflix’s Gaming Expansion

Netflix’s foray into the gaming realm with the addition of Grand Theft Auto: The Trilogy – The Definitive Edition by Take-Two Interactive to its gaming portfolio has driven user engagement. This strategic move not only broadens Netflix’s offerings but also solidifies its stance in the competitive gaming industry.

The Zacks Consensus Estimate pointing to a 5.9% rise in Netflix’s 2024 earnings to $16.93 per share within the past 60 days underscores the company’s upward trajectory. Additionally, Netflix’s shares have delivered a commendable 22.5% return year to date.

Warner Bros. Discovery’s Evolution

Warner Bros. Discovery, with its growing direct-to-consumer offerings and expanding content availability, is driving top-line growth. The strategic focus on enhancing viewership through a mix of linear, digital, and over-the-top platforms bodes well for the company’s revenue stream.

Fox’s Adaptive Strategy

Fox’s emphasis on live programming and partnerships like the one with Warner Bros. Discovery to innovate a new streaming sports service showcases its commitment to stay ahead in a dynamic market. The strong user base driven by Fox News and Fox Business Network indicates promising growth prospects for the company.

Roku’s User Engagement Surge

Roku’s position as the top TV streaming platform in the United States, Canada, and Mexico underlines its burgeoning user engagement. Collaborations such as the one with Tennis Channel to introduce T2 in the United States further reinforce Roku’s commitment to delivering diverse and compelling content offerings.

The narrowing of Roku’s 2024 estimated loss by 20 cents to $2.13 per share over the past 60 days, coupled with a notable 30.5% year-to-date stock gain, signifies the company’s resilience and growth potential in the streaming landscape.

The Future of Streaming

Amidst the industry shifts and evolving consumer preferences, streaming giants such as Netflix, Warner Bros. Discovery, Fox, and Roku continue to navigate the digital landscape with innovation and strategic partnerships. The dynamic content strategies and user-focused approaches adopted by these companies position them as key players in the ever-changing streaming landscape.

Investors and industry observers keen on the streaming segment are urged to keep a close watch on the developments and growth trajectories of these industry leaders as they evolve to meet the demands of an increasingly digital-centric audience.