Is It Time to Consider Dollar General Despite Recent Struggles?

Investors may be wary of Dollar General (NYSE: DG), with its stock nearly halved since its peak in March. A significant drop of 34% since late August highlights the lack of enthusiasm for the retailer’s shares.

Yet, the market pullback could present a buying opportunity for those willing to look past the current turmoil. Here are four convincing reasons to consider investing in Dollar General.

1. A Tough Economy Favors Dollar General

Dollar General’s primary customers come from budget-conscious households. Historically, this has worked to their advantage, especially during economic downturns that make affordable shopping appealing.

However, the financial strain has recently been more pronounced, leading to a decline in shopper activity. While the company’s overall revenue rose 4.2% in the last quarter, same-store sales saw only a meager 0.5% increase. CEO Todd Vasos noted, “We believe the softer sales trends are partially attributable to a core customer who feels financially constrained.”

This reflects a critical point: many of their customers are facing financial difficulties, which has contributed to Dollar General’s 30% stock decline since August.

Looking ahead, this downturn might not last. The Atlanta Federal Reserve predicts the nation’s GDP grew at 3.2% in the third quarter, a noteworthy improvement from earlier estimates. Furthermore, the Department of Labor reported a 4% increase in wage growth in September. These modest yet encouraging signs may entice cash-strapped shoppers back into Dollar General’s stores.

2. Todd Vasos Returns as CEO

Todd Vasos played a crucial role in Dollar General’s significant growth, expanding its store network from under 9,000 to over 20,000 during his tenure from 2008 until 2022. His familiarity with the company and its operations is invaluable.

After a brief hiatus, Vasos returned as CEO in October last year. As he resumes his leadership, improvements in strategy and performance are anticipated, benefiting the company moving forward.

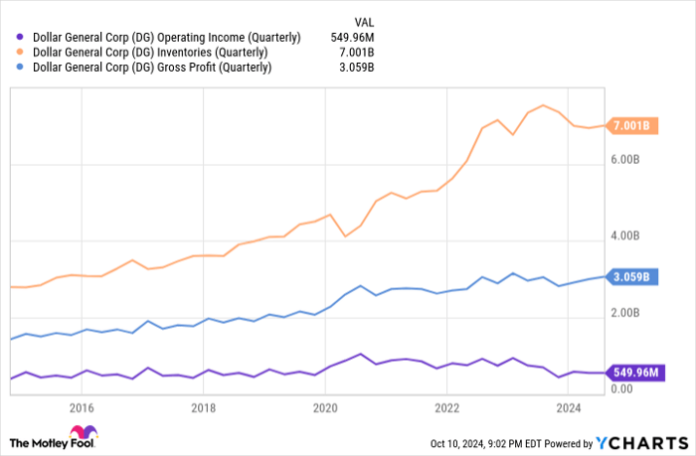

3. Tackling Inventory Issues

The COVID-19 pandemic severely disrupted Dollar General’s supply chain, which hampered inventory levels when consumer demand surged in 2022. In an attempt to capitalize on this anticipated boom, the company overstocked inventory—only to find the sales were not as strong as expected.

This mismatch has caused Dollar General to struggle with unsold goods in the wrong categories. However, steps are being taken to rectify this. During a recent earnings call, Vasos shared plans to cut around 1,000 stock-keeping units (SKUs) and improve logistics for replenishing stores. The addition of ShelfEngine’s AI platform will further enhance their ability to order fresh produce efficiently.

While these changes may not seem groundbreaking, they highlight Dollar General’s commitment to solving its most pressing challenges.

4. Competitors Facing Challenges

Dollar General also stands to benefit from the difficulties faced by its rivals. Dollar Tree (NASDAQ: DLTR) is currently reviewing its Family Dollar chain, which has 7,761 stores, while Big Lots has entered Chapter 11 bankruptcy. This adds another 1,200 locations that could potentially be vacated.

Although not all competitors are guaranteed to shut down, some may need to close to protect their value during these transitions. With rivals on the defensive, Dollar General has an opportunity to expand its physical footprint and attract new customers.

Proceed with Caution

Investing in Dollar General is not without risks. Although the company can rebound, change may not be immediate. Monitoring same-store sales growth will be essential in gauging its recovery, particularly among less-affluent consumers. If you find this uncertainty difficult to accept, it may be wise to explore other investment options.

Despite the potential risks, several signs point to a possible turnaround, suggesting that the recent sell-off might be exaggerated. Analysts remain cautiously optimistic; despite a significant number of “hold” ratings, the consensus price target stands at $98.23 per share, nearly 20% higher than its current valuation. This offers a reasonable starting point for a new investment.

Should You Invest $1,000 in Dollar General Now?

Before committing to an investment in Dollar General, keep this in mind:

The Motley Fool Stock Advisor team has highlighted what they believe are the 10 best stocks available today—and Dollar General did not make the list. The stocks chosen could yield substantial returns in the coming years.

For context, consider Nvidia, which was recommended on April 15, 2005. If you had invested $1,000 at that time, your investment would now be worth $826,069!*

Stock Advisor provides straightforward guidance for investors, covering portfolio building, analyst updates, and two new stock picks each month. The service has more than quadrupledthe return of the S&P 500 since its inception in 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.