Dutch Bros Stock: An Opportunity Amidst Uncertainty

After last year’s impressive 70% increase, investing in Dutch Bros (NYSE: BROS) stock might seem daunting. However, evaluating the company’s future rather than solely its past performance could reveal significant growth potential ahead.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks for investment today. See the 10 stocks »

There are four compelling reasons to consider entering the market after the recent pause in Dutch Bros’ stock surge.

Discovering Dutch Bros

Dutch Bros is a popular chain of coffee drive-thrus, with a current total of 950 locations primarily found on the West Coast and in the southwestern United States. The company is gradually expanding eastward.

Although it competes against giant Starbucks (NASDAQ: SBUX), which boasts 16,941 U.S. stores, Dutch Bros offers a unique experience with its exclusively drive-thru format.

Don’t underestimate Dutch Bros’ smaller footprint; the company attracts customers by fostering a distinct connection with them that includes community involvement.

Why Now is an Opportune Time to Invest in Dutch Bros Stock

Dutch Bros distinguishes itself from Starbucks and coffee competitors such as McDonald’s through its unique approach. Here are four key reasons why this stock presents a strong investment opportunity:

1. Strong Growth

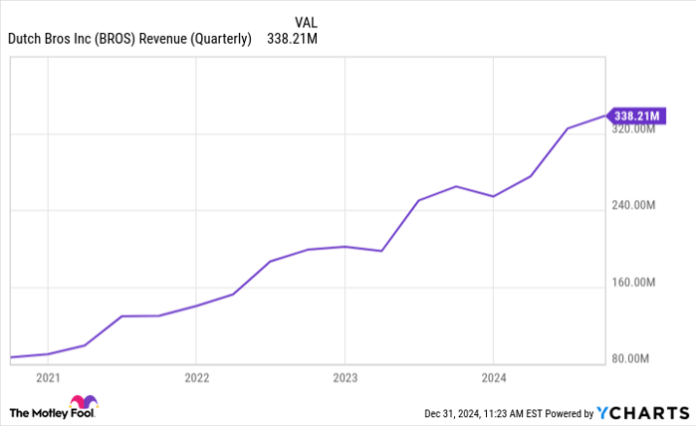

In the third quarter ending September, Dutch Bros reported a revenue of $338 million, marking a 28% year-over-year increase. This growth was spurred by opening 38 new stores and a respectable 2.7% rise in same-store sales, compared to 4% in the same quarter a year earlier. This consistent growth trend has been evident since Dutch Bros became public in September 2021.

BROS Revenue (Quarterly) data by YCharts.

Furthermore, analysts expect similar growth patterns to continue at least through 2026.

2. Future Expansion

Analysts project that Dutch Bros will successfully meet its ambitious growth targets. While the company has increased its stores from 800 two years ago to 950 today, it aims to ultimately open 4,000 locations.

This expansion offers opportunities without having to directly compete with larger rivals like McDonald’s and Starbucks. The company’s smaller size helps maintain personal connections with customers and allows for improved customer service.

3. Profitability on the Rise

Unlike many of its peers, Dutch Bros has achieved profitability, with earnings predicted to rise from $0.30 per share in 2023 to $0.45 in 2024, eventually reaching $0.55 in 2025.

Data source: StockAnalysis.com. Chart by author.

As the company grows, its fixed costs remain stable, allowing more revenue to contribute to the bottom line, supported by better negotiating leverage with suppliers.

4. Meeting Consumer Demand

Importantly, Dutch Bros has embraced a more casual approach to customer interaction that resonates with consumers. This shift reflects a broader change in market preferences, as people increasingly seek authenticity over polished, corporate experiences.

Historical preferences evolve frequently—shopping patterns have shifted from department stores to community malls, and brand allegiance has transformed over the years. Notably, Oberlo research shows that 88% of consumers value authenticity in their buying decisions, with many willing to pay more for trusted brands.

Furthermore, Dutch Bros’ drive-thru only locations provide efficiency, reinforcing its appeal in a fast-paced world.

Expecting Volatility Ahead

Investors should prepare for potential volatility in Dutch Bros stock. Historical trends suggest some swings are likely. However, focusing on the company’s robust growth narrative can be reassuring during any fluctuations that may arise.

Is Investing $1,000 in Dutch Bros the Right Call?

Before making any investment in Dutch Bros, reflect on this:

The Motley Fool Stock Advisor team has revealed their top 10 stocks for investment right now, and Dutch Bros was not included. The stocks chosen could yield impressive returns in the coming years.

For context, when Nvidia made this list on April 15, 2005, investing $1,000 would result in $847,637 today!*

Stock Advisor offers a straightforward path for investors, including portfolio guidance and regular analyst updates, along with two new stock picks each month. Since 2002, Stock Advisor has more than quadrupled the returns of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of December 30, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.