Written by Sam Kovacs

Unveiling the Dividend Aristocrats

One of the curious wonders of Dividend Aristocrats is their adherence to rewarding shareholders with increasing dividends over extensive periods. It’s an easy and reliable way to identify stocks with a commendable track record in providing value to their investors.

However, the nomenclature “aristocrats” and its brethren like dividend champions and superheroes may raise an eyebrow or two. It somehow undermines the essence of detachment an investor should maintain from their stock holdings. Stocks are not akin to sports teams – while you can blindly support the Knicks, a rational approach to stocks is viewing them as a means to a financial end, not an end in itself.

It’s crucial to grasp this concept to make “Buy Low, Sell High” a plausible reality. But for dividend investors, there’s an extra twist to this age-old adage – “Buy Low, Sell High, Get Paid To Wait.” This mantra resonates deep – in a market of stocks, the timing shifts, and some stocks inevitably emerge as bargains while others stand as overly priced contenders.

“Buy Low, Sell High, Get Paid To Wait” – this philosophy is ingrained in our ethos. It allows us to curate a collection of high-quality businesses that can potentially enrich investors. When we invest in the best stocks at their nadir, sell them at their zenith, and funnel the proceeds into stocks with greater potential, we pave the way for amplified income and capital gains.

So, how does this work?

If you invest in a stock at $100 yielding 4%, you rake in $4 annually in dividends. If the stock doubles and you trade it for $200, reinvest that sum at 4% and your annual dividends soar to $8 – a twofold surge in income.

This tactic not only propels income but can also bolster capital gains, albeit not always immediately or in a linear manner.

By parting with overvalued stocks and acquiring undervalued ones, we trade assets priced beyond their intrinsic value for those undervalued – a shrewd move that can potentially fuel gains.

Exemplifying “Buy Low, Sell High, Get Paid To Wait”

Let’s spotlight a tangible demonstration of this strategy, based on trades from our High Yield model portfolio – one of three model portfolios in our service.

Our portfolio history with Exxon (XOM), a dividend aristocrat, reflects our calculated approach.

Starting our XOM expedition in January 2021 at $54, we fortified our position in March and August 2021 at $57 and $58, respectively.

Our subsequent exit from the XOM position unfolded in four increments:

- 12% of the position at $80 in March 2022.

- 22% of the position at $99 in June 2022.

- 17% of the position at $110 in November 2022.

- 51% of the position at $110 in January 2023.

Gradually accumulating and exiting our position allowed us to savor more of the upside.

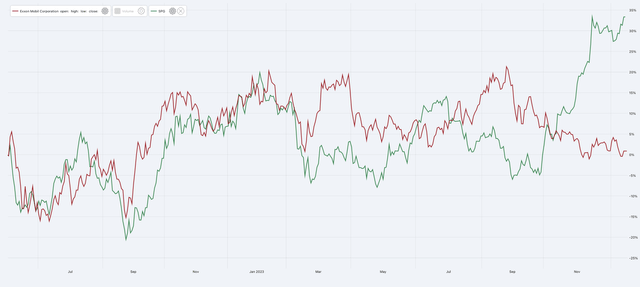

Exiting XOM at an average cost of $105, we missed its height at $120, but near enough for a commendable outcome.

Regrettably, XOM’s progress plateaued at $100 post our exit in June 2022.

At that time, XOM’s yield was approximately 3.5%.

Simultaneously, we secured shares in Simon Property Group (SPG) at $109, unaware of its lucrative prospects until the final quarter of 2023, when REITs burgeoned.

Since June 2022, SPG surged by 35% while XOM remained stagnant, underscoring the potency of “Sell High” as a dividend investor.

Occasionally, this strategy doesn’t unfold as seamlessly, and we retain a portion of the position even if the price falls below our “sell above price” – and that’s acceptable.

In the same model portfolio, we accumulated investments in Chevron (CVX) over the past months. Amid volatility, the discipline of “Buy Low, Sell High, Get Paid To Wait” is a tried and tested method to navigate the unpredictable market currents.

Insights into Current Investment Strategies

Investing in the stock market requires both finesse and strategy. It’s not just about timing the market, but also about picking the right stocks and understanding when to hold, buy, or sell. Let’s delve into the recent trends in the stock market and explore some interesting investment strategies.

The Tale of Chevron

Positioned between the tumultuous periods of January and September 2021, Chevron’s stock reflected a roller-coaster journey. The investor divested a fraction of the position in April 2021 at $164 and another in November at $183. However, the stock took an unexpected turn before more shares could be offloaded, resulting in the dilemma of holding 3/5ths of the Chevron position amidst fluctuating energy stocks.

This prudent decision has yielded fruit despite the stock price volatility. The dividend payment on the Chevron stock soared by 17% since the initial purchase, providing a commendable 6.5% yield, proving that patience pays off handsomely in the world of investments.

With insightful foresight, the approach of identifying quality dividend stocks that continue to escalate their returns eases the need to sell high. While navigating these waters can be tricky, the members of the Dividend Freedom Tribe are eagerly awaiting an update on Chevron’s outlook. At the present prices, both Exxon and Chevron are deemed as holds or watches for now, aligning with the overall strategy to hold top dividend stocks, with no urgency to abandon them.

The Stubborn Dividend Aristocrat

Quoting John Keynes, the market’s irrational behavior sometimes challenges even the most seasoned investors. Walmart, a dividend aristocrat, has remained persistently overvalued since the pandemic without any significant signs of retracement. Trading at $160 with a yield of 1.4%, it has resisted correction despite earlier recommendations to sell.

Reflecting on past calls, comparing the performance of stocks like Nexstar, Coca Cola, VICI Properties, and Charles Schwab, it is evident that while some trades yielded gains, others did not. However, considering the opportunity cost is more crucial than absolute performance. A significant increase in income from the revised portfolio stands as a testament to wise investment choices. Walmart’s persistent overvaluation emphasizes the necessity to reconsider its position in an investment portfolio.

The Real Estate Aristocrat

Within the expanse of the stock market, there lies a market of stocks. As some like Walmart remain irrationally overvalued, others present as undervalued gems, notably, Realty Income (O), standing as a beacon among the dividend aristocrats. With a current trading price of $58.9, slightly below the buy-below price of $60, Realty Income flaunts its allure as a potential investment opportunity.

Foreseeing the prospects of 2024 embracing the reign of REITs, the case for Realty Income becomes even more compelling when looked at within the context of the overall market. Amidst these considerations, understanding the nuances of REIT investments along with the broader 2024 market view becomes paramount. Realty Income presents an enticing opportunity in light of these market dynamics, painting a more promising picture than overvalued alternatives like Walmart in the investment landscape.

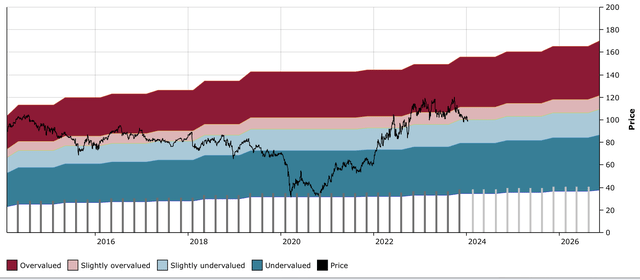

Why O is the Stock for Dividend Investors to Buy Now

Investors were recommended O as one of the top stocks for dividend investors on October 26th when the stock was trading at $49, yielding 6%. This seemed like a solid bargain, and though the bottom was missed, the current price of $59 still presents a significantly undervalued opportunity with a 5.2% yield expected to grow at 3-4% per year for the foreseeable future.

Additionally, the appeal of a monthly dividend check cannot be understated – it always feels nice to be sent money every month.

It’s projected that O will at least return to $70 this year, with the potential to reach $80 and even new highs of $90 within the next two years if the market gets ahead of itself. The market outlook therefore seems optimistic for O.

So the word from investors is clear: buy!

The Importance of Buying High-Quality Dividend Aristocrats at the Right Price

When it comes to high-quality dividend aristocrats, buying them at the right price is the key. The right price provides an attractive stream of dividends through a combination of both dividend yield and dividend growth.

These two requirements are negatively correlated. More yield means less growth, and vice versa. Many dividend aristocrats yield too little given their dividend growth profile, such as Colgate (CL) and Walmart.

The fundamental idea revolves around buying low, selling high, and getting paid to wait, which are the principles that often lead investors to success in the stock market.

Image source: Seeking Alpha