Rough Waters Ahead for Oil & Gas Equipment Industry

While oil prices have seen improvement, they are still far below the peak levels of 2022. This challenging environment is expected to dampen the demand for drilling and production equipment, casting a shadow over the Zacks Oil and Gas – Mechanical and Equipment industry.

Debt burdens are also a pressing issue for companies in this sector, hindering their ability to establish a stable footing amidst business uncertainties. Despite the gloomy outlook, certain players like Kodiak Gas Services, Inc. (KGS), Oil States International, Inc. (OIS), Matrix Service Company (MTRX), and Profire Energy, Inc. (PFIE) are striving to weather the storm.

Industry Landscape

The Zacks Oil and Gas – Mechanical and Equipment sector consists of companies that supply essential oilfield equipment, including production machinery, valves, and drilling components, to aid exploration and production firms. These entities play a crucial role in helping energy companies extract oil and gas from both onshore and offshore fields, contributing significantly to the upstream energy sector.

Challenges Facing the Oil & Gas Equipment Industry

Declining Demand for Drilling & Production Equipment: Despite favorable crude prices, the industry is unlikely to witness a resurgence to the $100 per barrel mark seen in 2022. Economic slowdown predictions for 2024 are expected to lead to reduced exploration and production activities, thereby diminishing the demand for crucial equipment.

Reduced Production Growth Rate: Investors are emphasizing shareholder returns over excessive capital allocation to oil and gas production. This shift is dampening production growth rates, impacting the demand for drilling and production equipment.

Debt Overhang: Compared to the broader energy sector, companies in the oilfield equipment industry hold disproportionately high debt levels. This vulnerability leaves them exposed to market uncertainties and financial risks.

Assessing Future Prospects

The Zacks Industry Rank for Oil and Gas – Mechanical and Equipment sits at #151 out of over 250 industries, placing it in the lower 40%. This ranking indicates muted short-term prospects for the sector. Industry data suggests that top-performing sectors tend to outshine lower-ranked ones by a 2-to-1 margin.

Stock Performance and Valuation

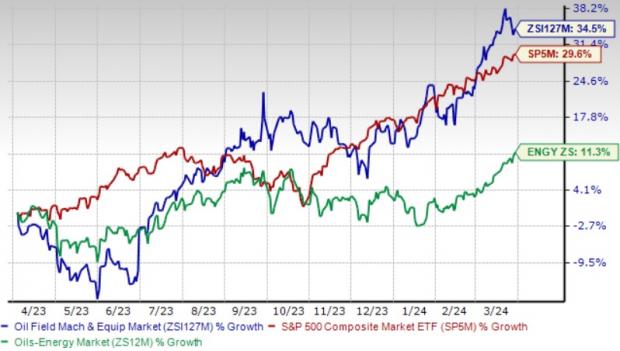

Despite industry challenges, the Oil and Gas – Mechanical and Equipment sector has outperformed the broader Oil – Energy sector and the S&P 500 index in the past year. With a 34.5% surge compared to the sector’s 11.3% and the S&P 500’s 29.6% growth, these companies are displaying resilience in an uncertain environment.

Current Valuation: Given the debt-heavy nature of oilfield equipment providers, evaluating them based on EV/EBITDA ratio is prudent. While the sector’s ratio stands at 10.08X, lower than the S&P 500’s 15.17X, it remains higher than the sector’s 4.26X. Over the past five years, this ratio has fluctuated between 2.4X and 12.8X, with a median of 10.01X.

Profile of 4 Resilient Oil & Gas Equipment Stocks

Oil States International, Inc: Emphasizing capital and cost discipline, Oil States International has seen revenue and EBITDA growth amidst sector improvements. With a Zacks Rank of 3, the company boasts a robust balance sheet with lower debt exposure than its industry counterparts.

Matrix Service Company: Known for offering engineering and construction services to the energy sector, Matrix Service has been securing steady project awards, bolstering its revenue streams. Ranked at 3 by Zacks, the company is moving ahead with confidence.

Profire Energy, Inc: A key player in burner and combustion management solutions, Profire Energy focuses on expanding its product offerings in various energy sectors. With a Zacks Rank of 3, the company is capitalizing on new opportunities in the oil and gas industry.

Kodiak Gas Services: Specializing in natural gas contract compression services, Kodiak Gas Services is well-positioned to capitalize on the growing demand for clean energy. With a Zacks Rank of 1 and positive earnings estimate revisions, the company is a standout player in the sector.

Curious to Explore More Stock Picks?

Discover a diverse range of stock recommendations and investment insights from Zacks Investment Research. Start your exploration today.