Four Retail Giants That Have Turned $1,000 Into Millions

Investors dream of transforming small amounts of money into substantial wealth. While finding quick, high-return investments is challenging and risky, these four retailers have proven it can be done with time and strategy.

Considering where to invest $1,000 today? Our analysts have identified the 10 best stocks currently available. Learn More »

These established companies continue to perform well, offering sustainable growth potential. While they may not replicate their extraordinary past returns, their reliability makes them solid additions for long-term portfolios.

1. Amazon: The E-Commerce Powerhouse

Amazon (NASDAQ: AMZN) began as an online bookstore in the 1990s. Today, it’s a colossal force in retail and technology. An investment of $1,000 when Amazon went public would now be worth approximately $2.4 million, marking an impressive 2,400-fold return.

Amazon holds about 40% of the e-commerce market in the U.S., while online sales account for less than 20% of total retail spending, indicating further growth potential. Its Prime subscription service, which includes benefits like video streaming, enhances customer loyalty and revenue.

Additionally, Amazon Web Services (AWS) has become the leading cloud computing provider globally, driving profitability and future growth opportunities. The increasing demand for AI technology could expand this market significantly, promising exciting prospects for investors.

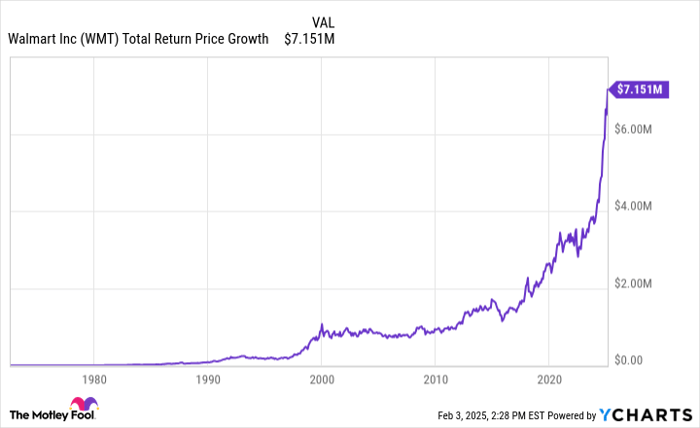

2. Walmart: The Retail Giant

Walmart (NYSE: WMT) evolved from a modest Arkansas store to a dominant global retailer. Today, around 90% of Americans live within ten miles of a Walmart. An investment of $1,000 made in 1972 would now be worth nearly $7.2 million.

WMT Total Return Price data by YCharts

The retailer’s reputation for low prices stems from its immense scale, enabling it to negotiate better deals with suppliers. This advantage makes it difficult for smaller competitors to match pricing. Walmart has also made significant strides in e-commerce, holding 10%-11% of the online retail market share.

Walmart’s commitment to lowering prices and consistent dividend payments (51 years of increases) positions it as a stable business for long-term investors, promising gradual growth and increased dividends.

3. Costco: The Membership Retailer

Costco Wholesale (NASDAQ: COST) has garnered a loyal customer base. An initial investment of $1,000 in 1982 would have grown to over $1.1 million. Its business model focuses on bulk sales at low prices, charging a membership fee for access.

Costco is known for its bargains, like the iconic $1.50 hotdog meal that has remained unchanged since 1984. The retailer avoids extensive marketing, instead sharing profits with members through dividends. Potential growth could come from increasing its membership base or raising subscription fees, which it recently did after six years.

4. Home Depot: The Home Improvement Leader

Home Depot (NYSE: HD) has exceptional growth, turning a $1,000 investment into approximately $20 million over 40 years. The company’s extensive store network and diverse product offerings have made it the largest home improvement retailer worldwide.

HD data by YCharts

Home Depot thrives within the $50 trillion U.S. residential real estate market. This sector fuels demand for home renovations and maintenance, securing long-term growth potential. Their recent acquisition of SRS for $18.25 billion diversifies their offerings into specialized areas, although market fluctuations could influence near-term revenues.

A Second Chance at Lucrative Opportunities

Have you ever felt like you missed out on investing in high-performing stocks? Here’s a chance to reconsider.

From time to time, our expert team issues a “Double Down” stock recommendation for companies they predict will surge. If you’re worried about missing out on investing, the present moment may be your best opportunity:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $333,669!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,168!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $547,748!*

We are currently recommending “Double Down” alerts for three remarkable companies, and this may be an opportunity you won’t want to miss.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Costco Wholesale, Home Depot, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.