Fueling Up for Growth

During these times of technological marvels and AI breakthroughs, the world seems to have barely noticed the soaring potential in energy stocks. Morgan Stanley (MS) has sounded the clarion call, pointing out that these stocks have been the unsung heroes behind post-pandemic S&P 500 Index ($SPX) earnings. The numbers don’t lie – with forecasts predicting a global oil and gas market worth over $9.4 trillion by 2028, the table is set for substantial growth.

With such prospects in mind, Morgan Stanley has upgraded its rating on the energy sector to “Overweight,” citing the potential for a catch-up rally. Led by Mike Wilson, the analysts at Morgan Stanley see energy as a diamond in the rough – overlooked, undervalued, and ripe for the picking.

Exploring The Top Contenders

Energy Stock #1: ConocoPhillips

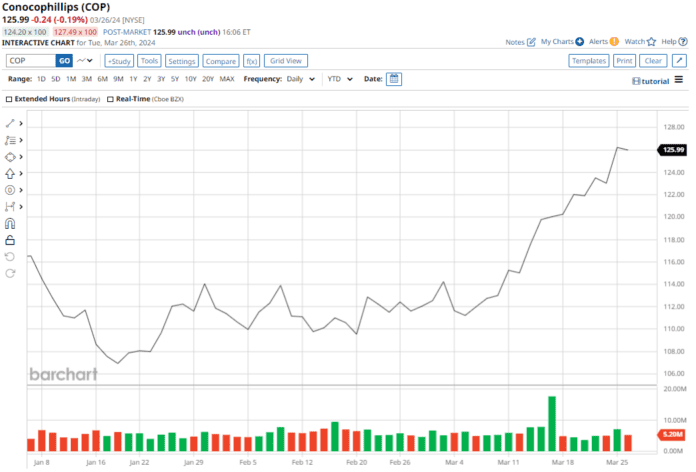

Emerging from a union as storied as a classic American novel, ConocoPhillips (COP) shines as an independent exploration and production company. Established in 2006 through the merger of Conoco and Phillips Petroleum, this Texas-based giant has a market cap that echoes its prowess at $148.2 billion.

Boasting an 8.7% YTD stock uptick, ConocoPhillips offers investors a forward dividend yield of 1.84%. Analysts have pegged the mean target price at $132.67, showcasing the potential for a 5.3% upswing. The consensus among experts leans towards a “Moderate Buy,” with 14 “Strong Buy” ratings out of 22.

Energy Stock #2: Devon Energy

Founded in 1971 by the Nichols family, Devon Energy (DVN) stands tall as an independent explorer and producer focused on the bountiful lands of the United States. With a market cap of $30.98 billion, Devon Energy’s stock has surged 8.7% YTD, offering a sweet dividend yield of 1.80%.

Market gurus advocate for a “Moderate Buy” on DVN stock, projecting a mean target price of $53.62, a notable 8.9% lift from current levels. Of the 22 analysts tracking the stock, 12 recommend a “Strong Buy,” underlining the bullish sentiment.

Energy Stock #3: Occidental Petroleum

A favorite in Warren Buffet’s playbook, Occidental Petroleum (OXY) boasts a legacy dating back to 1920. Engaged in oil and gas exploration globally, OXY commands a market cap of $56.1 billion. With a respectable 7% YTD stock growth, the company offers a dividend yield of 1.39%.

Experts have dubbed OXY stock a “Moderate Buy,” envisioning a 5.9% uptick to the mean target price of $67.67. Among the 18 analysts covering Occidental Petroleum, the sentiment leans towards 6 “Strong Buy” ratings.

Energy Stock #4: Diamondback Energy

Rounding out the selection, Diamondback Energy (FANG) emerges from the depths of the Permian Basin in Texas. With a market cap of $35.1 billion, this exploration and production powerhouse has seen its stock skyrocket by 26.3% YTD.

Despite already surpassing the mean target price of $194.35, experts maintain a “Strong Buy” consensus on FANG stock. The lofty Street-high target price of $250 hints at a further 27.6% upside potential. Out of 23 analysts, a resounding 19 rate Diamondback Energy as a “Strong Buy.”