Equinix Shows Strong Potential Amid Positive Financial Outlook

Equinix (EQIX) remains a key player in digital infrastructure as analysts express optimism over its growth. The estimate revision trend for 2025 funds from operations (FFO) per share reveals an upward trajectory for the company.

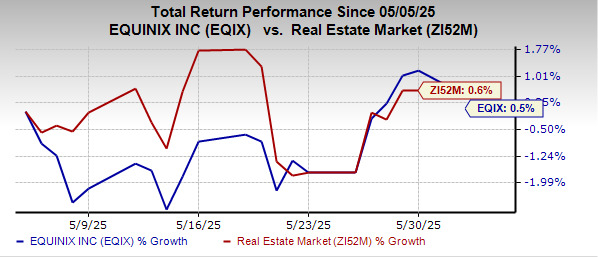

Over the past month, Equinix shares increased by 0.5%, while the overall real estate market saw a 0.6% gain. With robust fundamentals and favorable estimate revisions, the stock is expected to maintain its strong performance in the near future.

Strengths Supporting Equinix’s Position

Solid Market Fundamentals: The rising integration of artificial intelligence (AI) among enterprises boosts demand for Equinix’s services. Its diverse portfolio of International Business Exchange (IBX) data centers positions the company well to capitalize on these trends.

Revenue Growth: Over 90% of Equinix’s total revenues come from existing customers. In Q1 2025, 36% of recurring revenues were generated by its 50 largest clients. This demand is projected to increase, with recurring revenues estimated to grow 3.8% year-over-year in 2025.

Expansion Initiatives: Equinix is focused on expanding its data center capacity through acquisitions and new developments. In February 2025, it launched an IBX data center in Jakarta, Indonesia, and is set to acquire three facilities in the Philippines for $180 million, expected to close in Q3 2025. The company operates 270 IBX data centers across 35 countries as of March 31, 2025.

Furthermore, Equinix is developing 56 major projects in 33 markets across 24 countries, including 12 xScale projects.

Financial Stability: As of March 31, 2025, Equinix reported $7.6 billion in liquidity, supported by strong investment-grade credit ratings, allowing favorable debt market access.

Attractive Dividend: Equinix remains committed to solid dividend payouts. It has raised its dividend five times in the past five years, with a five-year annualized growth rate of 13.07%. Its lower-than-industry dividend payout ratio suggests sustainability in future distributions.

Other Noteworthy Stocks

Other Zacks Rank #2 (Buy) stocks to consider in the REIT sector include VICI Properties (VICI) and W.P. Carey (WPC). The 2025 FFO per share estimate for VICI has increased by one cent to $2.34, while WPC’s estimate has risen by 1% to $4.88.

Note: Earnings referenced in this article pertain to funds from operations (FFO), a key metric for assessing REIT performance.