Key Takeaways

- Amazon, Maplebear, Carvana, Booking Holdings and BigCommerce Holdings stocks look to have big holiday bumps.

- Adobe estimates online holiday sales for the last two months of the year to hit a record $240.8 billion.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free today!

We are in the fourth quarter of an eventful 2024 and market researcher’s attention has shifted toward the holiday sales season of 2024-25. Several research firms have already projected retail sales for the upcoming holiday season.

Although physical or in-house store sales are expected to be muted and may even decline year over year, online or e-commerce sales are likely to be bright spot this year. Under this scenario, investors should invest in e-commerce stocks with a favorable Zacks Rank to strengthen one’s portfolio.

Five such stocks to invest in are Amazon.com Inc. AMZN, Maplebear Inc. CART, Carvana Co. CVNA, Booking Holdings Inc. BKNG and BigCommerce Holdings Inc. BIGC.

Strong Online Holiday Sales Projections

Adobe has estimated 2024 holiday sales from Nov. 1 through Dec. 31 to reach a record-high $240.8 billion, up 8.4% year over year. More significantly, mobile transactions will account for 53.2% of total online sales, up 12.8% year over year.

Mastercard SpendingPulse has forecast total retail sales from Nov 1 to Dec 24, 2024 to increase 3.2% year over year. Within this, online retail sales are likely to advance 7.1% annually.

Deloitte’s retail and consumer products practice projects holiday sales will total $1.58 trillion to $1.59 trillion between November 2024 and January 2025. This indicates a year-over-year rise of 2.3-3.3%. E-commerce sales are expected to grow 9% year over year to reach $289 billion to $294 billion.

EMARKETER projected that holiday sales during the November-December period will grow 4.8% annually to hit $1.353 trillion. However, online sales are expected climb 9.5% year over year. Salesforce predicts a 2% year-over-year increase in 2024 holiday sales to $272 billion.

5 E-Commerce Stocks to Gain From Strong Holiday Sales

We have narrowed our search to five e-commerce stocks with strong growth potential for the rest of 2024. These stocks have seen positive earnings estimate revision in the last 30 days. Each of our picks carries a Zacks Rank # 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amazon.com Inc.

Amazon.com’s third-quarter results were driven by Prime and AWS momentum. We expect 2024 net sales to increase 10.7% from 2023. Strengthening AWS services portfolio and AMZN’s growing adoption rate contributed well to AWS performance. AMZN’s ultrafast delivery services and expanding content portfolio were beneficial.

The strengthening relationship with third-party sellers was a positive. Robust advertising business contributed well. AMZN’s expanding global presence remains a positive. AMZN’s Growing capabilities in grocery, pharmacy, healthcare and autonomous driving are other positives. Deepening focus on generative AI is a major plus.

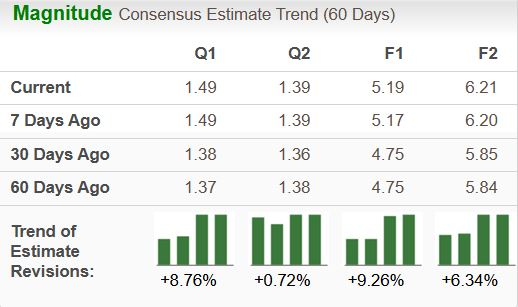

Amazon.com has an expected revenue and earnings growth rate of 10.9% and 79%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last seven days.

Image Source: Zacks Investment Research

Maplebear Inc.

Maplebear is a grocery technology company principally in North America that works with grocers and retailers to transform how people shop. CART’s Instacart Platform offers retailers a suite of enterprise-grade technology products and services to power their e-commerce experiences, fulfill orders, digitize brick-and-mortar stores, provide advertising services, and glean insights. CART also operates virtual convenience stores; and provides software-as-a-service solutions to retailers.

Maplebear has an expected revenue and earnings growth rate of 11.2% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 21.7% over the last 30 days.

Image Source: Zacks Investment Research

Carvana Co.

Carvana’s acquisition of ADESA’s U.S. operations has bolstered its logistics, auction capabilities, and reconditioning efforts. Most importantly, management has shifted focus from growth to operational efficiency. CVNA’s three-step plan—achieving positive adjusted EBITDA, boosting EBITDA per unit, and resuming growth with an efficient model—is driving its turnaround.

For that, CVNA is focusing on enhancing operational efficiency across the business, with several technology, process and product initiatives underway. Also, CVNA has managed to reduce retail reconditioning and inbound transport costs. In the last reported quarter, CVNA reported record gross profit per unit and adjusted EBITDA margin. A positive outlook for unit sales growth and EBITDA adds confidence.

Carvana has an expected revenue and earnings growth rate of 24.9% and 54.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 30 days.

Image Source: Zacks Investment Research

Booking Holdings Inc.

Booking Holdings reported impressive third-quarter 2024 results, wherein both earnings and revenues grew on year over year. Revenue growth was driven by growing leisure travel demand. Substantial improvement in booking was a major tailwind for BKNG.

Strong momentum across BKNG’s merchant and advertising, and other businesses contributed well to top-line growth. The growing alternative accommodation business was a tailwind for BKNG. Solid growth in rental car and airline ticket units was a positive. The uptick in booked room nights is contributing well to gross bookings’ growth.

Booking Holdings has an expected revenue and earnings growth rate of 9.6% and 19.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2.4% over the last 30 days.

Image Source: Zacks Investment Research

BigCommerce Holdings Inc.

BigCommerce Holdings operates a software-as-a-service platform for enterprises, small businesses, and mid-markets in the United States, North and South America, Europe, the Middle East, Africa, and the Asia-Pacific. BIGC provides a platform for launching and scaling an e-commerce operation, including store design, catalog management, hosting, checkout, order management, reporting, and pre-integration into third-party services. BIGC serves stores in various sizes, product categories, and purchase types, such as business-to-business and business-to-consumer.

BigCommerce Holdings has an expected revenue and earnings growth rate of 75% and more than 100%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.5% over the last 30 days.

Image Source: Zacks Investment Research

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Carvana Co. (CVNA) : Free Stock Analysis Report

Maplebear Inc. (CART) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

BigCommerce Holdings, Inc. (BIGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.