“`html

Spotting Potential Moonshots: Investment Opportunities to Watch

Tom Yeung here with this week’s Sunday Digest.

As a conservative investor, I prioritize a company’s long-term profitability, particularly cash flow. Earning 10% dividends from quality stocks is appealing, yet some growth opportunities are simply too significant to overlook.

In February, I forecasted that Nvidia Corp. (NVDA) could reach a split-adjusted value of $160 by 2027. This prediction has proven sound, as the stock price has surged from $72 to $144.

Similarly, the exuberance surrounding Dogecoin (DOGE-USD) in 2021 was remarkable. I suggested an investment of $500 in this cryptocurrency valued at $0.10, which soared to $0.64.

Some investors have turned high-volatility trades into successful careers. Jonathan Rose, an expert on options trading, has recorded astonishing returns of 16%, 48%, 156%, 545%, and even 1,306% in under seven hours by focusing on options expiring the same day. These “zero-day options” represent one of the fastest-growing segments in today’s financial markets.

Remarkably, Jonathan manages to limit his downside risk while trading these high-stakes options.

Recently, he launched a four-day free Strategy Summit, which includes a LIVE market analysis session tomorrow at 11 a.m. ET. Additionally, the grand finale session on Tuesday will unveil his five-step strategy for identifying one-day trading successes—available free of charge.

To secure your spot for all sessions—including Tuesday’s finale—register here.

Understanding Equity Stubs

Some companies carry significant risks due to precariously high debt levels compared to their equity. Firms with just $1 of equity for every $4 of debt experience greater stock price fluctuations in response to small changes in enterprise value—a 10% increase could result in a 50% rise in stock price.

This describes the current predicament of Sabre Corp. (SABR).

Sabre is one of three global operators of the Global Distribution System (GDS), which manages airline and hotel reservations. This system allows websites like Google Flights and Kayak to access real-time flight information, and it aids airlines in booking passengers on rival carriers during travel disruptions.

It’s worth noting that no viable alternatives to GDS have emerged. A product introduced by the International Air Transport Association (IATA) a decade ago has not gained traction due to inefficiencies in its decentralized system, which contacts each airline for bookings. As a result, GDS companies enjoy substantial profit margins with little competition.

However, private equity firms began leveraging companies like Sabre during the mid-2000s, aiming to generate high returns on the GDS business while borrowing at low interest rates.

This strategy was successful until the Covid-19 pandemic hit. Sabre’s stock plummeted from the $20-$30 range to the single digits. Today, it trades around $3.60, with high interest payments consuming the company’s reduced profit pool.

Despite these struggles, recovery in travel is underway. According to the IATA, air travel has surpassed pre-Covid levels earlier this year, with projections of an 8% increase by 2025. Sabre’s booking revenues have nearly tripled since 2020.

The company is on track to cover its $500 million annual interest payments, with analysts predicting a shift to an $86 million net income in 2025, following a $57 million loss in 2024. This financial improvement could facilitate debt repayment and refinancing at better rates. Historically, a transition from losses to profits indicates positive market trends, and Sabre is positioned to achieve this.

Three Companies with Turnaround Potential

Several moonshot investments show promise for recovery in 2025. Here are three noteworthy candidates:

1. Stratasys Ltd. (SSYS): A frontrunner in 3D printing based in Minnesota, Stratasys has expanded its technological lead through acquisitions, including RPS and XAAR. Analysts predict a tough year in 2024 but anticipate net profits to soar to $26 million next year, a tenfold increase.

The looming threat of 20% tariffs could further boost profits. If steep import barriers are enacted, many U.S. manufacturers may need to purchase parts locally, enhancing Stratasys’s sales prospects, especially since it’s outperforming its main competitor, 3D Systems Corp. (DDD).

2. Evolv Technologies Holdings Inc. (EVLV): After a 50% plunge in share price this autumn due to an accounting investigation, Evolv presents an intriguing investment opportunity. This Massachusetts-based company designs AI-powered gates that detect concealed weapons, already utilized by numerous stadiums and schools.

As laws regarding concealed carry are expected to be tested in various states, demand for Evolv’s products may rise. Additionally, the company’s collaboration with the Transportation Security Administration (TSA) could lead to further growth if approved for use in commercial airports.

3. UiPath Inc. (PATH): Shares of this AI firm have declined 83% since its IPO in 2021 amid concerns about growth and management changes. However, analysts predict a rebound in growth by 2025. Businesses are increasingly pressured to cut costs through AI, and UiPath is recognized as a top-tier provider of such solutions. Analysts at Gartner have identified UiPath as a leader in business automation.

The trend of AI becoming more sophisticated could further drive growth, benefitting companies like UiPath capable of delivering innovative solutions.

“`

Investors Eye Opportunities in Uncertain Times: Pfizer and the Future of Options Trading

Innovations in automation are set to boost demand for UiPath’s suite of products. Despite rapid advancements in AI, companies will still require expertise from firms like UiPath to effectively integrate these technologies.

Unpredictable Impact of Leadership Changes

As we prepare for Donald Trump’s second term, it’s clear that his presidency has been marked by disruption. His first term was defined by challenges to established norms, and he has committed to continuing that trend, bringing increased uncertainty—especially in highly regulated sectors like healthcare.

Take Pfizer Inc. (PFE). Recently, Eric Fry, a global macro specialist, advised his Fry’s Investment Report members to sell after Trump mentioned Robert F. Kennedy Jr. as a candidate for Secretary of the Department of Health and Human Services (HHS).

Pfizer generates about 25% of its revenue from Covid-19 vaccines and therapies, making it one of the most exposed companies to vaccine-related changes in the pharma sector. Kennedy is known for his skepticism toward vaccines, prompting Eric to advise caution.

Conversely, even Trump’s critics recognize that some of his policies may benefit healthcare stocks. Proposals to roll back Medicare negotiation aspects of the Inflation Reduction Act, lessen Federal Trade Commission regulations on mergers, and lower corporate tax rates could all buoy the sector.

Regardless, Pfizer’s stock price, currently fluctuating around $25, is unlikely to stay stagnant. By 2026, it either will soar or fall significantly.

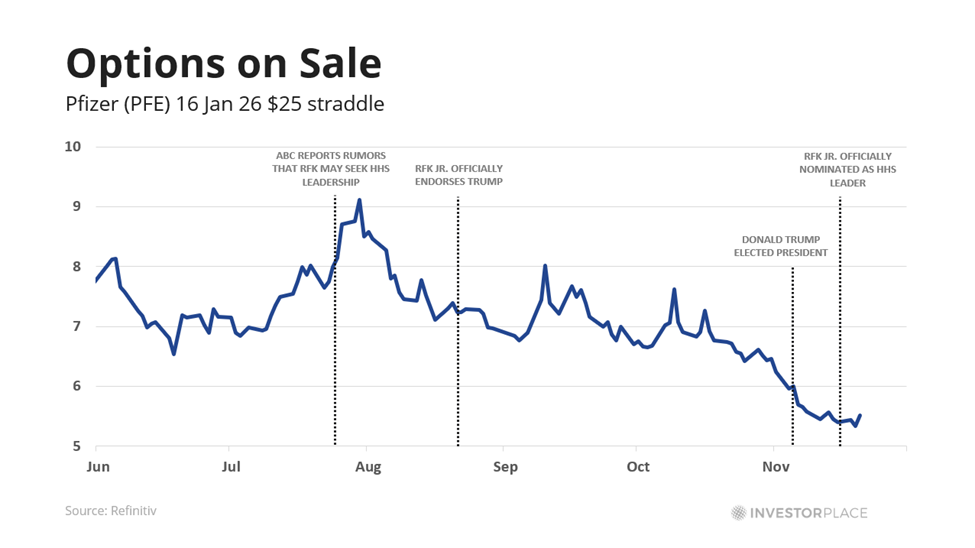

To capitalize on this volatility, investors are considering at-the-market 2026 Pfizer straddles—an options strategy that could yield profits if PFE trades outside the $19.50-$30.50 range by January 2026. Should the shares rise to $35 as they did earlier in Trump’s presidency, investors could see a 100% return. A drop to $15 would yield the same percentage gain. Furthermore, a straddle may become profitable before 2026 should volatility increase sufficiently.

Notably, these straddles are currently available at lower prices due to reduced market volatility; the VIX Index has decreased by 25% since the election, causing the cost of 2026 straddles to fall from the $7-$9 range to $5.50.

Uncovering Rapid Gains with Options

Not everyone is willing to wait for the next year for Pfizer straddles or 3D printing companies to recover. With Trump’s inauguration set for January, clear policies will take time to emerge.

Therefore, attending free presentations by Jonathan Rose on zero-day options strategies is crucial. According to JPMorgan Chase, approximately $1 trillion in zero-day options trade hands daily.

Such significant capital flowing into specific market segments often results in major opportunities for profit. However, these potential rewards also carry notable risks; hence, a solid risk management strategy is essential to safeguard investments while allowing for upside potential.

On Tuesday, November 26, Jonathan will conclude his free masterclass with the One-Day Winners Live Summit, where he’ll demonstrate his trading strategies.

During this session, attendees will learn how to utilize these trades to potentially triple their money following Donald Trump’s election victory—an achievement reached in less than seven hours.

Jonathan brings over 25 years of experience in trading, having progressed from a floor trader to a CBOE market maker and trading mentor. His impressive track record includes returns of 126%, 245%, and even up to 463%, often within a 30-day timeframe.

So if you’re curious about the growing market for zero-day options, Jonathan is the ideal expert to learn from.

Don’t miss this opportunity; on Tuesday, November 26, Jonathan will host his urgent summit on this innovative trading approach. Attendance is entirely free.

Click here now to reserve your spot.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace