“`html

Wall Street Poised for Continued Growth: Five Stocks to Watch

With just one and a half months left in 2024, Wall Street is positioned to replicate its remarkable rally from 2023. Last year, the three major stock indexes—the Dow, the S&P 500, and the Nasdaq Composite—recorded gains of 13.7%, 23.9%, and 43.4%, respectively. So far in 2024, the gains have continued, with the Dow up 17.4%, the S&P 500 up 26.5%, and the Nasdaq Composite up 30.7%.

Over the past 22 months, many stocks, especially those from large corporate names, have soared. However, despite the U.S. stock market’s overall success, some giant corporations have underperformed compared to the broad-market index—the S&P 500.

Investors should consider stocks that show strong momentum and possess a favorable Zacks Rank. These stocks demonstrate strong short-term upside potential. Notable mentions include Amazon.com Inc. AMZN, KLA Corp. KLAC, Newmont Corp. NEM, Uber Technologies Inc. UBER, and S&P Global Inc. SPGI.

Why Momentum Investing Matters

Momentum investing requires ongoing assessment of stocks. Investors aim to avoid struggling companies and instead focus on those with growth potential. Momentum investors typically buy shares at higher prices, betting that they will continue to rise in the coming months.

Uncertainty surrounds upcoming economic policies from President-elect Donald Trump during his second term, particularly regarding tariffs and corporate tax rates. While these factors could lead to some market volatility, Wall Street is expected to trend upward due to three key influences.

First, the U.S. economy’s fundamentals remain strong. The GDP has grown by 1.6%, 3%, and 2.8% in the first three quarters of 2024. Additionally, on November 7, the Atlanta Fed’s GDPNow tracker estimated a 2.5% growth rate for the fourth quarter, surpassing pre-pandemic levels.

Second, as of November 8, 452 S&P 500 companies have revealed their quarterly earnings. Their total earnings rose by 7.1% year-over-year, supported by a 5.5% increase in revenues. Impressively, 73.5% exceeded earnings per share (EPS) expectations, and 61.5% surpassed revenue forecasts.

The overall earnings for the S&P 500 Index in the third quarter are projected to increase by 7.4% compared to the same period a year ago, accompanied by a 5.6% rise in revenues.

Lastly, the Federal Reserve cut the benchmark lending rate by 25 basis points in its November FOMC meeting, following a more considerable 50 basis-point reduction in September. The current Fed funds rate sits between 4.50% and 4.75%, down from a 23-year high of 5.25%-5.5% until mid-September. The CME FedWatch tool indicates a 70% chance for another 25 basis-point rate cut in December.

Five Stocks With Promising Short-Term Upsides

We have identified five large-cap momentum stocks that have recently shown robust earnings estimate revisions along with significant upside potential for the remainder of 2024. Each selected stock holds a Zacks Rank of #2 (Buy) and boasts a Momentum Score of A. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

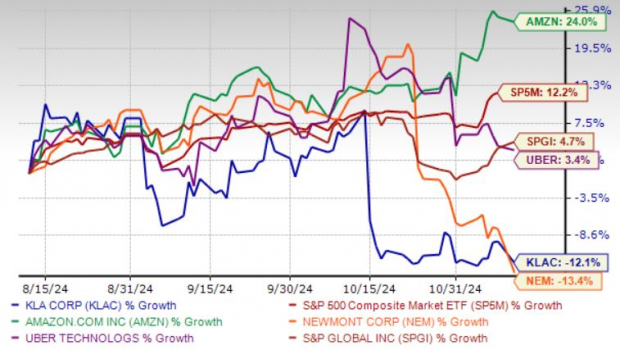

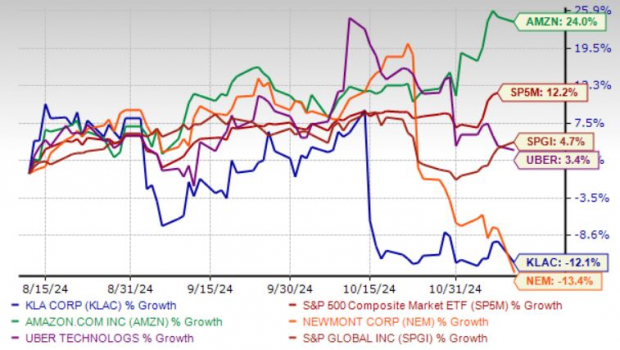

The following chart illustrates the price performance of our five picks over the past three months.

Image Source: Zacks Investment Research

In-Depth: Amazon.com Inc.

Amazon.com’s performance in the third quarter was propelled by momentum in its Prime and AWS services. The AWS sector benefits from a robust portfolio, strong adoption rates, and ultrafast delivery options. Additionally, an expanding content library and enhancing ties with third-party sellers have further strengthened Amazon’s business.

The company’s advertising segment has shown promising growth, while its worldwide reach continues to expand. Investments in grocery, pharmacy, healthcare, and autonomous driving sectors add to Amazon’s positive outlook. The company’s focus on generative AI is also a significant advantage. AMZN’s fourth-quarter 2024 guidance has been positive, creating excitement among investors.

Promising Price Outlook for AMZN Stock

Brokerage firms have set an average short-term price target that suggests a 13.7% increase from AMZN’s last closing price of $206.84. The target price ranges from $197 to $285, indicating a possible maximum increase of 37.8% with no downside risks.

Amazon.com expects its revenue and earnings to grow by 10.8% and 78.3%, respectively, for the current year. Review of the Zacks Consensus Estimate reveals a 1.2% uptick in projected earnings over the last week.

Corporate Spotlight: KLA Corp.

KLA is thriving due to its strong wafer inspection segment, driven by increasing demand for advanced applications in technology. The company benefits from a rise in wafer manufacturing, complex designs, and larger chip sizes prompted by strong AI adoption.

Growing demand for advanced packaging enhances KLA’s prospects by increasing process control intensity. Sustained investments across various nodes and heightened capital intensity in Foundry and Logic also propel KLA’s growth. The company’s emphasis on integrating AI into its solutions further distinguishes it in the semiconductor space.

Exciting Price Projections for KLAC Shares

Brokerage firms predict an average short-term price target for KLAC that signals a 20.8% increase from its last closing price of $666.03. The target range spans from $620 to $977, implying a maximum potential gain of 46.7% against a potential downside of 6.9%.

KLA’s expected revenue and earnings growth rates for the current year (ending June 2025) stand at 19.6% and 30.2%, respectively. The Zacks Consensus Estimate for earnings in the current year has increased by 6.1% over the past month.

Growth Insights: Newmont Corp.

Newmont is actively advancing its growth initiatives. The company expects to benefit from various projects, including the expansion of the Tanami mines. The acquisition of Newcrest has bolstered Newmont’s already strong portfolio and offers significant synergies. The company remains committed to enhancing operational efficiency and delivering shareholder value. Progress with efficiency improvement programs continues to take shape.

In 2024, gold prices have reached record highs, making the yellow metal one of the strongest-performing assets. This surge in price has been fueled by high demand from central banks, further solidifying Newmont’s positive outlook.

“`

Investment Opportunities Show Promise Amid Global Uncertainty

With the Federal Reserve adopting a dovish interest rate outlook against a backdrop of global uncertainties, there’s growing demand for safe-haven investments. Escalating tensions in the Middle East and fears of an economic slowdown are driving investors towards safer assets.

Newmont Corporation: Bright Prospects Ahead

Newmont Corporation (NEM) presents a strong investment opportunity, with brokerage firms projecting a 31.6% rise from its last closing price of $42.33. Price targets for NEM range from $47 to $72.32, suggesting a potential upside of 70.9% with no downside risk.

For the current year, Newmont’s expected revenue growth sits at 53.3%, while earnings growth may reach an impressive 95.7%. Additionally, the Zacks Consensus Estimate for this year’s earnings has seen a 6.1% improvement over the past month.

Uber Technologies Inc.: Delivering Growth

Uber Technologies (UBER) is capitalizing on strong online order volumes in its Delivery segment. The company’s strategy of successive acquisitions aims to enhance its delivery operations. A resurgence in its Mobility segment also contributes to its growth. For the third quarter of 2024, Uber anticipates gross bookings between $40.25 billion and $41.75 billion.

UBER’s focus on financial discipline is noteworthy, with adjusted EBITDA expected to range from $1.58 billion to $1.68 billion in the same quarter.

Potential for UBER Shares to Rise

Brokerage firms project an average price increase of 26.8% from the last closing price of $71.65 for UBER shares. The target price ranges from $66 to $120, indicating a maximum upside of 67.5% and a maximum downside of 7.9%.

Uber’s anticipated revenue growth rate is pegged at 17.3%, with earnings growth potentially exceeding 100% this year. The Zacks Consensus Estimate for current-year earnings has improved by 7.6% in the past week.

S&P Global Inc.: Positioned for Success

S&P Global Inc. (SPGI) is well-positioned to benefit from rising demand for business information services. The company is bolstered by strategic buyouts, which enhance its offerings and product development. Recent service launches have also contributed positively to SPGI’s growth.

Share buybacks and dividend payments are likely to strengthen investor confidence, contributing to better earnings per share. A current ratio above 1 confirms that SPGI is capable of settling its short-term liabilities with ease.

SPGI Shares with Strong Growth Potential

The average short-term price target of brokerage firms indicates a potential 15.8% increase from SPGI’s last closing price of $507.26. Current target prices range from $535 to $620, showing a maximum upside of 22.2% with no downside.

S&P Global’s expected revenue growth rate is 12%, while earnings are projected to grow by 20.1% this year. The Zacks Consensus Estimate for current-year earnings has ticked up by 0.5% in the last week.

Five Stocks with the Potential to Double

Selected by a Zacks expert as the top picks for a potential +100% increase in 2024, these five stocks have previously demonstrated remarkable gains, with some surging by +143.0%, +175.9%, +498.3%, and +673.0%.

While not every selection can deliver similar results, many of these stocks remain under the radar of Wall Street, creating a prime opportunity for investors to get in early.

Explore these 5 potential home runs >>

Interested in the latest recommendations from Zacks Investment Research? You can download the report on the 5 Stocks Set to Double here.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

KLA Corporation (KLAC): Free Stock Analysis Report

Newmont Corporation (NEM): Free Stock Analysis Report

S&P Global Inc. (SPGI): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.