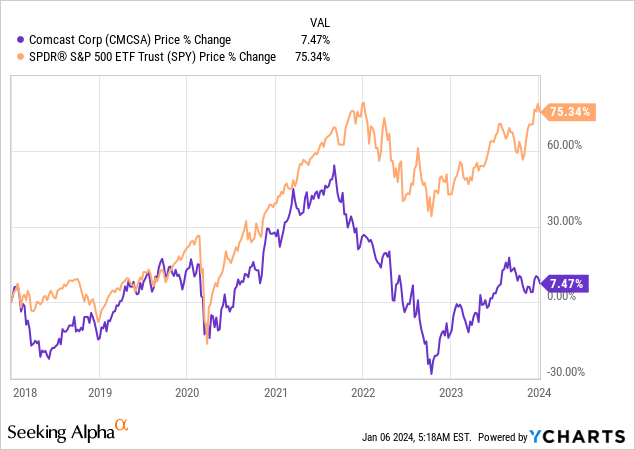

Comcast’s Stock Performance – A Dismal Tale

7.5%.

That’s how much Comcast Corporation (NASDAQ:CMCSA) shares have risen since January 2018. An underwhelming performance compared to the 75% returns made by investors in the S&P 500 during the same period, with lower risks.

An unsightly chart displays the case:

Since my article titled “Comcast: Between Dead Money And Undervaluation” in August 23, 2023, the stock has fallen 5.3%, while the S&P 500 has returned 5.9%.

In this article, I’ll update my bull case and focus on its valuation, which could be highly attractive if the company is able to maintain consistent growth and convince investors that it deserves to trade above its current (very subdued) valuation.

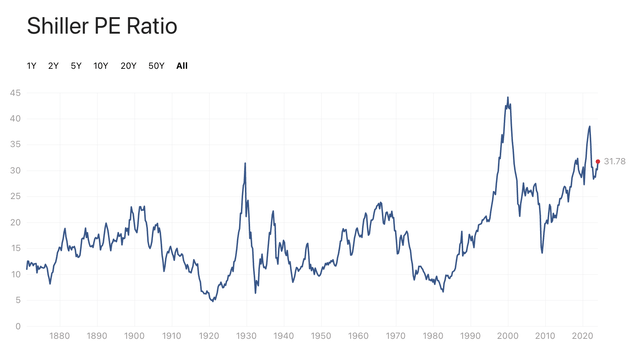

If everything goes right, CMCSA could be a highly attractive dividend growth stock in a market that is everything except cheap.

Unlocking Value – The Management Conundrum

Comcast is not a bad company. However, it struggles to unlock shareholder value.

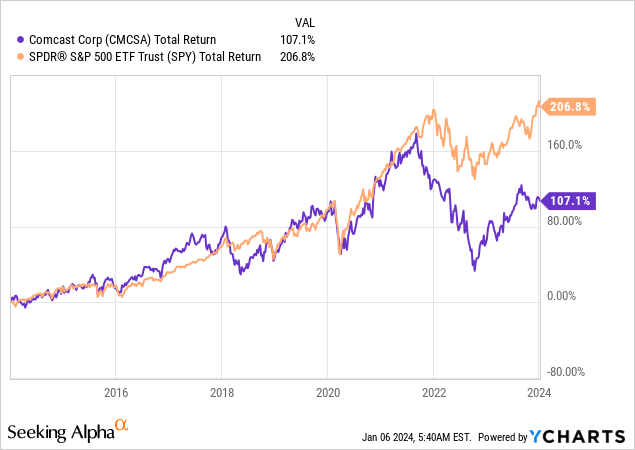

The past decade saw Comcast shares keeping up with the market until 2021 – a turning point apparent in the historical graph:

Since 2021, the stock has weakened, hampering the overall return picture dating back to at least 2018.

However, CMCSA remains a sturdy contender, fraught with a lack of trust.

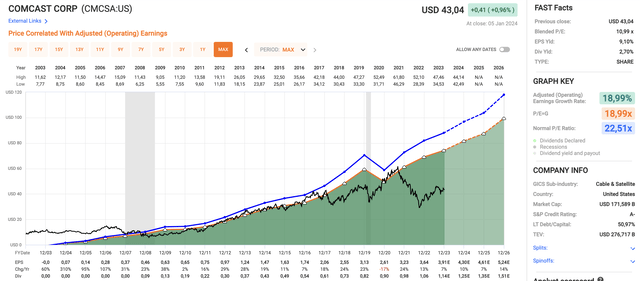

Reviewing the data, a few interesting points emerge:

- CMCSA witnessed only one year of negative EPS growth since 2003.

- 2023 projects a 7% EPS growth, followed by 10% growth in 2024,

- 7% growth in 2025, and a robust 14% growth in 2025.

The chart above indicates a normalized valuation of 22.5x earnings (the blue line). Until the pandemic years, it has been a reliable guide for the stock price.

Since 2021, the stock traded at a discount. Currently, CMCSA trades at just 11x earnings – a blended P/E ratio of the last twelve months and the next twelve months’ earnings per share.

In other words, a valuation near to 20x earnings (factoring in the expected EPS growth rates) would place the stock at its prior all-time high, approximately 50% above its current price.

Unlocking value hinges on two factors:

- EPS growth meeting or surpassing expectations.

- Investors finding cause to assign the stock a higher valuation.

In simpler terms, business growth alone won’t suffice. CMCSA must present an airtight case for enduring long-term growth well beyond 2026.

Additionally, it needs interest rates to decrease, as I’ll discuss further.

The Road to Expansion – Comcast’s Strategy

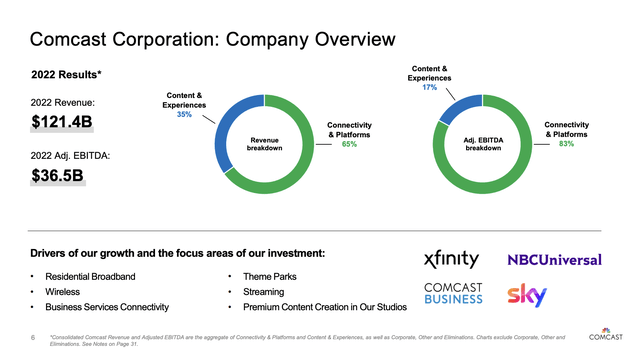

In 2022, the company chalked up over $120 billion in revenue, predominantly from Connectivity & Platforms.

As the leading broadband provider in the U.S., Comcast operates within a fiercely competitive industry with substantial secular growth propellants.

Despite stellar results, lingering ambiguity about the industry’s future perpetuates investor skepticism.

At the recent UBS Global TMT Conference, the company delineated its trajectory toward sustained growth.

In the next section, we’ll delve into Comcast’s opportunities and risks as it aims to reignite investor excitement and fortify its position in the market.

Comcast’s Growth Strategy: A Prolific Rise in Revenue Streams

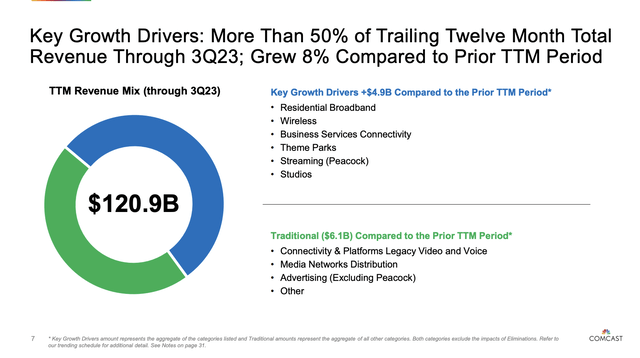

In a recent conference, Comcast addressed concerns about its below-GDP revenue growth. Michael Cavanagh, the President of Comcast, assured investors of the company’s commitment to top-line growth. Cavanagh outlined the strategic significance of six key businesses, contributing over 50% of the company’s revenues, which are anticipated to fuel substantial and sustained growth. These businesses are projected to elevate the company’s total business exposure from 50% to 75%.

Residential Broadband Ascendancy

Comcast’s residential broadband segment, boasting 32 million subscribers, holds a pivotal role in the company’s growth narrative. The burgeoning demand for high-speed internet services, in tandem with an upward trajectory in data consumption, presents an auspicious tailwind for Comcast.

The company’s strategic emphasis on bolstering network capabilities, including advancements in DOCSIS technology, positions Comcast to not only meet but surpass customer expectations.

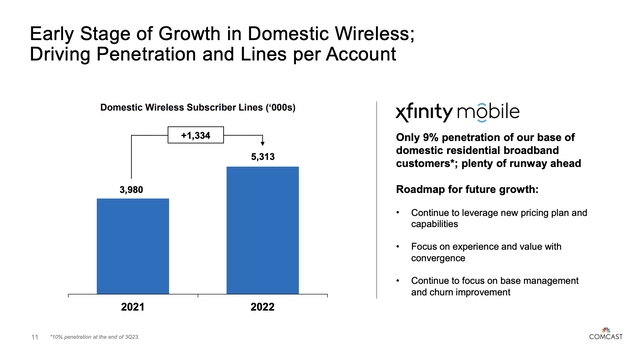

Wireless Business: Seizing Growth Opportunities

Comcast’s wireless business, with approximately 6 million lines and a noteworthy revenue growth of around 16% year-over-year, stands as a promising avenue for expansion. With the escalating prominence of 5G technology and the proliferation of connected devices, Comcast is primed to capitalize on the burgeoning wireless market.

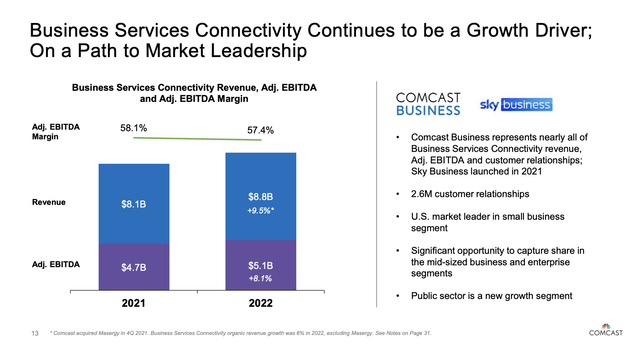

Business Services: Lucrative Path to Growth

Comcast’s business services segment, contributing nearly $10 billion in revenues with 60% incremental margins, unveils a lucrative avenue for further growth. As connectivity assumes increasing criticality for enterprises and mid-market businesses, Comcast’s expansion into these segments aligns seamlessly with broader industry trends.

The company’s ongoing investments in technology and infrastructure, coupled with a disciplined approach to cost management, enable it to tap into the evolving needs of the business community.

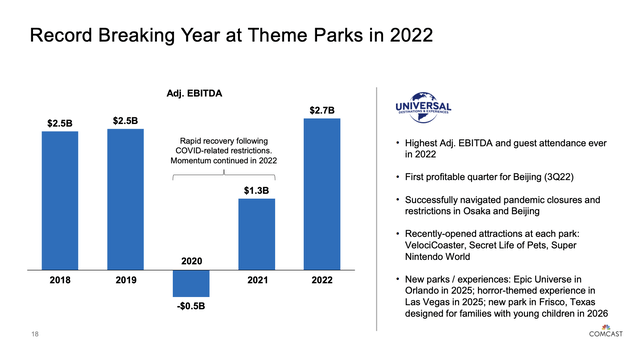

Thriving Theme Parks: Immersive Entertainment Prowess

Comcast’s theme parks business is undergoing remarkable growth, propelled by sustained investments in new attractions and experiences. The company’s strategic foray into theme parks resonates with the escalating demand for immersive entertainment experiences.

While I might not be the biggest fan of theme parks myself, it’s hard to ignore Comcast’s spot-on emphasis on “immersive” experiences, a trend inundating both entertainment and marketing landscapes.

The year 2022 bore witness to record-breaking strides for Comcast’s theme parks, a testament to the upward surge in traction for this facet of the company’s operations.

Growth persisted into 2023, with the third quarter witnessing an impressive 20.0% year-over-year adjusted EBITDA growth.

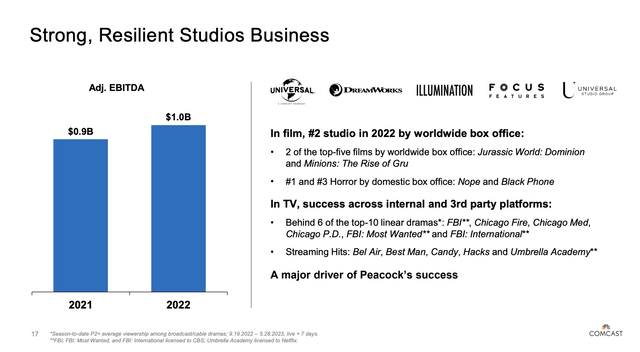

Content Creation Success: Studios and Peacock

Comcast’s studios business consistently ranks among the top performers in box office revenue, a testament to the company’s triumph in content creation.

As depicted in the PowerPoint slide above, the studios business stands as a pivotal driver of Peacock’s success, marking the sixth growth driver for Comcast.

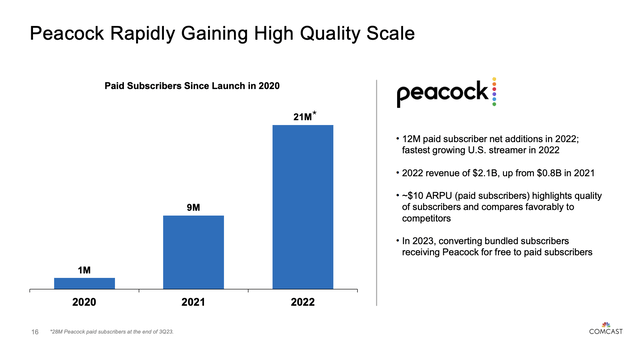

The company’s streaming segment represented by Peacock has achieved significant milestones, amassing around 30 million paying subscribers. In a fiercely competitive streaming arena, Comcast’s ability to carve a niche with a domestic service and amass a substantial subscriber base is a major growth catalyst

Explosive Growth of Peacock

Peacock’s unmitigated growth is nothing short of astounding. In 2020, it counted 1 million paid subscribers. Fast forward to 2022, and that figure soared to 21 million. As of 3Q23, the number has surged to a staggering 28 million subscribers, with an additional 4 million new subscribers joining in the third quarter alone.

Even more striking is the fact that Peacock has achieved these meteoric growth rates despite a tepid consumer sentiment.

Lavish Shareholder Distributions

Amidst its ambitious growth targets, Peacock stands as a veritable cash-generating machine. In 2023 alone, the company is anticipated to generate an impressive $13.4 billion in free cash flow, underscoring its commitment to rewarding shareholders generously.

Comcast Corporation’s Long Haul of Long-Term Shareholder Value

Quite the trajectory it’s been for Comcast Corporation. The firm is set to hit $13.8 billion in the near future, projecting a further surge to $15.4 billion by 2025.

In terms of market cap, the company stands tall at $173 billion, pointing to a 2024E free cash flow yield of 8.0% – a number investors would usually be frothing at the mouth for.

Even with $92 billion in gross debt, Comcast’s net leverage ratio of 2.4x serves as a feather in its cap, backing a cushy A- investment-grade credit rating. Now, if that’s not impressive, I don’t know what is.

In a world increasingly rattled by rising rates, Comcast’s skirt-chasing investors might be attributed to its gross debt. But let’s face it, everyone’s got a little baggage these days.

At any rate, the company’s ability to swaddle cash remains unchallenged. Currently, its quarterly dividend of $0.29 per share beams with a yield of 2.7%. And to top it off, they just hiked it by 7.4% on January 26, with a tempting five-year dividend CAGR of 8.8%.

Not to mention, its free cash flow allows comfort by a crackling fireplace. With a whopping 27% 2024E earnings payout ratio – oh-so-low, mind you – Comcast’s dividends are safer than a bank vault.

Naturally, there’s room to kick back some excess cash, which Comcast has tactfully used to buy back 11% of its shares over the last five years. That’s quite a few feathers in their cap, wouldn’t you say?

All in all, Comcast’s long-term shareholder value glimmers like a treasure chest at the bottom of the stock market ocean. But for this value to sparkle, the company has to dance a precarious tango with its growth projects and shield its balance sheet from the beating heart of booming interest rates.

Once Comcast is able to do the hokey-pokey just right, then investors are looking at consistent double-digit annual returns the moment interest rates caper back down the hill.

So, it’s no surprise that the stock gets a glowing Buy rating from yours truly. I see Comcast as a gorgeously priced gem in a market with a slightly inflated valuation. Blink and you might miss it, folks.

Comcast: A Tough Crowd to Please

Unlocking shareholder value has been like finding a needle in a haystack for Comcast lately.

Despite consistent EPS growth, Comcast’s stock is strolling along at a hefty discount, laying the ground for a tantalizing investment opportunity.

But hey, Comcast isn’t just a one-trick pony. It operates in Residential Broadband, Wireless, Business Services, Theme Parks, and Streaming (Peacock). That’s quite the cabinet of curiosities.

With some ambitious growth targets and hefty cash flow from Peacock, Comcast flaunts a free cash flow yield that’s easy on the eyes.

While balancing growth projects and tiptoeing around interest rate dilemmas are imperative, the potential for double-digit annual returns makes Comcast one heck of a long-term buy – if it can deftly handle these challenges, that is.