Ubiquiti, Inc. UI reported soft third-quarter fiscal 2024 results, with both the bottom and top lines falling short of the respective Zack Consensus Estimate. However, the New York-based networking products and solutions providers reported a revenue growth growth year over year, owing to healthy traction in the Enterprise Technology vertical. Soft demand trends in several regions, including South America and Asia Pacific, impeded net sales.

Net Income

Net income, on a GAAP basis, in the quarter was $76.3 million or $1.26 per share compared with $98.6 million or $1.63 per share in the year-ago quarter. The downturn was primarily induced by higher operating expenses and cost of revenues.

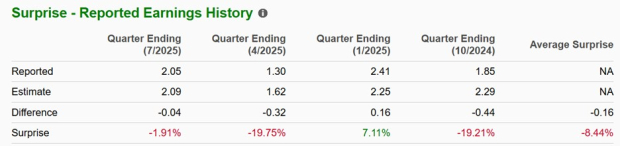

Non-GAAP net income in the third quarter of fiscal 2024 was $77.6 million or $1.28 per share, down from $99.5 million or $1.65 per share in the year-earlier quarter. The bottom line missed the Zacks Consensus Estimate of $1.79.

Ubiquiti Inc. Price, Consensus and EPS Surprise

Ubiquiti Inc. price-consensus-eps-surprise-chart | Ubiquiti Inc. Quote

Revenues

Net sales in the quarter increased to $493 million from $457.8 million in the prior year quarter. Healthy demand in North America, Europe, the Middle East and Africa (EMEA) region supported the top line. However, the top line missed the consensus estimate by $5 million.

Enterprise Technology generated $414.3 million in revenues, up 11% from $373.6 million in the prior year quarter. The top line fell short of our estimate of $417.8 million. Strong demand trends across all regions led to revenue growth from this segment.

Service Provider Technology registered $78.7 million in revenues, down from $84.2 million in the year-ago quarter. Net sales fell short of our revenue estimate of $84.9 million.

Region-wise, revenues from North America stood at $242.5 million compared with $230.7 million in the year ago quarter. Net sales from EMEA aggregated $200.7 million, up from $173.3 million. Asia Pacific revenues decreased 2% year over year to $26.5 million from $26.9 million in the year-earlier quarter. Revenues from South America were $23.4 million, down 13% year over year.

Other Details

During the March quarter, gross profit was $174.1 million compared with $188.5 million in the year-ago quarter, with respective margins of 35.3% and 41.2%. The research and development expenses increased 11.3% year over year to $42.5 million due to higher employee-related expenses and prototype-related expenses. Operating income was $111.2 million, down from $133.5 million in the prior year.

Cash Flow & Liquidity

In the nine months ended Mar 31, Ubiquiti generated $310.1 million of cash in operating activities compared with a cash utilization of $159.9 million in the previous-year period. As of Mar 31, 2024, the company had $102.5 million in cash and cash equivalents, with $839 million of long-term debt.

Zacks Rank & Other Stocks to Consider

Ubiquiti currently carries a Zacks Rank #2 (Buy).

Here are some other top-ranked stocks that investors may consider:

NVIDIA Corporation NVDA, sporting a Zacks Rank #1 (Strong Buy) at present, delivered a trailing four-quarter average earnings surprise of 20.18%. In the last reported quarter, it delivered an earnings surprise of 13.41%. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit. Over the years, the company’s focus evolved from PC graphics to AI-based solutions that sup

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 at present, is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 15.68% and delivered an earnings surprise of 15.39%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200 and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Silicon Motion Technology Corporation SIMO, sporting a Zacks Rank #1 at present, delivered a trailing four-quarter average earnings surprise of 4.72%.

It is a leading developer of microcontroller ICs for NAND flash storage devices. The semiconductor company also designs, develops and markets high-performance, low-power semiconductor solutions for original equipment manufacturers and other customers.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Don’t Wait. Download FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.