Flying taxis could transform transportation as we know it, and Archer Aviation (NYSE: ACHR) is one company looking to bring it to the masses. The company develops electric vertical takeoff and landing aircraft (eVTOL), flying vehicles that can take off, land, and hover vertically like a helicopter. Unlike helicopters, though, eVTOLs use electric motors for a more efficient method of transportation that is also significantly quieter, making them an ideal candidate for urban transportation.

Archer is well-positioned in an industry that could explode in growth over the next few decades. However, it faces an uphill climb as it scales up its manufacturing and commercial operations, making it riskier than your regular stock. If you’re thinking of buying Archer Aviation today, consider the following first.

Archer’s Midnight aircraft is making strides

Archer Aviation and Joby Aviation are two companies leading the charge in developing eVTOL technology, and have taken significant steps toward achieving FAA certficiation. Archer Aviation’s flagship eVTOL, Midnight, has made huge strides, obtaining its Special Airworthiness Certification from the FAA, which cleared the path for test flight operations.

In the first quarter, Archer flew over 100 flights and is closing in on a key milestone of taking off vertically, accelerating until transitioning from thrust-born to wing-borne flight, and then landing vertically. It is also making progress on rigorous testing ahead of its ongoing FAA certification.

Development of the flying taxi industry will take time

Archer and its Midnight aircraft could change urban transportation as we know it. Major cities in particular could benefit from flying taxis, which could help bypass traffic jams and reduce congestion. The aircraft can seat up to four passengers, has a range of up to 100 miles, and is ideal for 20- to 50-mile trips on minimal charging time. These vehicles could also generate fewer emissions and be a cleaner transportation alternative.

Image source: Archer Aviation.

The urban air travel industry will take time to develop as companies work on creating the vehicles and infrastructure needed to make it all possible. Vertiports would need to be created to support the takeoff and landing of the aircraft, and must be accessible either on top of buildings or at street level. It will also take time for the public to accept the technology and build public trust that these methods of transport are safe and secure.

According to Morgan Stanley, urban air mobility could be a $29 billion market by 2030, $1 trillion by 2040, and up to $9 trillion by 2050. Air taxis would compete with Uber and Lyft for consumer purposes and could find commercial usage delivering life-saving medical supplies or even online orders quickly and efficiently.

Archer has backing from some big names

The eVTOL industry will take time to develop, and the best-positioned companies are those with adequate funding and backing from major companies with skin in the game. Luckily for Archer, it has garnered investments from United Airlines, Stellantis, Boeing, and Ark Investment Management.

United Airlines is a flagship customer and partner and ordered up to $1.5 billion in aircraft, with $10 million paid upfront. It also helped announce the industry’s first eVTOL route from Manhattan to Newark in November 2022.

The airline, Stellantis, and Boeing have also made equity investments in the company, helping Archer secure $1.1 billion in funding midway through last year.

Stellantis will be a manufacturing partner for Archer, helping it scale and manufacture thousands of aircraft per year. The auto manufacturer purchased an additional 8.3 million shares of Archer stock in March. CEO Carlos Tavares told investors, “This recent move by Stellantis signals our confidence in Archer’s team and the progress we see firsthand through our deep partnership.”

Is Archer Aviation a buy?

Archer Aviation is making strides with its eVTOL technology, and it is on track to obtain FAA-type certification and begin product to manufacture its aircraft at scale.

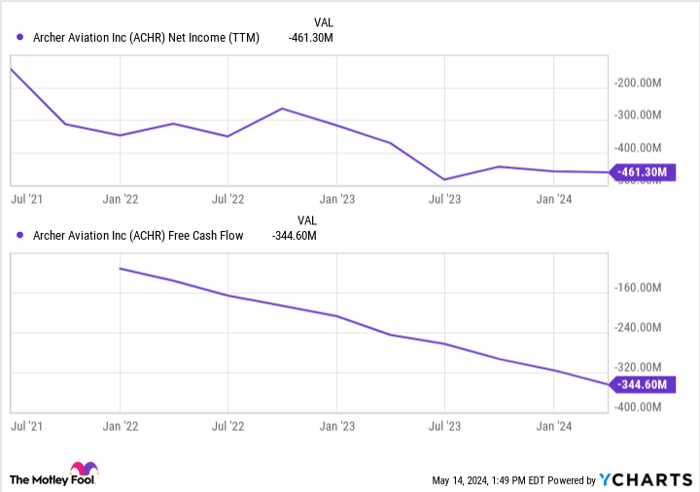

The company sees commercial operations beginning as soon as 2025, but it will take time to scale up and generate meaningful cash flows from its endeavors. Until then, the company will continue to burn through cash, making the stock vulnerable to volatile price swings.

ACHR Net Income (TTM) data by YCharts

Because the company is in its developmental phase, there is still a lot of risk if it cannot meet crucial milestones. The company also has to prove it can scale its manufacturing and operate on a large scale, and it will take time for the public to trust flying taxis, which could take years to play out.

For that reason, Archer stock is best suited for patient investors with a high risk tolerance. If you buy the stock today, don’t risk more than you’re willing to lose, and consider starting a small position and building it up over time as Archer achieves key milestones.

Should you invest $1,000 in Archer Aviation right now?

Before you buy stock in Archer Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Archer Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $559,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Courtney Carlsen has positions in Morgan Stanley. The Motley Fool has positions in and recommends Uber Technologies. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.