One of the simplest ways to generate passive income is by investing in companies that pay shareholders a regular dividend. If you’re looking for reliable dividend stocks, Dividend Kings could be a good place to start. These companies have track records of good capital management, allowing them to raise their dividend payments for at least 50 consecutive years.

S&P Global (NYSE: SPGI) is one company with a 52-year streak of increasing its dividend payout. If you’re an income investor wondering if the stock deserves a spot in your portfolio, consider the following.

S&P Global has a robust economic moat around its credit-ratings business

S&P Global has a long history of raising its dividend payout, thanks to a robust business model that generates steady cash flow. The company is the largest credit-rating business in the U.S., with a 50% share of the total market. Moody’s Corporation comes in second at 32%, and Fitch Ratings is a distant third at 12%.

Credit-rating companies are crucial to bond markets because they inform investors about a company’s health, ability to repay its debts, and the riskiness of owning that debt. The industry is incredibly hard to break into, giving S&P Global a robust economic moat around its business.

The company’s earnings fluctuate depending on the amount of credit that companies and governments issue, which has been lackluster over the past few years. In 2022, the Federal Reserve raised interest rates aggressively throughout the year to curb inflation, which had reached its highest reading on a year-over-year basis in four decades.

As a result, corporate debt sales plummeted, and S&P Global’s primary business struggled to generate growth. In 2022, its operating profit from its ratings business plummeted by 36%. Its data and analytics businesses, boosted by its acquisition of IHS Markit, picked up the slack and helped the company produce solid results despite the challenging operating environment.

Image source: Getty Images.

Income investors may not like its dividend yield

S&P Global’s long history of raising its dividend payment is impressive. It’s a testament to its business model and robust economic moat, allowing it to generate steady cash flow over time.

Despite this, it’s not necessarily an impressive dividend stock if you want to generate significant income from your portfolio. That’s because the stock yields a modest 0.84% and is less than the broader market SPDR S&P 500 ETF Trust, which yields 1.27%. In other words, for every $10,000 invested in S&P Global stock, you would earn $84 in dividend income per year.

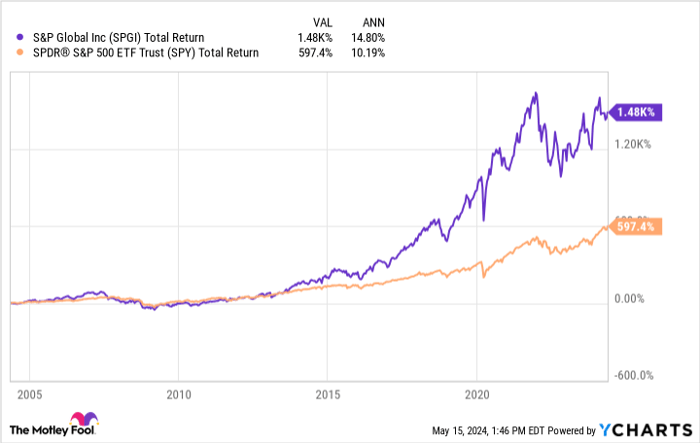

Although its dividend yield is modest, when you combine its stock price performance with its dividend, S&P Global has been a solid performer for long-term investors. During the past two decades, it has delivered a total return (accounting for reinvested dividends) of 14.8% annually, beating the S&P 500 index over that same period.

SPGI Total Return Level data by YCharts.

Is S&P Global stock for you?

S&P Global is a solid stock for investors to hold for the long term. It has a robust economic moat and excellent cash flow supporting its dividend payout, which has increased yearly for five decades. Not only that, but corporate sales picked up in the first quarter, which could be a tailwind for its business.

When deciding if the stock is right for your portfolio, consider your investment objectives and goals. If you’re OK with the modest payout, S&P Global is a solid performer that can deliver a growing dividend and stock-price appreciation over the long haul.

However, if you want to generate significant income from dividend stocks, then S&P Global may not be the right stock for you. In that case, you may want to consider some of these higher-yielding alternatives.

Should you invest $1,000 in S&P Global right now?

Before you buy stock in S&P Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $579,803!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Moody’s and S&P Global. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.