Realty Income Corporation O announced an increase in its common stock monthly cash dividend to 26.25 cents per share from 25.70 cents paid out earlier. This marked its 125th dividend hike since its listing on the NYSE in 1994.

The increased dividend will be paid out on Jun 14 to shareholders of record as of Jun 3, 2024. The latest dividend rate marks an annualized amount of $3.150 per share compared with the prior rate of $3.084. Based on the company’s share price of $55.13 on May 17, the latest hike results in a dividend yield of 5.71%.

Though the latest hike marks a marginal increase from the prior dividend, the latest dividend announced will be the company’s 647th consecutive monthly dividend payout in its 55-year operating history.

Solid dividend payouts are the biggest enticements for real estate investment trust (REIT) investors, and Realty Income is committed to boosting its shareholder wealth. This retail REIT holds the trademark of the phrase “The Monthly Dividend Company.” It has made 107 consecutive quarterly dividend hikes. This retail REIT has witnessed compound average annual dividend growth of 4.3% since its listing on the NYSE.

Moreover, Realty Income has increased its dividend 22 times in the last five years and has a five-year annualized dividend growth rate of 2.99%. Check Realty Income’s dividend history here.

The latest hike reflects O’s ability to generate decent cash flow through its operating platform and high-quality portfolio. The majority of its annualized retail contractual rental revenues are generated by clients who have a service, non-discretionary and/or low-price-point component to their business. Such businesses are less likely to be affected by economic downturns and competition from online sales. These provide more reliable streams of income, which boost the stability of rental revenues and generate predictable cash flows.

Moreover, Realty Income’s diversified tenant base and accretive buyouts bode well for its long-term growth. The solid property acquisitions volume at decent investment spreads has aided the company’s performance so far. In January 2024, Realty Income completed its all-stock merger transaction with Spirit Realty Capital, Inc. The transaction is immediately accretive on a leverage-neutral basis and adds to Realty Income’s size, scale and diversification, enabling it to expand its scope for future growth.

In November 2023, Realty Income entered into a JV with Digital Realty DLR to facilitate the development of two build-to-suit data centers in Northern Virginia. The move marked the retail REIT’s maiden foray into the data center sector and further diversified its portfolio. It invested approximately $200 million, securing an 80% equity interest in the venture, while Digital Realty maintains a 20% interest.

Realty Income maintains a healthy balance sheet position and exited the first quarter of 2024 with $4 billion of liquidity. The company ended the quarter with modest leverage and strong coverage metrics with net debt to annualized pro forma adjusted EBITDAre of 5.5X and a fixed charge coverage of 4.5X. O also enjoys a credit rating of A- (Stable) and A3 (Stable) from Standard & Poor’s and Moody’s, respectively, which provides access to the debt market at favorable costs.

With ample financial flexibility, the company remains well-poised to respond to any challenges and bank on growth opportunities.

Moreover, with a healthy financial position and a lower debt-to-equity ratio compared with the industry, we expect the latest dividend rate to be sustainable.

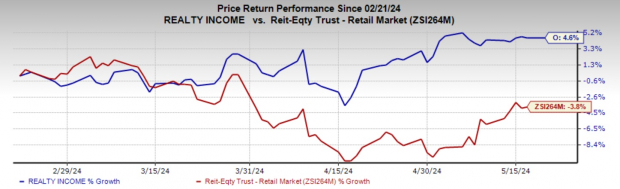

Over the past three months, shares of this Zacks Rank #3 (Hold) company have risen 4.6% against the industry’s fall of 3.8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the retail REIT sector are Kite Realty Group Trust KRG and Acadia Realty Trust AKR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kite Realty Group’s ongoing year’s funds from operations (FFO) per share is pegged at $2.05, which indicates a year-over-year increase of 1%.

The Zacks Consensus Estimate for Acadia Realty Trust’s current-year FFO per share has been revised a cent upward over the past month to $1.28.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

Acadia Realty Trust (AKR) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

Kite Realty Group Trust (KRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.