The so-called “Magnificent Seven” stocks aren’t all hype. This group of tech leaders has made it a habit to deliver market-beating returns. That’s why they have earned the moniker, and why investors have flocked toward these companies, sending their market caps to stratospheric levels.

But even at these heights, there remain excellent reasons to invest in some members of the “Magnificent Seven.” Here are two that I think are worth sticking with over the long haul: Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN).

1. Meta Platforms

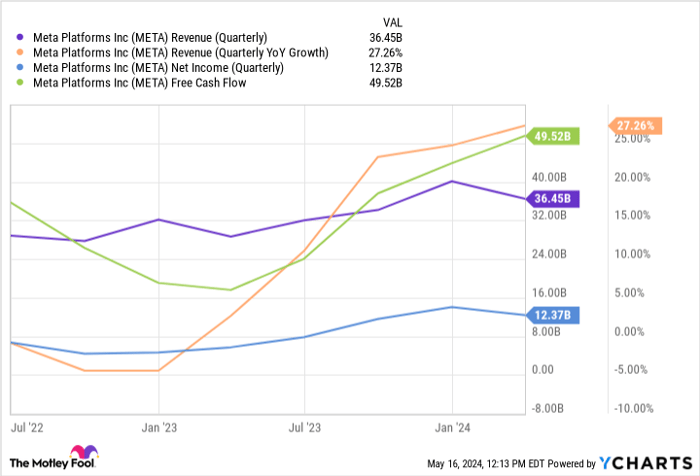

Meta Platforms has proven that its business is incredibly resilient. Though the company struggled a couple of years ago due to mounting economic troubles, increasing interest rates, and lower advertising spending, Meta Platforms stayed the course and was able to bounce back. Revenue growth increased over the past few quarters, the bottom line got back in the green, and free cash flow is trending up, too.

META Revenue (Quarterly) data by YCharts

One of the secrets behind Meta Platforms’ recent comeback — besides aggressive cost-cutting efforts — is the company’s vast ecosystem. There are few, if any, other corporations in the world with a daily active user count of 3.24 billion. That’s the number Meta Platforms ended the first quarter with, and it represented a 7% year over year increase. The tech giant is receiving more money from this audience thanks to its various offerings.

Short-form videos — also known as Reels — have played a key part. Meta Platforms uses an artificial intelligence (AI)-powered recommendation system to entice viewers to keep watching. On the other side of the coin, Meta is also utilizing AI to help companies design advertising campaigns with higher returns on investments, an obvious selling point. Considering Meta’s large network of users, it’s difficult to see the tech company losing significant advertising business — in fact, quite the opposite.

Meanwhile, Meta Platforms will have many growth opportunities, including AI. The company is positioning itself as a leader in the generative AI field, having released a large language model (LLM) called Llama and an AI virtual assistant called Meta AI, among other initiatives. Further, Meta Platforms is still building up the metaverse, which could be another potential massive revenue source in the future.

Meta Platforms has proven to be an incredibly inventive company. Its large ecosystem of users grants it the ability to experiment with various money-making strategies until it finds several lucrative ones. Meta Platforms is currently looking to ramp up monetization on WhatsApp through paid and business messaging, for instance.

So long as the company remains the leading social media platform — and its network effect will ensure that it does for a while — Meta Platforms will be an excellent stock to buy and hold. Lastly, the tech giant now offers a dividend. Though that’s just a recent development, Meta Platforms’ underlying business is surely strong enough to sustain growing payouts for a long time.

And those who opt to reinvest the dividend could see their gains increase meaningfully over time. Just one more reason to hold onto Meta Platforms’ stock for good.

2. Amazon

Amazon started as an online bookstore before becoming the e-commerce juggernaut we know today. The company’s secret has been management’s ability to identify and pursue attractive opportunities, and having the innovative abilities to lead major industries in which it does business.

As it currently stands, Amazon arguably has three attractive long-term growth opportunities. The first is, interestingly enough, e-commerce.

Though retail activity has shifted to online channels over the years, there remains plenty of room to grow. In the U.S., e-commerce accounted for just 15.9% of total retail sales in the first quarter of 2024, an increase from 14.9% in the comparable period of 2023. Being the leading e-commerce platform in the U.S. — with a 37.6% market share of last year — Amazon will benefit from the upward trend.

The website’s popularity also allows Amazon to generate meaningful revenue from its advertising business.

Second, there is cloud computing, another area in which Amazon is the leader. It held a 31% slice of the pie as of the first quarter. Cloud computing can offer a range of benefits to businesses, from ease of data access to increased efficiency and cost savings. The industry should still expand by leaps and bounds, benefiting established leaders like Amazon.

Third, there is AI: Amazon isn’t letting this potential gold go to waste. The tech company has started offering various AI services through its cloud computing arm, Amazon Web Services. It is also building an LLM to compete with OpenAI, the company behind ChatGPT.

Amazon will also benefit from other opportunities, including video and music streaming, its investments in healthcare, and more. The company can still beat the market even with a market cap close to $2 trillion.

Investors can’t go wrong with this one: Holding onto Amazon’s stock for good is a great move.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Amazon and Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.