Janus International Group, Inc. JBI announced that it has acquired Terminal Maintenance and Construction (“TMC”), which is expected to support growth of its Facilitate division.

Madison, GA-based TMC is a premier terminal maintenance services provider for the trucking industry in the Southeast. The integration will help JBI to provide complete facility maintenance services, with an initial focus on commercial customers.

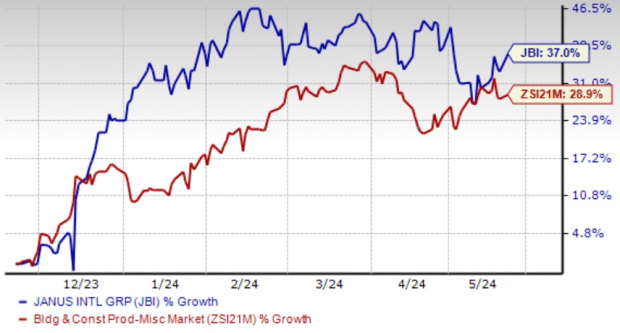

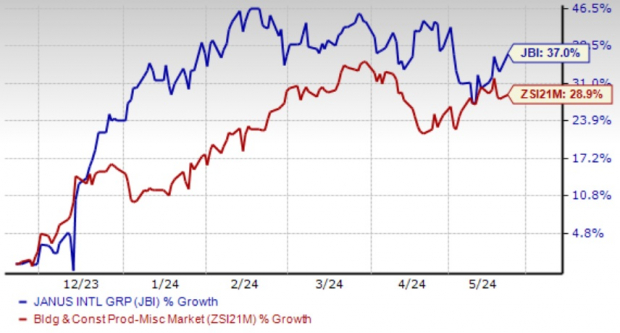

JBI’s shares rose 2.7% on May 20 during the trading session. Also, the stock has gained 37% in the past six months, outperforming the Zacks Building Products – Miscellaneous industry’s 28.9% growth.

Image Source: Zacks Investment Research

Janus is strategically oriented toward attaining sustained long-term growth by fortifying its presence in key markets. Moreover, the company aims to enhance the adoption of the Noke system among its self-storage clientele, optimize platform efficiencies, and execute strategic, value-adding mergers and acquisitions. This multifaceted approach underscores Janus’ commitment to long-term growth and innovation in its industry.

A Look at Q1 Earnings & Margins Performance

The company recently reported its fiscal first-quarter (ended Mar 30, 2024) results, wherein earnings per share (EPS) and revenues topped the Zacks Consensus Estimate and increased on a year-over-year basis.

The company’s growth trend was backed by improved market conditions, product mix and commercial actions. It witnessed solid contributions from its Self-Storage segment, which were somewhat offset by declines in the Commercial and Other segments. Also, positive impacts of segment mix and declines in material costs added to the uptick.

The adjusted EBITDA margin was up 180 basis points from the prior-year period’s levels. This was primarily due to the positive impacts of segment mix and declines in material costs, partially offset by increased operating costs as the business scales for continued growth.

Janus is optimistic about its growth trajectory through 2024, given its varied and innovative mix of technology-driven product offerings, along with its resilient business model.

For fiscal 2024, revenues are projected to be in the range of $1.092-$1.125 billion, up 4% at the midpoint compared with 2023. The adjusted EBITDA is anticipated to be in the range of $286-$310 million, which signifies mid-point growth of 4.3% compared with 2023.

Zacks Rank and Other Stocks to Consider

Presently, Janus carries a Zacks Rank #2 (Buy).

Investors interested in some other top-ranked stocks can consider Frontdoor, Inc. FTDR, Armstrong World Industries AWI and Owens Corning OC.

Frontdoor: Based in Memphis, TN, the company provides home service plans in the United States. The firm is benefiting from impressive customer retention rates. Thanks to the robust awareness of the Frontdoor brand, it has been shifting its attention toward capitalizing on customer demand. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FTDR’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average being 286.8%. The Zacks Consensus Estimate for its 2024 sales and EPS indicates growth of 2.9% and 9.6%, respectively, from the prior-year reported levels.

Armstrong World Industries: This Pennsylvania-based leading global producer of ceiling systems for use primarily in the construction and renovation of commercial, institutional and residential buildings banks on acquisitions. Also, operational excellence and improving business trends are added positives.

AWI currently flaunts a Zacks Rank #1. AWI delivered a trailing four-quarter earnings surprise of 15.2%, on average. The Zacks Consensus Estimate for AWI’s 2024 sales and EPS indicates growth of 9.3% and 10.7%, respectively, from the prior-year reported levels.

Owens Corning: This world leader in building materials systems and composite solutions benefits from favorable delivery, lower input and manufacturing costs and higher selling prices. Moreover, its focus on new product and process innovation, along with inorganic moves, bode well.

OC currently flaunts a Zacks Rank #1. It delivered a trailing four-quarter earnings surprise of 17.4%, on average. The Zacks Consensus Estimate for OC’s 2024 sales and EPS indicates growth of 1% and 7.9%, respectively, from the prior-year reported levels.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Owens Corning Inc (OC) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

Janus International Group, Inc. (JBI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.