Exchange-traded funds increasingly grow more complex, offering investors access to progressively more strategies and asset classes. Ongoing ETF innovation including the impending move to T+1 creates several challenges for ETF service providers.

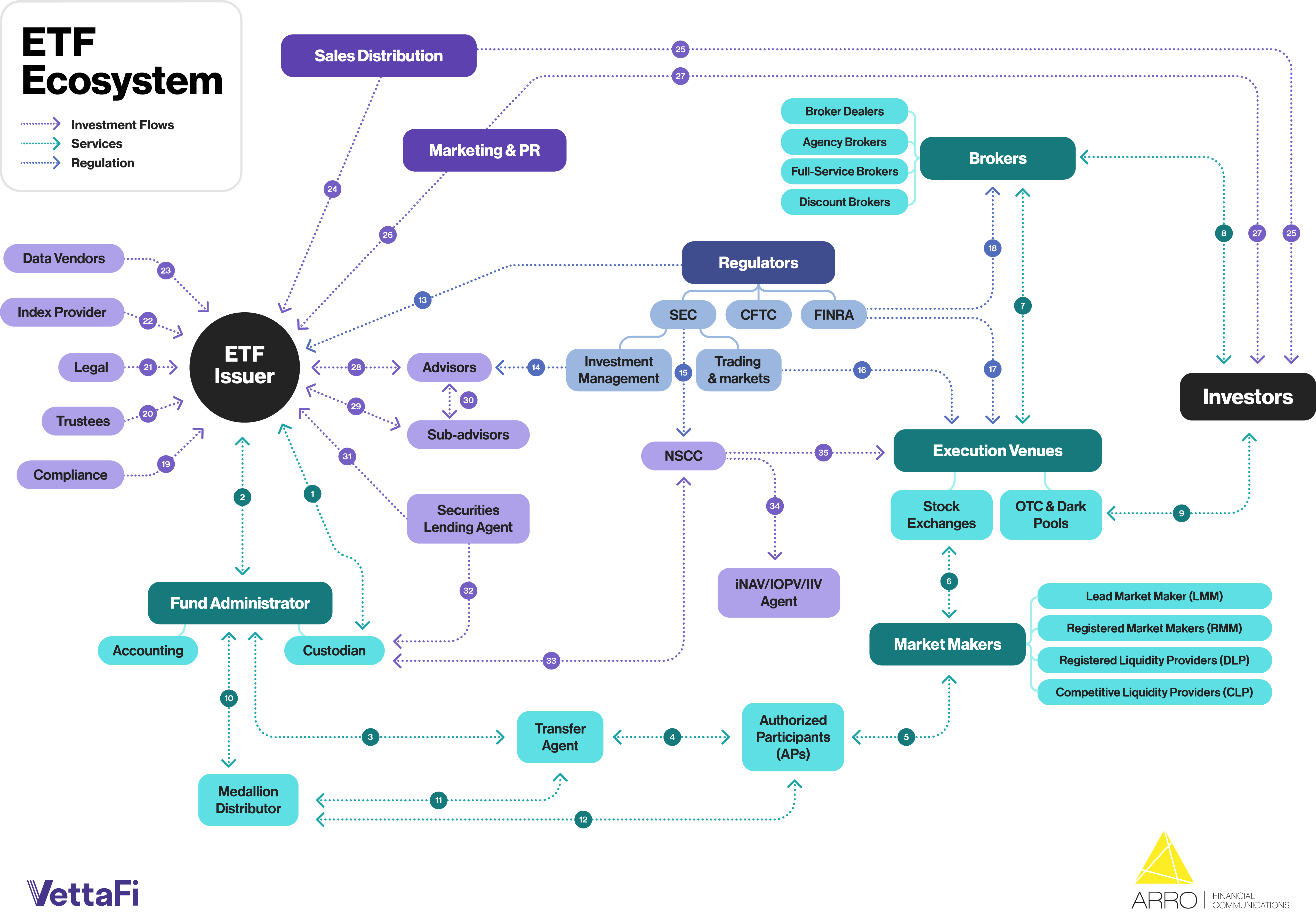

Service providers wear many hats including fund administration, launching ETFs, custody, and distribution. While these services are immensely valuable, we’re focusing on a service provider’s role in the primary market.

The Impact of T+1

The total cost of ownership for an ETF includes the fund’s expense ratio, liquidity cost, and tracking error. ETF service providers play a critical role in facilitating liquidity on the primary market by mitigating risks and increasing efficiencies between the ETF and Authorized Participants.

ETFs trade on the secondary market where investors buy and sell ETF shares through exchanges. However, the creation and redemption of custom baskets occurs on the primary market between Authorized Participants (APs) and market makers.

Service providers facilitate this creation and redemption process unique to ETFs. They do this through platforms they create that utilize a variety of technologies. For many established, large ETF service providers, these technology stacks are legacy ones.

ETF service providers must work to streamline and upgrade their technologies and platforms to provide scalability and efficiency for investors. The transition from T+2 to T+1 in the U.S. will test creation and redemption efficiencies. Currently, when a trade is executed, it takes 2 business days for the trade settlement to become official (T+2). Under the new system going live on May 28, 2024, trades will settle in just one business day.

A smaller trading window between order and settlement creates the potential for more failed trades and higher spreads within ETFs. When pricing ETFs, APs don’t always have the full basket of securities, leading to potential late deliveries. It can create settlement mismatches between the secondary and primary market according to Brown Brothers Harriman.

Faster trading will require faster systems and workflows for creation and redemptions. To support the continued growth and innovation of the ETF industry, “asset servicers will need to allocate more resources into their technology systems and deliver on standardization, the benefits of which can be passed downstream from ETF issuers to investors,” Calastone, the largest global funds network, wrote in a recent white paper.

The Challenge of Innovation for ETF Service Providers

As more innovative ETFs come to market, such as spot bitcoin ETFs, mutual fund conversions, options-based strategies, and more, service providers must invest in new technologies to keep up with the innovations. It’s proving to be a challenge.

Image source: Calastone

“While many of the older asset servicers are investing in their organizations, the reality is that a lot of this spend is being allocated towards maintaining legacy technology stacks, as opposed to developing innovative solutions,” Calastone wrote.

Innovations in ETFs create demand for newer technologies to process orders — a demand often met more easily by new ETF service providers. Much of these newer technology stacks focus on the automation of creation and redemptions. Automation reduces inefficiencies and increases processing speed compared to manual input. It’s the most important area of focus that needs improvement according to ETF issuers Calastone surveyed.

Beyond just automation, increased ETF innovation means a wider variety of asset types trading across an increased number of markets. Crypto-centric ETFs, mutual fund conversion ETFs, options-based strategies, and more often require customized solutions from providers to process. Such niche, custom solutions generally do not scale across multiple issuers.

While newer service providers generally offer newer technology stacks and capabilities, AUM constraints limit their ability to invest more into these technologies. It creates a scalability issue as well.

Meanwhile, legacy providers often are limited by the spending allocated to their existing technologies. That or their investment gets tied up in individual, bespoke technology stacks created for specific clients.

Both newcomer and more established service providers contend with issues of scalability for different reasons, but the results end up the same for investors.

“The inefficiencies this causes is adding extra basis points on for investors when buying and selling ETFs,” Calastone explained.

To remain both competitive and efficient, ETF service providers will need to innovate and scale alongside the ETF industry.

For more news, information, and analysis, visit VettaFi | ETF Trends.

Read more on ETFTrends.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.