Vishay Intertechnology VSH recently launched eight new 850 nm and 940 nm high-power infrared (IR) emitters in a bid to boost its optoelectronics offerings.

These AEC-Q102 qualified emitters, featuring a double-stack chip, offer high radiant intensity of up to 6000 mW/sr at 5 A pulse current and 2000 mW/sr at 1.5 A DC current, low thermal resistance, and reduce costs and space by occupying a 20% smaller footprint.

These IR emitters operate at a temperature range of -40°C to +125°C and have high ESD immunity and a 168-hour floor life.

Vishay is expected to gain solid traction across ADAS, driver and cabin monitoring systems, eye tracking, CCTV, and automotive applications on the back of its latest launch.

Moreover, these IR emitters will strengthen Vishay’s foothold in the global IR-emitter market, presenting a significant growth opportunity for the company. Per a Research and Markets report, the global IR-emitter market is expected to witness a CAGR of 7.6% between 2024 and 2030.

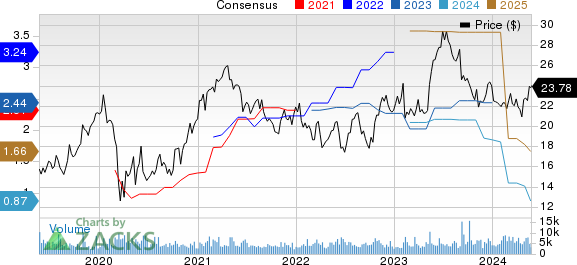

Vishay Intertechnology, Inc. Price and Consensus

Vishay Intertechnology, Inc. price-consensus-chart | Vishay Intertechnology, Inc. Quote

Strengthening Optoelectronics Portfolio

Apart from these IR emitters, the company recently launched VOIH72A, a new single-channel 25 MBd optocoupler featuring a CMOS logic digital input and output interface, low pulse width distortion, two mA maximum supply current, wide voltage range, and high-temperature operation up to +110°C.

The company also upgraded TFBS4xx and TFDU4xx IR transceiver modules with its in-house integrated circuit (IC) and surface emitter chip technology. The IR modules incorporate a PIN photodiode, infrared emitter and low power control IC, offering 20% longer link distance and improved ESD robustness to 2 kV for IrDA applications.

Vishay also introduced three new IR sensor modules, TSMP95000, TSMP96000 and TSMP98000, designed for remote control systems. It boasts features like pin-to-pin compatible replacements, wider supply voltage range, smaller bandwidth for better noise strength, higher ESD withstand capability and robust performance under strong DC light.

Earlier, the company launched VEMD2074, a high-speed silicon PIN photodiode with enhanced sensitivity for visible light, offering fast switching times of 70 ns and low capacitance for precise signal detection in wearable devices.

Conclusion

All the above-mentioned endeavors are expected to strengthen the company’s optoelectronics offerings and will likely aid Vishay in capitalizing on growth opportunities present in the global optoelectronics market. Per a report from Expert Market Research, the global optoelectronics market is expected to reach $25.31 billion by 2032, witnessing a CAGR of 14.8% during 2024-2032.

A Mordor Intelligence report indicates that the global optoelectronics market will hit $47.6 billion in 2024 and reach $62.9 billion by 2029, witnessing a CAGR of 5.7% between 2024 and 2029.

However, growing inventory adjustments, contracting lead times and a softening demand environment across industrial end markets remain major concerns for the company. Vishay’s shares have lost 0.4% in the year-to-date period, underperforming the Zacks Computer & Technology sector’s growth of 16.9%.

The Zacks Consensus Estimate for first-quarter 2024 revenues is pegged at $750.7 million, indicating a decline of 15.9% year over year.

The consensus mark for first-quarter 2024 earnings is pegged at 18 cents per share, indicating a 73.5% decline from the year-ago figure.

Zacks Rank & Stocks to Consider

Currently, Vishay carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Dell Technologies DELL, CrowdStrike CRWD and Intuit INTU, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Dell Technologies have gained 92% in the year-to-date period. The long-term earnings growth rate for DELL is 9.50%.

Shares of CrowdStrike have gained 35.3% in the year-to-date period. The long-term earnings growth rate for CRWD is currently projected at 22.31%.

Shares of Intuit have gained 7.2% in the year-to-date period. The long-term earnings growth rate for INTU is 14.57%.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

CrowdStrike (CRWD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.